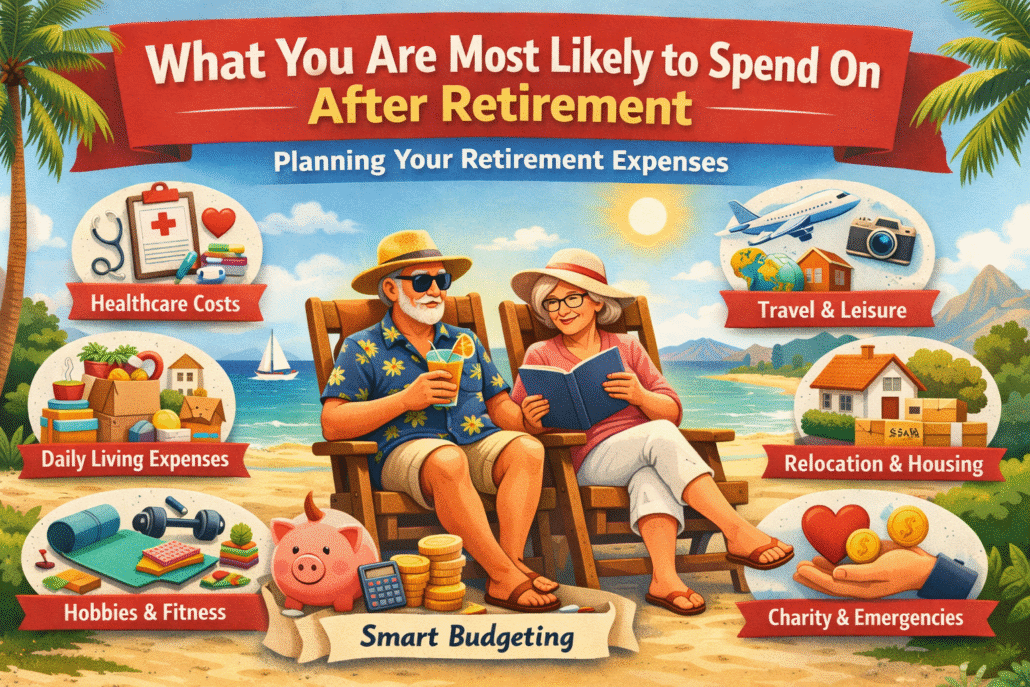

What You Are Most Likely to Spend on After Retirement – Complete Guide for Smart retirement expenses after retirement

Key Takeaways Healthcare will dominate expenses. Medical costs rise with age and must be planned early. Daily living costs continue. Groceries, utilities, and household expenses remain part of your retirement…