Have you ever wondered how your small monthly SIP turns into a big fortune over the years? Let’s find out how ₹10,000 monthly can grow when invested smartly — and why the SIP growth calculator shows numbers that can change your financial destiny.

What Is a SIP Growth Calculator and Why Is It Important?

A SIP growth calculator helps you estimate the value of your mutual fund investments over time. It compares your total invested amount with the future value based on a specific rate of return — here, we’re using 15% annual return.

This simple tool tells you one thing loud and clear:

👉 The earlier you start, the bigger your reward.

How Does SIP Growth Work Over Time?

SIPs work through power of compounding — earning returns on both your principal and the gains already earned. Over long periods, this effect multiplies your wealth dramatically.

Even if you invest a fixed amount every month, your returns accelerate with time because compounding grows exponentially.

Let’s Assume:

-

Monthly SIP: ₹10,000

-

Annual return: 15%

-

Investment duration: 10, 15, 20, 25, and 30 years

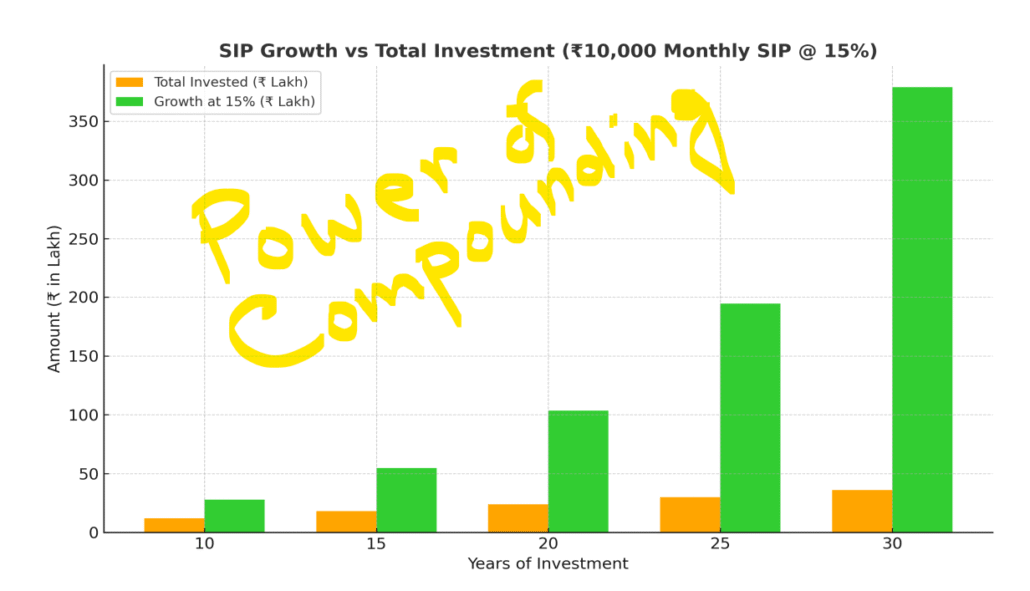

SIP Growth Calculator Table (₹10,000 Monthly @15%)

| Duration | Total Invested (₹) | Future Value (₹) | Wealth Gain (₹) |

|---|---|---|---|

| 10 Years | 12,00,000 | 27,82,000 | 15,82,000 |

| 15 Years | 18,00,000 | 54,79,000 | 36,79,000 |

| 20 Years | 24,00,000 | 1,03,68,000 | 79,68,000 |

| 25 Years | 30,00,000 | 1,94,46,000 | 1,64,46,000 |

| 30 Years | 36,00,000 | 3,79,00,000 | 3,43,00,000 |

📊 Interpretation:

In 30 years, your total investment of ₹36 lakh grows to a whopping ₹3.79 crore — almost 10 times higher!

Graph: SIP Growth at 15% vs Amount Invested

-

The straight line shows your total investment (gradual growth).

-

The curved line (stars) shows your SIP growth (accelerated compounding).

As time passes, the gap between the two widens massively — that’s the magic of compounding.

What Does This Mean for You as an Investor?

The difference between “what you invest” and “what you earn” grows with time.

This is why long-term investors always win — not because they invest more, but because they stay longer.

Even if you start small, patience beats perfection in SIP investing.

Why 15% Return Is Realistic for Long-Term Equity SIPs

Many good mutual funds, especially equity and flexicap funds, have historically given 12–16% CAGR over long periods.

So assuming 15% for long-term SIPs is ambitious, yet achievable — provided you stay invested through market ups and downs.

Exposure Benefit: How SIP Rewards Long-Term Investors

When you stay invested longer, your exposure to equity growth multiplies.

Here’s what happens with time:

-

10 years: You see results.

-

15 years: Compounding starts kicking hard.

-

20 years: Market volatility becomes your friend.

-

25 years: Your portfolio starts to snowball.

-

30 years: You witness wealth transformation.

Let’s Compare SIP Growth vs Total Investment Visually

| Years | Total Investment | Growth at 15% | Ratio (Growth ÷ Invested) |

|---|---|---|---|

| 10 | ₹12L | ₹27.8L | 2.3× |

| 15 | ₹18L | ₹54.8L | 3.0× |

| 20 | ₹24L | ₹103.6L | 4.3× |

| 25 | ₹30L | ₹194.4L | 6.5× |

| 30 | ₹36L | ₹379.0L | 10.5× |

The longer you stay, the larger your multiplier!

Real-Life Meaning of SIP Growth

Imagine investing ₹10,000 every month for 30 years — that’s a total of ₹36 lakh.

But what you get in return? Around ₹3.8 crore.

That’s not just numbers — that’s your:

-

Child’s higher education fund

-

Dream retirement house

-

Financial freedom from EMIs

Why You Should Start Your SIP Now

Waiting to start a SIP means losing out on compounding time. Even a delay of 5 years can reduce your final corpus by more than half.

So, don’t wait for the “perfect time.”

The perfect time is now.

Key Takeaways from SIP Growth Calculator

✅ SIP works best when you stay long-term

✅ Compounding rewards patience, not timing

✅ 15% return can create 10× wealth in 30 years

✅ Small, consistent SIPs can achieve big goals

✅ The earlier you start, the more financial peace you earn

FAQs on SIP Growth Calculator

1. What is the formula for SIP growth calculation?

The SIP future value formula is:

FV = P × [(1 + r)^n – 1] / r × (1 + r)

Where P = monthly SIP, r = monthly rate of return, n = total months.

2. Is 15% return guaranteed in SIP?

No. SIPs invest in market-linked funds. The 15% is an assumed long-term average based on historical data.

3. How can I calculate SIP returns easily?

Use an online SIP growth calculator — enter your amount, duration, and expected return.

4. Can SIPs make me a crorepati?

Yes, even a ₹10,000 SIP at 15% for 25 years can create nearly ₹2 crore.

5. Should I increase SIP every year?

Yes, a step-up SIP (increasing 10% annually) can boost your corpus dramatically.

🌱 Final Words: SIP is Not a Shortcut, It’s a Life Strategy

The SIP growth calculator proves one golden rule — wealth is built not by how much you invest, but by how long you let it grow.

Start today. Stay consistent. Let compounding do the heavy lifting.

Because in the world of SIPs, time is not just money — it’s magic.

![]()