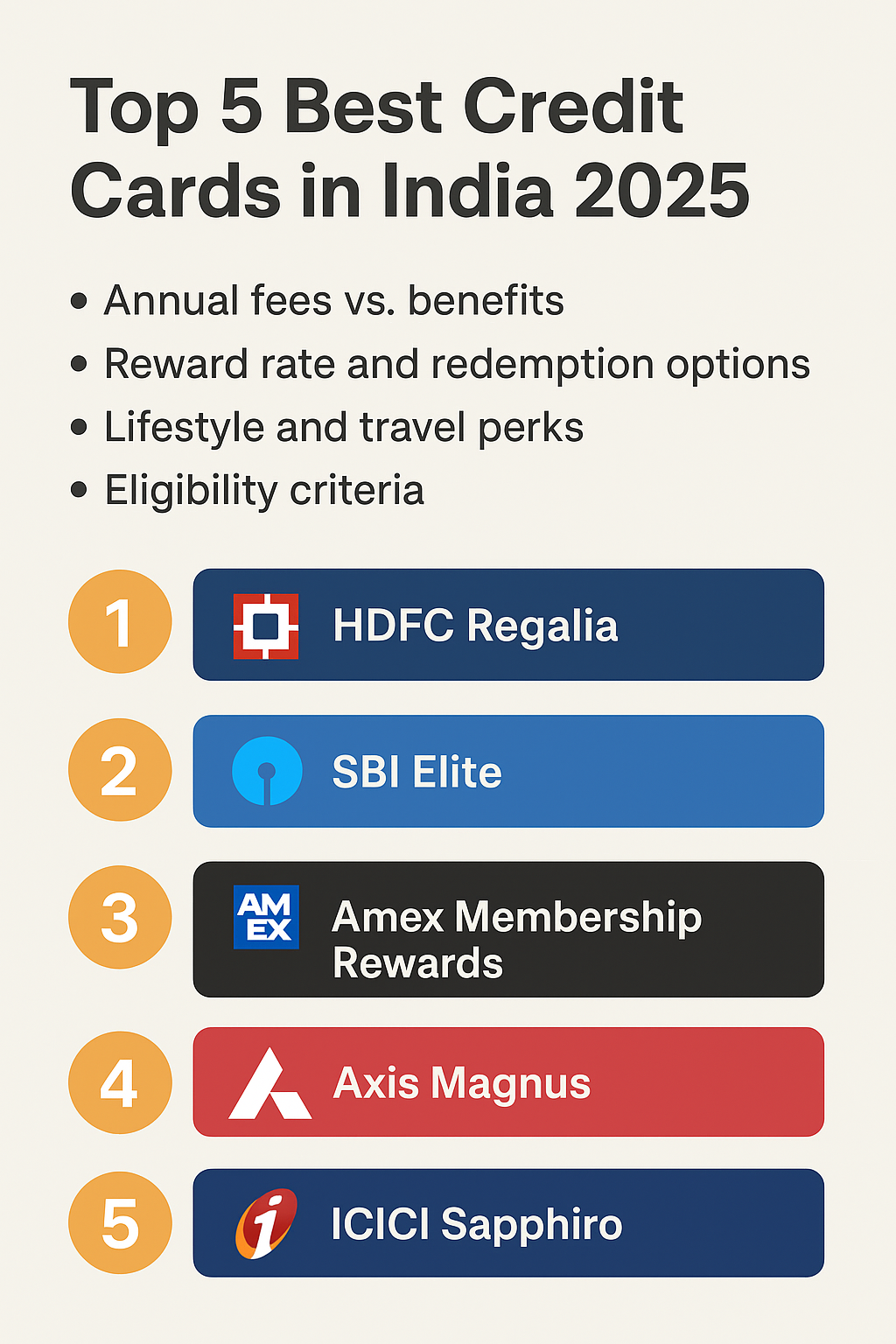

Top 5 Best Credit Cards in India 2025: Introduction

In today’s fast-paced financial landscape, credit cards are no longer just tools of convenience—they are gateways to rewards, travel privileges, lifestyle benefits, and financial flexibility. Choosing the right credit card can significantly enhance your spending experience. However, with hundreds of options available, selecting the best credit card can be overwhelming.

This comprehensive blog explores the Top 5 Best Credit Cards in India 2025, analyzing their features, eligibility, benefits, fees, and ideal user profiles. Whether you’re looking for a rewards card, a travel companion, or a card for shopping and dining, this guide will help you make an informed decision.

Why Choosing the Right Credit Card Matters

- Maximize Rewards: The right card ensures you earn maximum cashback, reward points, or miles for every rupee spent.

- Save Money: Waivers on fuel, dining discounts, and complimentary airport lounge access can save thousands annually.

- Financial Flexibility: Credit cards help manage cash flows with interest-free periods and EMI conversion options.

- Credit Score Building: Responsible usage improves your credit profile, which is crucial for future loans.

Criteria for Selecting the Best Credit Cards

HDFC Bank Regalia Credit Card

Overview

HDFC Regalia is one of the most popular premium lifestyle credit cards. Known for its travel perks, lounge access, and reward programs, it caters to professionals and frequent travelers.

Key Features

- Welcome Benefit: 2500 reward points on joining.

- Rewards: 4 reward points on every ₹150 spent.

- Airport Lounge Access: 12 complimentary domestic and 6 international visits annually.

- Travel Benefits: Complimentary Club Vistara Silver membership.

- Insurance Cover: Air accident cover up to ₹1 crore.

Fees

- Joining Fee: ₹2,500 (waived on spends of ₹3,00,000 in a year).

- Annual Fee: ₹2,500.

Ideal For

- Frequent travelers.

- Users seeking luxury lifestyle benefits.

Pros & Cons

Pros: Excellent travel benefits, strong reward rate, comprehensive insurance.

Cons: High eligibility requirement, annual fee may not suit low spenders.

SBI Card Elite

Overview

SBI Card Elite is a premium lifestyle credit card offering benefits across shopping, movies, dining, and travel.

Key Features

- Welcome Gift: E-voucher worth ₹5,000 from top brands.

- Rewards: 5x reward points on dining, department store, and grocery spends.

- Lounge Access: 6 international and 8 domestic lounge visits annually.

- Other Benefits: Free movie tickets worth ₹6,000 every year.

- Milestone Benefits: Anniversary gift vouchers worth ₹7,000.

Fees

- Joining Fee: ₹4,999.

- Annual Fee: ₹4,999 (waived on annual spends of ₹10,00,000).

Ideal For

- Lifestyle seekers who spend heavily on dining, movies, and shopping.

Pros & Cons

Pros: High-value welcome gift, great milestone benefits.

Cons: High annual fee, only worthwhile for high spenders.

American Express Membership Rewards Credit Card

Overview

The Amex Membership Rewards Card is designed for customers who enjoy redeeming reward points across multiple categories.

Key Features

- Welcome Gift: 4000 Membership Reward Points.

- Rewards: 1 Membership Reward Point per ₹50 spent.

- Monthly Bonus: 1000 bonus points on spending ₹4,000 every month.

- Redemption Options: Travel, shopping, and statement credit.

Fees

- Joining Fee: ₹1,000.

- Annual Fee: ₹4,500 (waived in some cases).

Ideal For

- Individuals who consistently spend monthly and prefer reward point accumulation.

Pros & Cons

Pros: Excellent reward redemption catalog, strong monthly bonus structure.

Cons: Limited merchant acceptance in small towns, high annual fee.

Axis Bank Magnus Credit Card

Overview

Axis Magnus is a luxury credit card designed for high-net-worth individuals offering exclusive travel and lifestyle privileges.

Key Features

- Welcome Gift: Taj voucher worth ₹10,000.

- Lounge Access: Unlimited international and domestic lounge access.

- Rewards: 12 EDGE reward points for every ₹200 spent.

- Travel Privileges: Complimentary airport pick-up and drop, concierge services.

- Insurance: Air accident cover up to ₹4.5 crore.

Fees

- Joining Fee: ₹10,000.

- Annual Fee: ₹10,000 (waived on spends of ₹15,00,000).

Ideal For

- High spenders, frequent international travelers.

Pros & Cons

Pros: Luxury benefits, unlimited lounge access, concierge services.

Cons: Very high annual fee, not suitable for average earners.

ICICI Bank Sapphiro Credit Card

Overview

ICICI Sapphiro is a dual card (Mastercard + American Express) offering comprehensive lifestyle, dining, and travel privileges.

Key Features

- Welcome Gift: Vouchers worth ₹9,000.

- Rewards: 4 reward points on international spends, 2 reward points on domestic spends.

- Lounge Access: 4 complimentary international and 2 domestic visits annually.

- Dining Benefits: Discounts up to 15% on dining bills.

- Insurance: Comprehensive coverage including lost card liability.

Fees

- Joining Fee: ₹6,500.

- Annual Fee: ₹6,500.

Ideal For

- Premium users seeking both international and domestic benefits.

Pros & Cons

Pros: Dual card facility, solid lifestyle benefits.

Cons: High joining fee, lower lounge access compared to peers.

Comparison Table of Top 5 Credit Cards

| Credit Card | Annual Fee | Key Benefit | Ideal For |

|---|---|---|---|

| HDFC Regalia | ₹2,500 | Travel perks, lounge access | Frequent travelers |

| SBI Elite | ₹4,999 | Shopping & lifestyle rewards | High spenders |

| Amex Membership Rewards | ₹4,500 | Reward redemption flexibility | Monthly spenders |

| Axis Magnus | ₹10,000 | Luxury travel & concierge | High-net-worth individuals |

| ICICI Sapphiro | ₹6,500 | Dual card + lifestyle benefits | Premium spenders |

How to Choose the Right Credit Card for You

With hundreds of credit cards available, each offering its own set of perks, benefits, and rewards, choosing the right one can feel overwhelming. The key is to find a card that doesn’t just look attractive on paper, but one that truly matches your lifestyle, spending behavior, and financial goals. Here are some essential factors to keep in mind when making your decision:

Understand Your Spending Habits

The first step is to analyze where you spend most of your money. Credit cards are designed to cater to different kinds of consumers:

- Frequent Travelers: If you travel often, go for cards that provide complimentary airport lounge access, air miles, travel insurance, and tie-ups with airlines or hotels. These can save you thousands while making your trips more comfortable.

- Foodies & Shoppers: If your biggest expenses are on dining, groceries, or retail shopping, a lifestyle or cashback-focused card will give you maximum value. Many cards provide accelerated rewards, exclusive discounts, and partner deals at restaurants and retail outlets.

- Online Shoppers: For those who shop heavily on e-commerce platforms, look for cards tied up with Amazon, Flipkart, or Paytm that offer extra cashback, no-cost EMI options, and reward points.

- Fuel Spenders: If a significant portion of your budget goes into fuel, opt for a fuel credit card that gives surcharge waivers and reward points on petrol/diesel purchases.

By aligning your card with your top spending category, you maximize rewards and save more.

Compare Annual Fees vs. Benefits

Credit cards often come with annual or renewal fees, which can range from ₹500 to ₹10,000 or more, depending on the card tier. Before applying, ask yourself:

- Does the value of rewards, cashback, lounge access, or travel perks exceed the annual fee?

- Are there waiver conditions (e.g., spending a minimum of ₹1–2 lakh in a year) that make the card effectively free?

For instance, a card with a ₹5,000 fee but benefits worth ₹15,000 in lounge access, hotel stays, and rewards can still be highly valuable if you utilize the perks.

Look at Reward Redemption Flexibility

Earning rewards is only half the story—how easily you can use them matters even more. Check whether the card allows you to redeem points for:

- Flights and Hotels: Great for frequent flyers who want to reduce travel costs.

- Shopping Vouchers: Useful for retail and e-commerce enthusiasts.

- Cashback/Statement Credit: Ideal if you prefer reducing your credit card bill directly.

- Exclusive Experiences: Premium cards often provide redemption for concerts, dining, spa sessions, or concierge services.

The best credit card is one where rewards align with your personal lifestyle rather than lying unused.

Consider Eligibility & Income Requirements

High-end cards such as Axis Magnus, HDFC Infinia, or SBI Elite offer premium privileges but also come with strict eligibility criteria. These often require:

- A minimum monthly income (₹70,000–₹1,50,000 or more).

- A strong credit score (750+) and good repayment history.

- In some cases, an existing relationship with the bank (such as being a priority banking customer).

If you are just starting your credit journey, it may be better to choose an entry-level or mid-range card with lower eligibility requirements and gradually upgrade as your income and credit score improve.

Additional Features to Watch For

Apart from the basics, also consider these factors before finalizing your card:

- Interest Rates (APR): A lower interest rate helps if you sometimes carry a balance.

- International Usage: Check for foreign transaction fees if you frequently spend abroad.

- Security Features: Look for EMV chip technology, instant blocking via mobile apps, and fraud protection.

- Introductory Offers: Some cards come with bonus rewards, welcome vouchers, or fee waivers that make them more attractive in the first year.

Final Word

Choosing the right credit card is not about getting the one with the highest rewards or fanciest features—it’s about finding the one that fits your lifestyle and maximizes your value. Whether your priority is saving on daily expenses, traveling in luxury, or building a strong credit history, there’s a card tailored to your needs.

Take time to compare options, evaluate fees against benefits, and ensure you’ll actually use the perks being offered. When selected wisely, your credit card becomes a powerful financial partner—helping you save money, enjoy exclusive privileges, and unlock opportunities that go far beyond just making payments.

Would you like me to also create a comparison table (visually friendly) showing spending habits vs. best card type (e.g., Travel Card, Cashback Card, Lifestyle Card)? That would make this section more engaging and scannable.

Tips for Using Credit Cards Wisely

A credit card can either be your best financial companion or your worst enemy—it all depends on how you use it. While the right card offers rewards, savings, and privileges, mismanagement can lead to debt traps, penalties, and a damaged credit score. To make the most of your credit card while avoiding pitfalls, follow these practical tips:

Always Pay Your Bills in Full

The golden rule of credit card usage is simple: never carry forward unpaid balances. Credit cards usually come with interest rates between 30%–45% annually, which can turn even small unpaid amounts into large debts over time.

- Pay your total outstanding balance before the due date—not just the minimum due.

- Consider setting up auto-debit or reminders to avoid missing payments.

- By clearing bills in full, you not only save on interest but also maintain a healthy credit score.

💡 Think of your card as a convenience and rewards tool—not a borrowing tool (unless you’re using specific facilities like EMI conversion or loans on cards).

Track and Redeem Reward Points

Earning reward points is fun, but they are useless if left unused. Many banks set an expiry period (2–3 years) for reward points.

- Regularly check your reward balance on your bank’s mobile app or statement.

- Redeem points for flights, shopping vouchers, dining offers, or even cashback before they expire.

- Some cards offer accelerated rewards on certain categories—keep an eye out for promotions to maximize earnings.

💡 A well-tracked rewards strategy can save you thousands of rupees every year.

Build Credit History, Don’t Overspend

One of the biggest advantages of a credit card is its role in building a strong credit score (CIBIL/Experian/Equifax in India). Timely payments and responsible usage reflect positively on your credit profile, improving your chances of getting loans in the future.

- Keep your credit utilization ratio (spending vs. limit) below 30% for a healthy score.

- Use your card for planned purchases, not impulsive shopping.

- Avoid taking cash advances unless absolutely necessary, as they come with high fees and immediate interest.

💡 Think long-term: a disciplined credit history today means easier access to home loans, car loans, or premium credit cards tomorrow.

Spread Out Expenses to Unlock Milestone Rewards

Many premium credit cards offer milestone rewards when you cross specific spending thresholds—for example, vouchers or bonus points after spending ₹3 lakh or ₹5 lakh annually.

- Instead of using multiple cards for small spends, channel larger expenses (like utility bills, travel bookings, insurance premiums, or online shopping) through a single card to unlock milestones.

- Time your purchases smartly—for example, paying an annual insurance premium or holiday package with your card can help you reach reward thresholds faster.

- Use your card across categories where you get accelerated rewards, like dining, travel, or online shopping.

💡 Strategic spending helps you maximize benefits without overspending unnecessarily.

Monitor Statements & Stay Secure

With rising cases of fraud and phishing, credit card security should never be ignored.

- Review your monthly statements carefully to detect any unauthorized transactions.

- Enable transaction alerts (SMS or app notifications) for every purchase.

- Avoid sharing your CVV, PIN, or OTP with anyone—even close friends or relatives.

- For online transactions, use cards with 2-factor authentication and prefer secure payment gateways.

💡 A vigilant eye on your statements can save you from financial and legal headaches later.

Use EMI Options Smartly

If you must make a large purchase, many cards allow you to convert transactions into EMIs at lower interest rates compared to revolving credit.

- Only use EMI conversion for planned expenses (like electronics or travel), not everyday spending.

- Compare the processing fee and interest rate before opting in.

- Ensure the EMI fits comfortably within your monthly budget.

💡 EMIs can be a useful tool if used wisely, but avoid turning every small spend into long-term debt.

Final Word

A credit card, when managed smartly, can be a source of savings, convenience, and financial growth. But when used recklessly, it can quickly become a burden. Always remember:

- Spend within your means.

- Pay on time.

- Use rewards strategically.

- Protect your financial data.

By following these simple yet powerful tips, you’ll not only maximize the benefits of your credit card but also ensure that it remains a trustworthy financial ally for years to come.

FAQs on Best Credit Cards in India

Q1. Which is the best credit card for beginners in India?

Cards like HDFC Regalia or Amex Membership Rewards are good starting points due to reasonable fees and flexible benefits.

Q2. Which credit card is best for travel benefits?

Axis Magnus and HDFC Regalia are top choices for frequent flyers with excellent lounge access and travel perks.

Q3. What is the minimum income requirement for premium cards?

Premium cards usually require ₹8–15 lakh annual income. Entry-level cards can be availed at lower income levels (₹3–5 lakh per year).

Q4. Are annual fees worth it?

Yes, if you maximize benefits like lounge access, milestone vouchers, and reward redemptions. Otherwise, a no-annual-fee card might be better.

Q5. Do credit card reward points expire?

Yes, most banks set an expiry date (usually 2–3 years). Always track and redeem points in time.

Q6. How can I avoid high interest charges?

By paying the full outstanding balance on or before the due date. Avoid only paying the minimum amount.

Q7. Can I hold multiple credit cards?

Yes, but manage them wisely. Multiple cards can improve credit score if bills are paid on time and utilization is low.

Conclusion

Credit cards have come a long way from being simple payment instruments to becoming powerful financial allies that can shape the way you spend, save, and even travel. Today, they offer rewards, cashback, lounge access, concierge services, exclusive lifestyle privileges, and global acceptance, making them indispensable for those who know how to use them smartly.

Among the wide range of options available, the HDFC Regalia, SBI Elite, Amex Membership Rewards, Axis Magnus, and ICICI Sapphiro shine as the top-performing credit cards. Each of these caters to unique lifestyles and spending habits—whether you are an avid traveler, a luxury enthusiast, a frequent shopper, or someone who wants to maximize every rupee spent.

- The HDFC Regalia is perfect for those seeking a balanced mix of travel and lifestyle benefits.

- The SBI Elite stands out for movie lovers, frequent flyers, and premium lifestyle rewards.

- The Amex Membership Rewards Card is ideal if you value flexible redemption and global privileges.

- The Axis Magnus is a true game-changer for high spenders and luxury seekers, with unmatched premium benefits.

- The ICICI Sapphiro offers all-round lifestyle perks, striking the right balance between affordability and exclusivity.

Choosing the right credit card ultimately depends on your income, lifestyle, and financial goals. A frequent flyer may find immense value in complimentary lounge access and air miles, while a shopping enthusiast may prefer higher cashback and reward multipliers. Luxury seekers, on the other hand, may prioritize global concierge services, hotel tie-ups, and premium memberships.

When used responsibly, a credit card is not just a spending tool—it is a gateway to financial growth, savings, and enhanced experiences. The key is to match the right card with your needs, keep track of annual fees versus benefits, and use rewards strategically.

In short, the best credit card is the one that aligns seamlessly with your lifestyle aspirations while also helping you manage your money more efficiently. Whether it’s flying first-class, enjoying fine dining, shopping smartly, or building a strong credit history, the right card can truly elevate your financial journey.

![]()