Posted inMutual Fund Mutual Fund SIP Rules

Why Delaying Your SIP Can Cost You More Than You Think: Introduction In personal finance, there’s a constant debate: “Which mutual fund is the best? Should I invest in equity…

Posted inMutual Fund SIP Rules Mutual Fund

Step Up SIP – The Wealth-Acceleration Secret Every Middle-Class Investor Must Know Understanding the Real Meaning of Step Up SIP Step Up SIP is not just a technical feature your…

Posted inETFs Mutual Fund

The Truth Hidden in Plain Sight Have you ever felt like you're missing something crucial when it comes to investing in ETFs and Mutual Funds SIP? You're not alone. While…

Posted inMutual Fund Mutual Fund SIP Rules

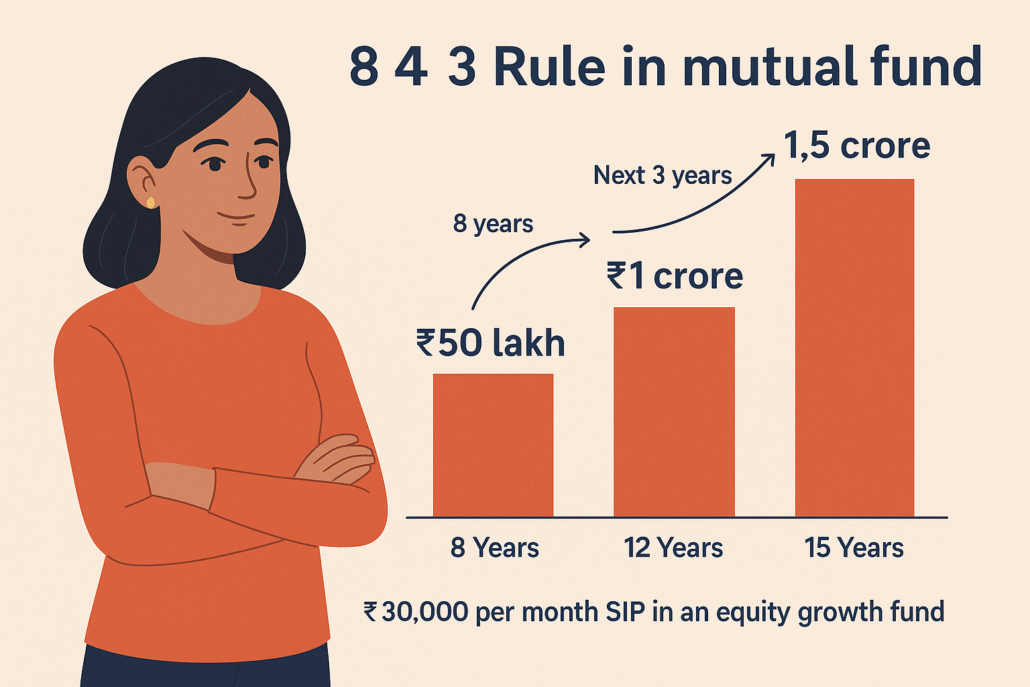

Understanding the 8 4 3 Rule in Mutual Fund The 8 4 3 rule in mutual fund is not just a number game — it’s a reality check for every…

Posted inMutual Fund Mutual Fund SIP Rules

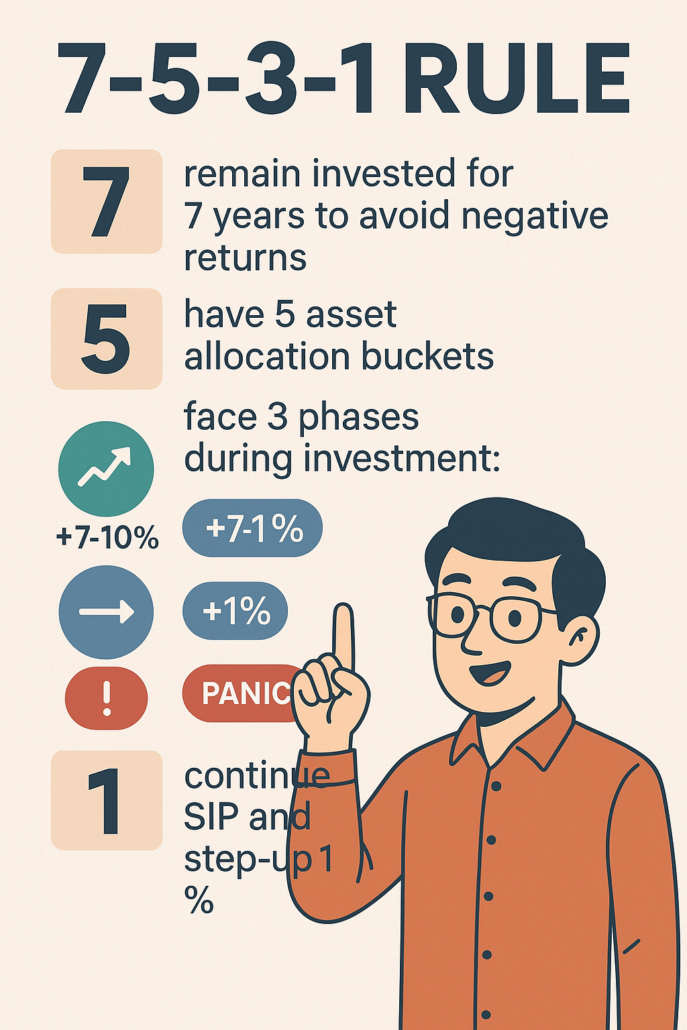

Introduction: Why You Need a Rule-Based Investment Strategy When it comes to investing, most people either rely on luck or react to market sentiments. But what if a simple rule…

Why Millennials Must Rethink Retirement Millennials—those born between 1981 and 1996—are facing a unique financial landscape. With unstable job markets, rising inflation, and increasing life expectancy, retirement planning isn't just…

Posted inMutual Fund

In the fast-changing world of investment, where risk and reward walk hand in hand, one term is quietly becoming a favorite among cautious yet growth-hungry investors: Flexi Cap mutual fund…

Posted inFixed Income Mutual Fund Mutual Fund

Understanding the Current Investment Landscape The Shift in Investor Sentiment Post-2023 India’s economic engine is roaring again, but the way we invest has changed drastically since the shocks of 2020…

Why Smart Retirement Planning Is No Longer Optional Retirement is no longer a phase you reach at 60 — it’s a financial goal that needs serious planning as early as…