Why Delaying Your SIP Can Cost You More Than You Think: Introduction

In personal finance, there’s a constant debate: “Which mutual fund is the best? Should I invest in equity or debt? Is now the right time to invest?”

While these are important questions, they often distract from the most powerful truth in investing: the earlier you start, the more wealth you can create.

When it comes to Systematic Investment Plans (SIPs), even a small delay — a few months or a couple of years — can shrink your future wealth by lakhs or even crores.

The problem is that most people underestimate the compounding effect of time. They believe they can “catch up” later by investing more. In reality, that’s rarely true without either taking excessive risks or making huge monthly contributions that strain your budget.

In this guide, we’ll explore why starting early matters so much, the cost of waiting, and how you can avoid falling into the Delaying Your SIP trap.

What is a SIP, and why is it Popular?

A Systematic Investment Plan (SIP) is an investment method where you invest a fixed sum at regular intervals — typically monthly — into a mutual fund scheme.

Instead of waiting to accumulate a lump sum, you commit small, consistent amounts that grow over time.

Why SIPs are popular in India:

- Affordability:

You can start with as little as ₹500–₹1,000 per month. This removes the “I don’t have enough to invest” excuse. - Rupee Cost Averaging:

When markets fall, your fixed contribution buys more units; when markets rise, it buys fewer. Over time, this averages out your cost per unit and reduces volatility impact. - Convenience:

SIPs can be automated through bank auto-debit instructions. Once set, you don’t need to manually invest every month. - Compounding Benefits:

SIPs tap into the exponential growth potential of compounding — your returns start earning returns. - Flexibility:

You can increase, pause, or stop SIPs whenever needed. - Behavioral Discipline:

Investing small amounts regularly makes it easier to stay committed, avoiding impulsive “in-and-out” decisions based on market noise.

Example:

Imagine you’re a salaried professional earning ₹50,000/month. You decide to start a ₹2,000 SIP in an equity mutual fund. After 20 years, at 12% annual returns, this grows to over ₹19 lakh — even though you’ve invested just ₹4.8 lakh.

💡 Action Step: If you’re new to SIPs, pick a large-cap index fund or a diversified equity fund and start with a small amount. The habit is more important than the amount in the beginning.

The Power of Compounding

Compounding is often described as “earning interest on your interest.” But in equity mutual funds, it’s more accurate to say “earning returns on your returns.”

At first, growth seems slow because your contributions are small relative to the total corpus. But over time, the magic happens — your accumulated wealth starts to generate returns so large that they exceed your yearly contributions.

Example: The ₹5,000/month SIP

| Years | Total Invested | Corpus @ 12% CAGR | Growth Multiple |

|---|---|---|---|

| 5 | ₹3 lakh | ₹4.1 lakh | 1.37x |

| 10 | ₹6 lakh | ₹11.6 lakh | 1.93x |

| 15 | ₹9 lakh | ₹24.8 lakh | 2.75x |

| 20 | ₹12 lakh | ₹50.3 lakh | 4.19x |

| 25 | ₹15 lakh | ₹95.5 lakh | 6.36x |

Notice how the growth accelerates after the 15th year. That’s the compounding effect at work.

Delayed start penalty: If you start 5 years late, you miss the most powerful years of compounding — the later years where returns explode exponentially.

💡 Action Step: Think in decades, not years. The longer your money stays invested, the more compounding works in your favor.

Real-Life Example: Starting Early vs. Delaying

Let’s compare Rahul and Priya:

| Investor | SIP Amount | Duration | Start Age | Total Invested | Corpus @ 12% CAGR |

|---|---|---|---|---|---|

| Rahul | ₹10,000 | 30 yrs | 25 | ₹36 lakh | ₹3.5 crore |

| Priya | ₹10,000 | 25 yrs | 30 | ₹30 lakh | ₹1.9 crore |

Difference in wealth: ₹1.6 crore

Key Insight: Rahul invested only ₹6 lakh more, but ends up with almost double Priya’s corpus because his money compounded for 5 extra years.

Now imagine if Priya tried to “catch up” later:

To match Rahul’s ₹3.5 crore corpus in just 25 years, she’d need to invest ₹18,000/month instead of ₹10,000 — an 80% higher contribution.

💡 Action Step: If you’re in your 20s, don’t delay — your small early investments will matter more than huge later investments.

Opportunity Cost of Delay

Opportunity cost means what you lose by not acting today. In SIPs, the loss isn’t just missed contributions — it’s the decades of lost compounding.

Example: 1-Year Delay

- SIP: ₹5,000/month, 25 years, 12% CAGR

- Delay start by 1 year = ₹60,000 not invested initially

- Future value after 25 years = ₹9.97 lakh lost

Example: 3-Year Delay

- Same SIP delayed by 3 years = ₹1.8 lakh not invested initially

- Future value lost = ₹33 lakh+

That’s the price of waiting for “the right time.”

💡 Action Step: Treat your first SIP payment as urgent as paying your electricity bill — because future you will thank you for it.

Market Timing vs. Time in the Market

Many investors delay SIPs thinking:

- “The market is too high now.”

- “I’ll wait for the crash.”

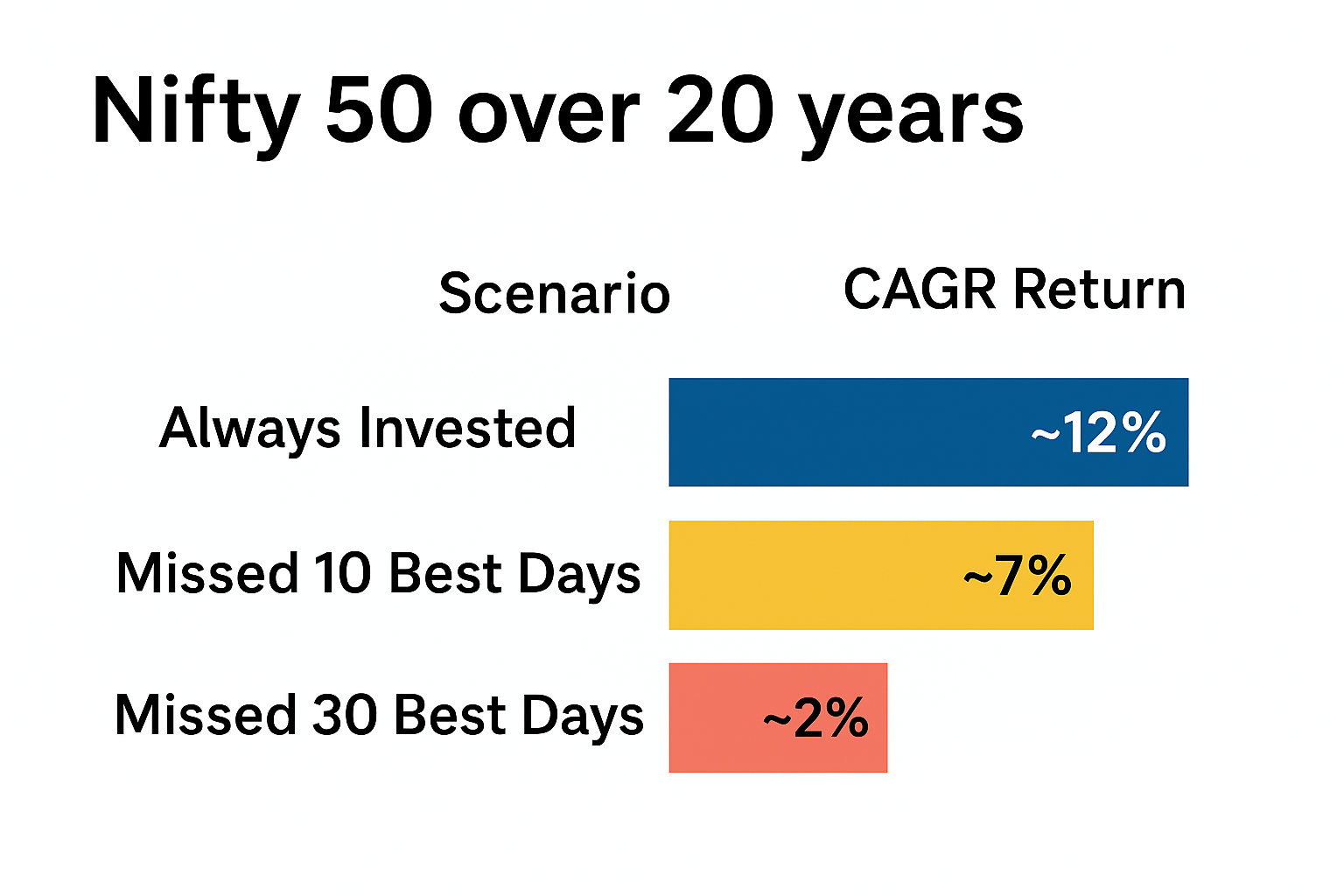

But here’s what data shows for Nifty 50 over 20 years:

Key Insight: The best market days often come right after the worst days. Trying to time the market risks missing them entirely.

Key Insight: The best market days often come right after the worst days. Trying to time the market risks missing them entirely.

💡 Action Step: Start your SIP now, keep it running regardless of market noise, and review only once or twice a year.

Behavioral Reasons for Delaying Your SIP

People delay SIPs for reasons that feel logical but are financially damaging:

- “I’ll start when I earn more” — But lifestyle expenses grow along with income, and “extra” money rarely appears.

- “I’ll wait for markets to fall” — Timing the market is guesswork.

- “I don’t have enough” — SIPs can start with ₹500.

- “Next financial year” — This becomes an endless cycle.

Behavioral Finance Insight: We overvalue present comfort over future security — a bias called hyperbolic discounting.

💡 Action Step: Commit to a small, automatic SIP now. You can scale it later without feeling the pinch.

How Delaying Affects Your Financial Goals

Let’s say your goal is your child’s education in 15 years (₹50 lakh needed).

| Start Age | SIP Needed @ 12% CAGR |

|---|---|

| 30 | ₹10,000/month |

| 35 | ₹18,000/month |

Impact: A 5-year delay means you need 80% more every month — a huge burden.

Similarly, for retirement:

| Start Age | SIP Needed for ₹5 crore corpus |

|---|---|

| 25 | ₹15,000/month |

| 35 | ₹27,000/month |

| 45 | ₹65,000/month |

💡 Action Step: Define your goals, use a SIP calculator, and see how delays inflate your monthly burden.

Inflation: The Silent Wealth Eroder

Inflation reduces purchasing power over time.

Example: ₹1 lakh today = ₹41,000 worth in 20 years at 5% inflation.

- Bank FDs (~6-7%): Barely keep pace with inflation.

- Equity SIPs (~10-14% historically): Consistently outpace inflation.

Delaying SIPs often means parking money in low-return instruments, which is a guaranteed way to lose wealth in real terms.

💡 Action Step: Use equity-oriented SIPs for long-term goals to beat inflation.

How to Overcome the Habit of Delaying

Procrastination is the silent killer of financial dreams. Even when we know that starting a SIP early is beneficial, our minds find creative excuses to postpone it — “I’ll start after my next salary hike,” “I’ll wait for the market dip,” “I’ll begin next financial year.” The problem is, these delays stack up and cost us precious compounding years.

To break the cycle, here are five powerful strategies that can help you start your SIP now and stick with it for the long term.

Start Tiny – Build the Habit First

One of the biggest misconceptions is that you need a big monthly amount to start investing. The truth is, amount matters less than habit in the beginning.

-

Even ₹500 or ₹1,000 a month is enough to begin.

-

Your first SIP is not about making you rich instantly — it’s about making you consistent.

-

Once the habit is set, scaling up becomes natural.

Example:

Rohit, a fresh graduate, started with just ₹1,000/month in 2018. Every year, he increased his SIP by ₹500. By 2025, he was investing ₹4,500/month without ever feeling the financial pinch — and his corpus had already crossed ₹3 lakh.

💡 Pro Tip: Pick a date in the next 7 days to set up your first SIP, no matter how small. Waiting for “the right amount” is how delays creep in.

Automate It – Remove the Decision Fatigue

When investing requires manual effort each month, there’s always a risk you’ll “skip this one” because of unexpected expenses or laziness.

Solution: Set up an auto-debit mandate with your bank or mutual fund platform so the SIP is deducted automatically on a fixed date each month.

-

Choose a date right after your salary credit — this ensures you “pay yourself first.”

-

Once automated, you don’t have to wrestle with the decision every month.

Why it works: Automation removes emotions from investing. Whether markets are up, down, or sideways, your SIP continues without hesitation.

💡 Pro Tip: Use a separate savings account linked to your investments. Keep only your monthly investment amount there to avoid accidental spending.

Goal-Linking – Give Your SIP a Purpose

A vague idea of “I should invest” is weaker than a clear, emotionally powerful goal. When your SIP is tied to something you truly care about, the motivation to keep going becomes much stronger.

Examples of goal-linked SIPs:

-

₹5,000/month SIP for child’s education in 15 years.

-

₹10,000/month SIP for retirement corpus by age 60.

-

₹2,000/month SIP for dream vacation in 8 years.

When you visualize your SIP as “future school fees” or “Europe trip fund,” it stops feeling like a boring deduction and starts feeling like a step toward something exciting.

💡 Pro Tip: Name your SIPs in your investment platform. Seeing “Retirement Freedom Fund” instead of “SBI Equity Fund” makes it more meaningful.

Annual Step-Up – Grow Your SIP with Your Income

One reason people delay starting SIPs is the belief that they should “wait until they earn more.” But income growth is inevitable for most — and you can use it to scale your SIP without feeling the pinch.

The Step-Up SIP Strategy:

-

Start with an amount you can easily afford today.

-

Increase it by 10%–15% every year in line with your salary hikes.

Example:

Starting SIP: ₹5,000/month at age 25, 12% CAGR

-

With no step-up: ₹95.5 lakh in 25 years

-

With 10% annual step-up: ₹2.2 crore in 25 years — over double the wealth without doubling your initial effort.

💡 Pro Tip: Set a calendar reminder every appraisal month to raise your SIP before adjusting your lifestyle expenses upward.

Accountability – Make Your Commitment Public

We’re more likely to stick to a habit when someone else knows about it. Share your SIP goals with:

-

A trusted friend

-

Your spouse/partner

-

A financial advisor

When you make it public, skipping or delaying feels like breaking a promise — and that social pressure can work in your favor.

You can also join online investment communities where members track and celebrate each other’s progress. Seeing others stick to their SIPs, even during tough markets, can reinforce your own discipline.

💡 Pro Tip: Pair up with an “investment buddy.” Set mutual SIP goals and check in quarterly to track each other’s progress.

vi. Final Thought on Beating Delay

Starting your SIP is not about finding the perfect market condition or the ideal amount — it’s about creating a system that makes investing automatic, easy, and goal-driven. Once you build that system, you remove the friction that causes delay.

Remember: You don’t become wealthy because you invest huge sums later. You become wealthy because you start early, stay consistent, and let compounding do the rest.

Conclusion: Start Small, But Start Now

In investing, the most dangerous four words are: “I’ll start next year.”

This single decision — or rather, indecision — can cost you far more than you realize.

The truth is, there is no perfect time to start a SIP. Markets will always look “too high” to some and “too risky” to others. There will always be global events, economic uncertainty, or personal expenses that make you think waiting is the safer choice. But every month you wait is not just a month of lost investment — it’s a month that could have been compounding for decades.

When you look back 10, 20, or 30 years from now, you won’t remember whether the market was at a “high” when you started. What you will notice is the size of your corpus — and how much bigger it could have been had you started earlier.

The High Cost of Waiting

Let’s put the cost of delay into perspective:

-

₹5,000/month SIP for 25 years @ 12% CAGR = ₹95.5 lakh

-

Same SIP starting 5 years late = ₹50.3 lakh

That’s ₹45 lakh less for the same monthly investment — all because you delayed. And remember, those extra years you skipped are the ones where compounding works its hardest for you.

Why Starting Small Works Wonders

Many people delay starting because they think, “I’ll wait until I can invest ₹10,000 or ₹20,000 a month.” This is a mistake. You can start with ₹500 or ₹1,000 — the amount doesn’t matter at first. What matters is building the habit and letting your investments start their compounding journey as soon as possible.

By starting small:

-

You remove the psychological barrier of “I can’t afford it yet.”

-

You give yourself the flexibility to step up later without pressure.

-

You let time — your most powerful ally — work for you immediately.

The Time vs. Timing Lesson

Over decades, time in the market will almost always beat timing the market. Even professional fund managers rarely get timing right consistently, and waiting for the “perfect entry” often results in missing the best-performing days.

Markets will rise and fall. But a SIP spreads your investments across market cycles, averaging your costs and ensuring you’re always participating in the next growth phase.

Key Takeaways for Action

-

Compounding rewards early starters exponentially — the longer you stay invested, the faster your wealth grows in later years.

-

Even small delays can cost lakhs or crores — these are losses you can never fully recover from without significantly higher contributions or risk.

-

Time in the market beats market timing — let your money work through all market cycles instead of waiting on the sidelines.

-

Start now, automate, and step up your SIP yearly — automation builds consistency, and annual step-ups align your investments with your income growth.

Final Word

The best time to start your SIP was yesterday. The next best time is today.

Don’t let the fear of small beginnings hold you back. Don’t wait for perfect conditions — they don’t exist. The cost of delay will always outweigh the perceived benefit of waiting.

Your future self will thank you for the decision you make today.

Start small. Start now. Stay consistent. And let compounding do the rest.

![]()

Pingback: India’s GDP Growth Surpasses Expectations: 7.8% Surge in Q1 FY 2025–26 - Cash Babu

Pingback: Tax Reform & Market Revamp – How "GST Rate Changes and Council Meeting Impact on Markets" Unlock Investment Opportunities for Retail Investors and the Middle Class - Cash Babu

Pingback: 27 Ways to Improve Concentration on Mutual Fund SIP—and Why It’s Crucial for Wealth Building - Cash Babu