Introduction: Why This Comparison Matters

Mutual fund managers, face countless questions related to TREPS in Mutual fund and TREPS vs FDs like, “Should I just park my idle funds in an FD or is there something smarter?” This question often leads to an insightful conversation about TREPS – a lesser-known but highly efficient short-term investment avenue.

Let’s break down the differences between TREPS (Tri-Party Repo) and FDs (Fixed Deposits) so you can make an informed decision with your idle cash.

What Are TREPS?

TREPS stands for Treasury Bills Repurchase, an instrument introduced by RBI to facilitate short-term borrowing through a repurchase agreement. It’s an overnight lending platform where mutual funds, banks, and other institutions lend or borrow funds using government securities as collateral.

Key features:

-

Tenure: Overnight (1 day)

-

Safety: Backed by sovereign securities

-

Regulated by: CCIL (Clearing Corporation of India Ltd) and RBI

Mutual funds often invest in TREPS to ensure your money is working — even for a day.

What Are FDs (Fixed Deposits)?

FDs are traditional instruments offered by banks and NBFCs where you park your money for a fixed period, earning a fixed rate of interest.

Key features:

-

Tenure: 7 days to 10 years

-

Safety: Covered up to ₹5 lakhs under DICGC

-

Regulated by: RBI (for banks)

FDs are simple, stable, and a go-to option for conservative investors.

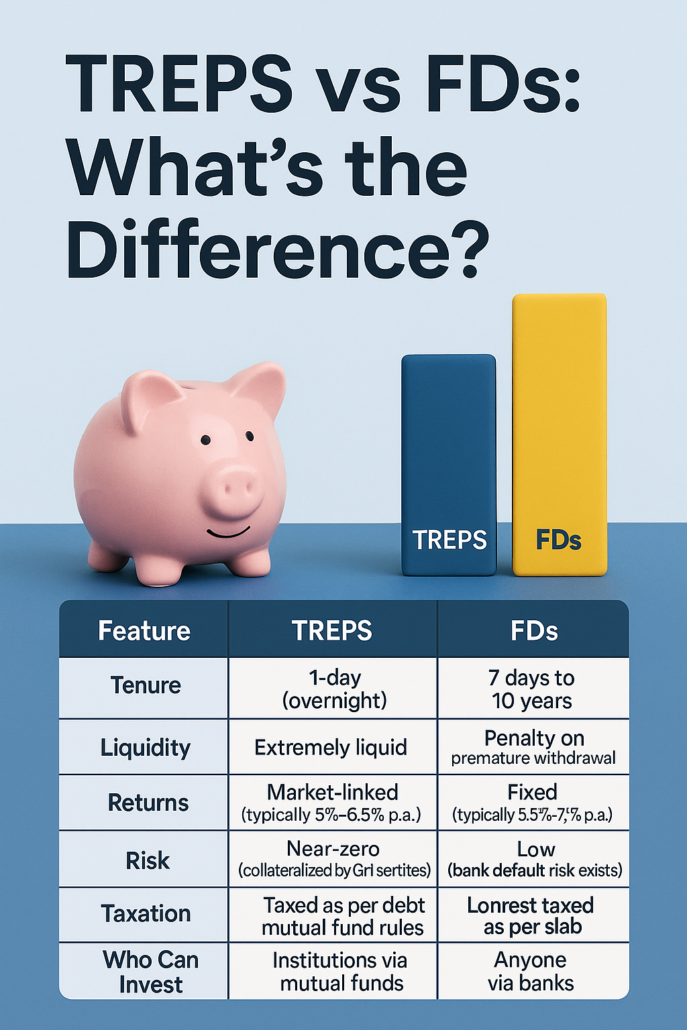

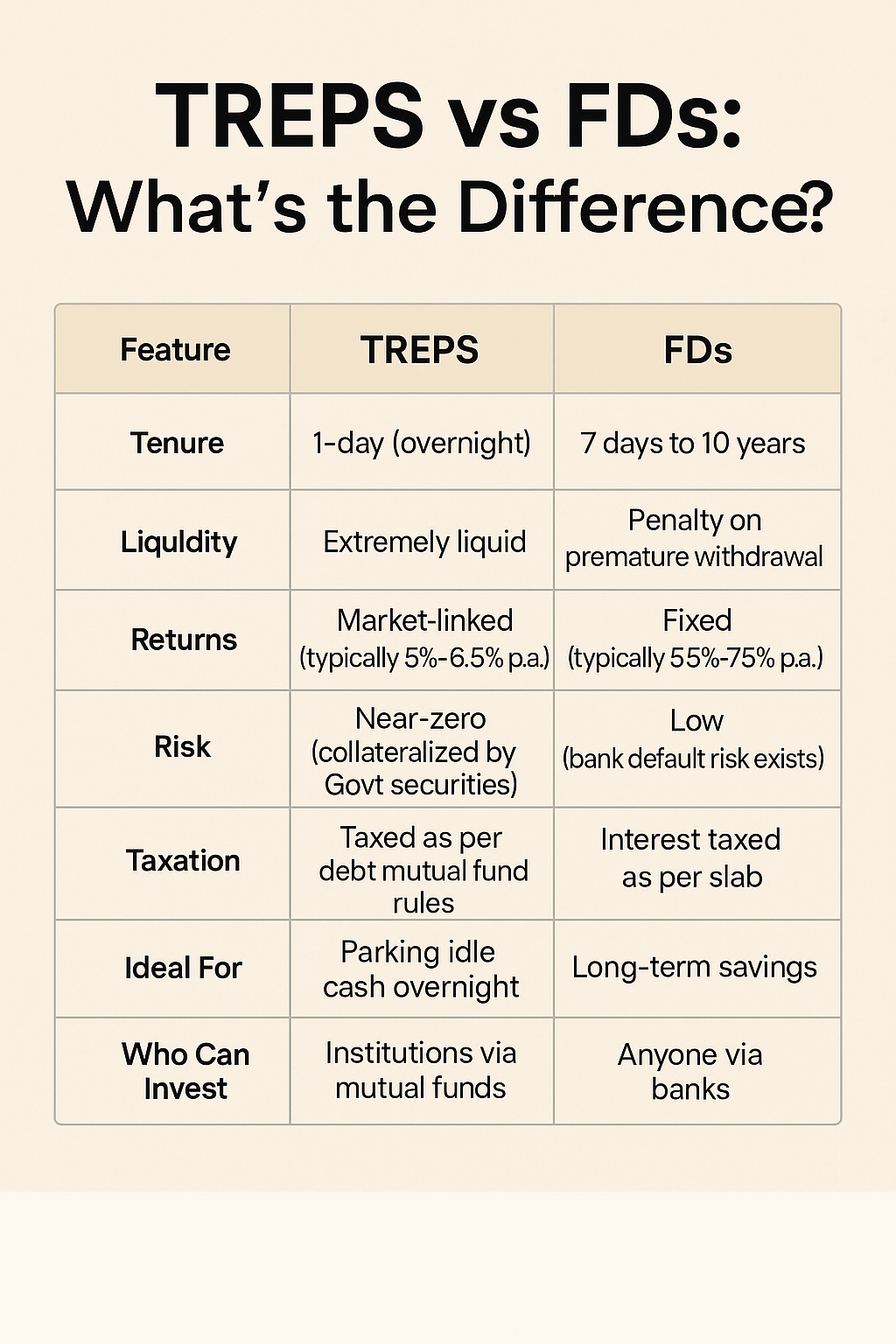

TREPS vs FDs: The Key Differences

| Feature | TREPS | FDs |

|---|---|---|

| Tenure | 1-day (overnight) | 7 days to 10 years |

| Liquidity | Extremely liquid | Penalty on premature withdrawal |

| Returns | Market-linked (typically 5%–6.5% p.a.) | Fixed (typically 5.5%–7.5% p.a.) |

| Risk | Near-zero (collateralized by Govt securities) | Low (bank default risk exists) |

| Taxation | Taxed as per debt mutual fund rules | Interest taxed as per slab |

| Ideal For | Parking idle cash overnight | Long-term savings |

| Who Can Invest | Institutions via mutual funds | Anyone via banks |

TREPS: A Fund Manager’s Favorite for Cash Management

As a fund house, we use TREPS regularly in liquid mutual funds, overnight funds, and arbitrage funds. Why?

Because they:

-

Keep your capital safe

-

Offer competitive returns

-

Provide next-day liquidity

Imagine your SIP money reaches us today — we don’t just let it sit idle. We deploy it in TREPS overnight, earning something for you every single day.

FDs: Safe but Less Flexible

FDs are popular because they’re simple. You know exactly what you’ll earn. But:

-

Breaking an FD early attracts penalties

-

No returns during that premature closure period

-

Tax on interest earned can significantly reduce post-tax returns

For those looking for predictability and are okay with lower liquidity, FDs work well.

When Should You Choose TREPS?

✅ When you have idle cash for a few days

✅ When you’re investing via liquid or overnight mutual funds

✅ When safety and liquidity matter more than high returns

✅ When you want next-day withdrawal without penalties

When Should You Choose FDs?

✅ When you’re saving for a goal 1+ years away

✅ When you prefer fixed returns and no market-linked variation

✅ When you’re a risk-averse investor and dislike volatility

✅ When you don’t need instant liquidity

How to Invest in TREPS as a Retail Investor?

While retail investors cannot directly invest in TREPS, they can benefit by investing in:

-

Overnight Mutual Funds

-

Arbitrage Funds (indirectly)

These funds use TREPS to manage cash efficiently, giving you ultra-short term gains with almost zero risk.

What Returns Can You Expect from TREPS?

Returns are not fixed but generally align with overnight repo rates. Historically, TREPS have delivered:

-

4% to 6.5% annualized, depending on the interest rate environment.

Remember, these are net of risk. You won’t get such low-risk returns from idle savings accounts.

Taxation: TREPS vs FDs

-

TREPS (via mutual funds):

-

Treated as debt mutual fund income

-

Taxed at slab rate if redeemed before 3 years

-

Indexation benefit available if held longer

-

-

FDs:

-

Interest is taxed at your income slab rate every year

-

No indexation benefit

-

What Happens in a Market Crisis, a brief idea on TREPS vs FDs?

During a crisis:

-

TREPS remain liquid and safe, thanks to collateralization with government securities

-

FDs in cooperative banks or NBFCs may face default risk or delayed withdrawals

This is why, as a fund manager, I trust TREPS for day-to-day liquidity management in any market cycle.

Final Verdict: Use Both Smartly

You don’t have to choose one over the other. Here’s what I suggest:

🔹 Use TREPS (via mutual funds) for parking idle funds for short durations — even just a day or two.

🔹 Use FDs when you have a definite financial goal and don’t want market-linked returns.

Conclusion: Let Every Rupee Work

As a fund manager, my job is to never let money sit idle. Even a single day matters. Whether you’re an HNI, a working professional, or a homemaker — if you’ve got idle cash, think beyond FDs.

Let that money work overnight in TREPS. Your financial freedom isn’t just about how much you invest — it’s also about how smartly you park your money in the short-term.

FAQs about TREPS vs FDs

Q1: Can retail investors invest directly in TREPS?

No. But you can access TREPS through mutual fund schemes like Liquid or Overnight funds.

Q2: Are TREPS returns guaranteed?

No, they are market-linked but very stable and predictable due to their overnight nature.

Q3: Is TREPS safe?

Yes. It’s backed by government securities and regulated by CCIL and RBI.

Q4: How do Liquid Funds use TREPS?

They invest your money in TREPS to earn returns even if held for a day.

Q5: Which gives better post-tax returns – TREPS vs FDs?

TREPS (via mutual funds) may offer better post-tax returns due to indexation (if held long enough), and no annual taxation unless redeemed.

![]()