Key Takeaways:

Starting early reduces the required monthly SIP drastically for a ₹2 crore retirement goal.

A 12% annual return needs smaller SIP amounts, but it comes with higher market risk.

Even with a conservative 10% return, disciplined monthly investing can still achieve ₹2 crore.

Consistency and patience are the real heroes behind compounding wealth.

Reviewing and slightly increasing your SIP every year helps beat inflation.

The earlier you begin, the more your money works for you, not the other way around.

A well-chosen mutual fund SIP can turn small savings into a powerful retirement corpus over time.

Dreaming of a Secure Retirement Corpus

You’re working hard, juggling family, bills, dreams. That quiet hope of retiring with dignity — perhaps a corpus of ₹2 crore — echoes in your mind. It’s possible. With a steady monthly SIP, you can build this future.

Why the “monthly SIP” strategy matters

A monthly SIP (Systematic Investment Plan) means investing a small amount every month. For many middle-class families, this approach fits life’s rhythm — paycheque, bills, obligations — and still allows your future to grow.

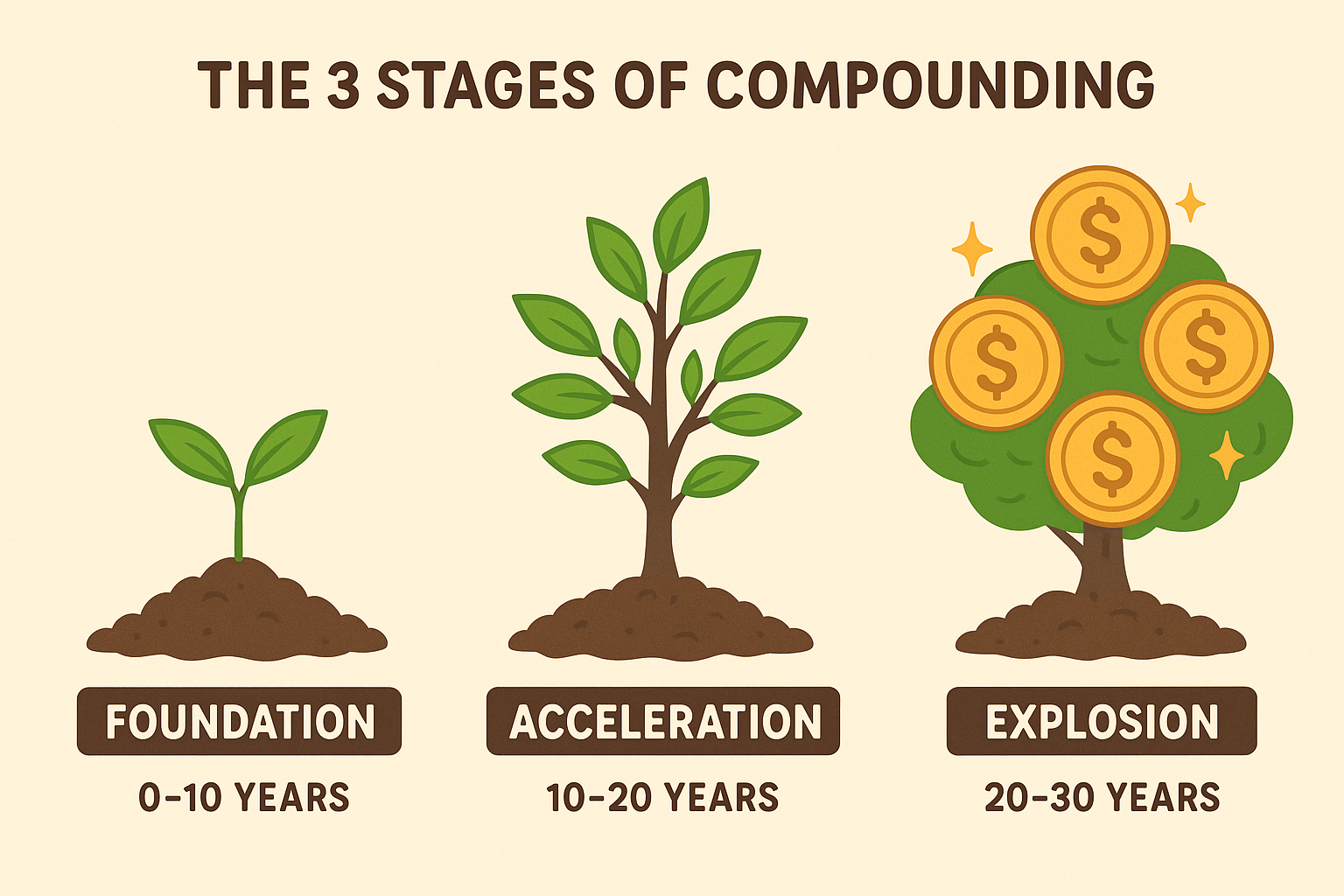

The power of compounding in your favour

When you start early, your monthly SIP doesn’t just add up — it multiplies via compounding. That means the returns you earn are reinvested, helping your money grow more than just linearly.

Setting a target: Why ₹2 crore by retirement

Why choose ₹2 crore? For many of us, that’s a realistic milestone: enough to support life after work, cover rising healthcare and living costs, and give peace of mind. Your monthly SIP becomes the tool to reach there.

Scenario one: Assuming 12% annual returns

Let’s assume you invest via your SIP and the portfolio earns ~12% yearly. If you stayed the course:

-

Over 20 years: you’d need to invest ~ ₹20,217/month (total investment ~₹48.52 lakh) to reach ~₹2 crore.

-

Over 15 years: ~ ₹40,034/month (total investment ~₹72.06 lakh).

-

Over 10 years: ~ ₹86,942/month (total investment ~₹1.04 crore).

| Tenor | Monthly SIP | Total Investment |

|---|---|---|

| 20 yrs | ₹20,217 | ~₹48.52 lakh |

| 15 yrs | ₹40,034 | ~₹72.06 lakh |

| 10 yrs | ₹86,942 | ~₹1.04 crore |

Scenario two: Assuming 10% annual returns

If your monthly SIP were invested earning ~10% annually (a more conservative assumption):

-

20 years: ~ ₹33,302/month (≈₹71.93 lakh total).

-

15 years: ~ ₹48,254/month (≈₹86.86 lakh total).

-

10 years: ~ ₹97,635/month (≈₹1.17 crore total).

| Tenure | Monthly SIP | Total Investment |

|---|---|---|

| 20 yrs | ₹33,302 | ~₹71.93 lakh |

| 15 yrs | ₹48,254 | ~₹86.86 lakh |

| 10 yrs | ₹97,635 | ~₹1.17 crore |

What this means for your planning

As a middle-class investor, these numbers may seem big. But don’t be discouraged. The takeaway:

-

Starting early lowers the monthly burden.

-

A higher assumed return means lower monthly SIP — but that’s also higher risk.

-

The key is consistency: your monthly SIP every month, without fail.

Real-life adjustments and considerations

-

Inflation: ₹2 crore today may not buy the same 20 years later — factor in rising costs.

-

Rates: A 12% return is optimistic; 10% may be more realistic long term.

-

Tenure: If you start late, you’ll need a bigger monthly SIP.

-

Discipline: Missed months, changing amounts, gaps will hurt your projection.

How to choose the right mutual fund for your monthly SIP

-

Pick well-managed funds with consistent performance.

-

Choose the right fund category (equity, hybrid) depending on your risk appetite.

-

Stay invested — the SIP thrives on staying the course, through ups and downs.

-

Review annually, but avoid reacting to short-term market swings.

Emotionally staying motivated through your SIP journey

It’s natural to feel overwhelmed — the monthly number might look large. But remember: each month’s SIP is a step towards your freedom. When you envision the day you retire, with worries behind you, you’ll thank your younger self for starting.

FAQs (for you and your family)

Q1: Can I start a monthly SIP even with a small amount?

A1: Absolutely. The earlier you start, the smaller the required monthly SIP becomes. Even modest amounts matter.

Q2: What if I can’t commit the full monthly SIP each month?

A2: Try at least a minimum you can sustain. Missing months or reducing the SIP weakens the compounding effect.

Q3: Is aiming for 12% return realistic?

A3: While some funds may deliver 12%, assuming 10% is safer for planning. Markets vary.

Q4: What happens if I start late?

A4: You’ll need a much higher monthly SIP to reach the same corpus in shorter tenure — as illustrated above.

Q5: Should I increase my SIP amount over time?

A5: Yes. If your income grows, increasing the SIP helps counter inflation and keep you on track.

Q6: What if I switch funds often?

A6: Switching too often can hurt returns. Stay invested for long term and focus on discipline over chasing short-term performance.

Q7: Who should I consult before making investments?

A7: Consult a SEBI-registered investment advisor to align your SIP with your risk, goals and time horizon.

![]()