How Much Should I Invest Monthly to Achieve My Financial Goals?

The Silent Worry Every Middle-Class Earner Has

“Will I have enough for my child’s education? What about retirement?” These questions haunt the average Indian middle-class family. Dreams are big, but salaries often limited. That’s where monthly investment for financial goals comes into play.

What Exactly Are Financial Goals for a Middle-Class Family?

From owning a 2BHK flat, to sending your daughter to college, or retiring with dignity—our goals aren’t luxury. They’re necessities. Have you listed yours yet?

Why Most People Don’t Reach Their Goals

It’s not because they don’t work hard. It’s because they don’t plan investments. Saving in an account isn’t enough. You need monthly investment for financial goals with vision and discipline.

Ask Yourself: “What Do I Want in 5, 10, or 20 Years?”

Break your dreams into timelines. Here’s a simple structure:

| Time Horizon | Sample Goals |

|---|---|

| 5 Years | Car, Vacation, Emergency |

| 10 Years | Kids’ Education, House |

| 20+ Years | Retirement, Legacy |

How Much Should You Really Be Investing Monthly?

There’s a rule: 50-30-20 budgeting.

-

50% for needs

-

30% for wants

-

20% for investments

If you earn ₹50,000/month, invest at least ₹10,000. But the smarter way is goal-based investing.

Use This Simple Formula to Calculate Your Monthly Investment

To reach ₹50 lakhs in 20 years (at 12% return), you need to invest around ₹4,500/month.

Formula:Future Value = SIP Amount x [((1+R)^N - 1)/R] x (1+R)

Where R = monthly rate of return, N = number of months

Interactive Table: SIP Investment Needed for Different Goals

| Goal Amount | Time Horizon | Monthly SIP Needed (12% return) |

|---|---|---|

| ₹10 Lakhs | 10 Years | ₹4,700 |

| ₹25 Lakhs | 15 Years | ₹5,000 |

| ₹1 Crore | 25 Years | ₹6,000 |

(Data based on average market returns)

Can You Start Small? Yes!

Even a ₹500 SIP is better than doing nothing. Begin with what you can. Increase every year by 10-15%—that’s how you win the long game.

What Happens If You Delay by 5 Years?

Let’s compare:

| Monthly SIP | Time | Final Corpus |

|---|---|---|

| ₹5,000 | 25 Y | ₹95 Lakhs |

| ₹5,000 | 20 Y | ₹50 Lakhs |

Just 5 years delay = ₹45 Lakhs lost! The cost of waiting is huge.

Real Story: How Manoj, a 35-Year-Old Clerk, Built Wealth Silently

Manoj started SIPs at 28 with just ₹3,000/month. By 43, he had over ₹15 lakhs. No side hustle. No big job. Just consistent monthly investment for financial goals—with patience and courage.

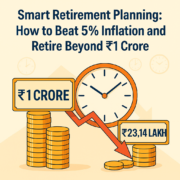

Are You Factoring in Inflation?

Your ₹1 crore today will only be worth ₹50 lakhs in 20 years. Plan goals with future cost, not today’s price. Use calculators online. Or just ask: “Will this be enough tomorrow?”

Your Action Plan Starts Today

-

List all financial goals

-

Attach timeline and cost

-

Use SIP calculator

-

Start your monthly investment for financial goals

-

Review every year

Final Thoughts: Middle-Class Dreams Need Middle-Class Planning

You may not be born rich. But your planning can make your next generation wealthy. Investment is not about crores today—it’s about consistent ₹1,000s every month that grow silently.

Ask Yourself: What’s stopping you from starting your first SIP today?

Trackbacks & Pingbacks

[…] How Much Life Insurance Do I Need for My Kids’ Education? […]

[…] ELSS mutual funds offer a unique combination of tax benefits and wealth potential. This section explores the key features of ELSS, including tax deductions, lock-in period, and investment style, to help you decide if they fit your financial goals. […]

Leave a Reply

Want to join the discussion?Feel free to contribute!