Introduction

The newly announced GST rate changes—under the recent GST Council meeting—promise to reshape India’s tax landscape and stir fresh momentum in the Sensex and Nifty stock market. With a revamped framework rolling out soon, here’s how this transformation can benefit retail investors and middle-class households, along with how you can align your investing strategy through step-up SIPs.

Key Takeaways

GST Overhaul Simplified: New two-tier GST structure (5% & 18%) will be effective from 22nd September 2025, with 40% only for luxury and sin goods.

Middle-Class Relief: Essentials like food items and insurance premiums are now cheaper, helping households save more.

Stock Market Boost: Sensex and Nifty rallied ~0.5%, with FMCG, auto, and insurance sectors leading gains.

Inflation Eases: Expected drop of up to 1.1% in inflation, improving purchasing power.

Investor Opportunity: A bullish market outlook makes this a good time to invest systematically.

Step-Up SIP Advantage: Gradually increasing your SIP helps you invest extra savings from tax cuts and benefit from compounding.

Festive Demand Tailwind: Diwali season spending and tax reforms may accelerate sectoral growth, favoring long-term investors.

What’s Changing? GST Rate Overhaul Explained

-

Shift to Two-Tier System: The GST Council has simplified the tax regime into just two primary slabs—5% and 18%—with a special 40% slab reserved only for sin and luxury goods. This restructuring effectively replaces the four-tier system previously in place.

-

When Will the Changes Kick In?

The new rates come into effect on 22nd September 2025, barring tobacco-related items—which will transition later upon compensation cess obligations being settled.

How This Tax Overhaul Benefits You

a) Relief for Everyday Consumers & Middle-Class Families

Numerous daily essentials are now taxed at just 5%, or even exempt—ranging from grooming products (hair oil, shampoo, toothpaste) to packaged food items like paneer, milk, and bread.

Additionally, GST on individual life and health insurance premiums has been entirely abolished, lightening financial burdens and encouraging broader coverage.

b) Boost for Consumer & Auto Stocks

The GST reform has catalyzed early gains in key sectors. Sensex rose about 0.55%, and the Nifty gained 0.53%, led by surges in automotive, consumer goods, and insurance stocks.

Expect continued momentum in stocks like Unilever, Nestle, Britannia, Maruti Suzuki, Mahindra & Mahindra, and Eicher Motors.

c) Macro-Boost—Lower Inflation & Higher Growth

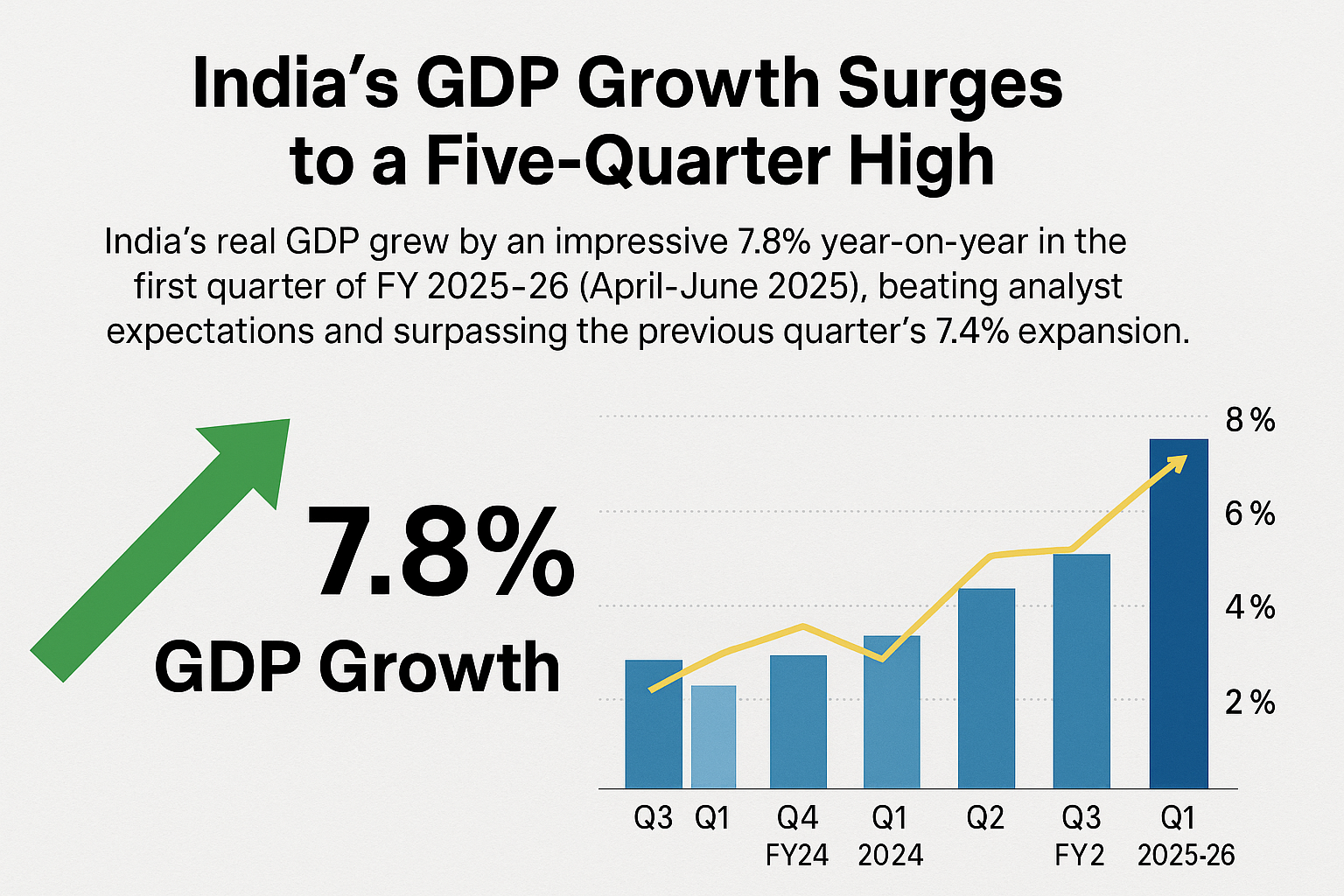

Economists predict a drop in inflation by up to 1.1 percentage points, with expected GDP growth uplift of 100–120 basis points over the next quarters.

Strategic Play: How to Use Step-Up SIPs in This Scenario

For retail investors, the current environment opens a sweet window to harness disciplined investing:

-

Start a SIP Focused on Rotation Picks

Look at sectors gaining from GST reforms—FMCGs, autos, consumer durables, insurance. Begin a SIP in a well-diversified mutual fund heavy in these sectors. -

Use Step-Up Strategy to Match the Upside

Start with a modest monthly SIP (e.g., ₹2,000) and increase it annually by 10–15%. As households save on daily expenses and get insurance relief, redirect those savings into your SIP. -

Align with Market Trends

As GST benefits kick in—especially leading up to and during Diwali—consumer demand likely surges, offering growth tailwinds to your SIP investments. -

Benefit from Compounding & Systematic Growth

Over 5–7 years, systematic step-ups coupled with market gains could compound impressively, far outpacing static investing.

Let’s have a quick summary on “GST rate changes and Council meeting impact on markets”

Summary Table

| Key Aspect | Details |

|---|---|

| Rate Structure | Two slabs—5% & 18%; 40% for sin/luxury goods |

| Implementation Date | From 22nd September 2025 (most goods/services) |

| Primary Benefits | Lower GST on essentials, insurance relief, boost to equities, easing inflation |

| Stock Market Response | Sensex & Nifty up ~0.5%—auto, consumer, insurance stocks rallying |

| Investor Tactic | Step-up SIP into reform-boosted sectors |

| Outcome Potential | Long-term gains via disciplined investing + compounding |

Final Thoughts

The GST rate changes, as crystallized in the recent GST Council meeting, represent more than just fiscal policy—they’re a potential catalyst for market growth and household relief. For the retail investor and middle class, pairing this wave with a smart step-up SIP strategy offers a way to ride sustained gains while benefiting from reduced everyday costs.

![]()

Pingback: ITR Filing Deadline 2025: 7 Key Updates Every Indian Taxpayer Must Know! - Cash Babu