Key Takeaways

Inflation is the real enemy — it silently erodes your purchasing power and can destroy unplanned retirement savings.

The 80% rule (needing 80% of your pre-retirement income) is a starting point, but not sufficient in India’s inflationary reality.

Even a 10–12% return means little if inflation eats 6% of it — focus on real returns, not just nominal ones.

Early retirement planning through SIPs and mutual funds allows time to compound wealth beyond inflation.

Build an inflation-adjusted corpus, not just a fixed target number, to ensure lifelong financial comfort.

Cutting expenses isn’t enough — disciplined, inflation-beating investments are the key to financial independence.

True retirement planning equals peace, dignity, and self-respect — not dependence on others.

Why most people underestimate retirement planning

Many middle-class families believe that saving a few lakhs is enough for retirement. But retirement planning isn’t just about saving — it’s about maintaining your lifestyle for 20–30 years without a paycheck. Most retirees realize too late that inflation quietly eats away their peace of mind.

What is the 80% rule in retirement planning?

The 80% rule suggests you’ll need about 80% of your pre-retirement income to live comfortably after retirement. For instance, if your current monthly expense is ₹60,000, you’ll need around ₹48,000 per month during retirement to maintain your lifestyle.

Why this 80% rule doesn’t tell the full story

The rule assumes expenses drop after retirement. But ask any retired couple today — medical costs, electricity bills, travel, and daily groceries are all costlier than ever. Inflation ensures your ₹48,000 will buy much less in the future.

Inflation: The hidden thief of your retirement dreams

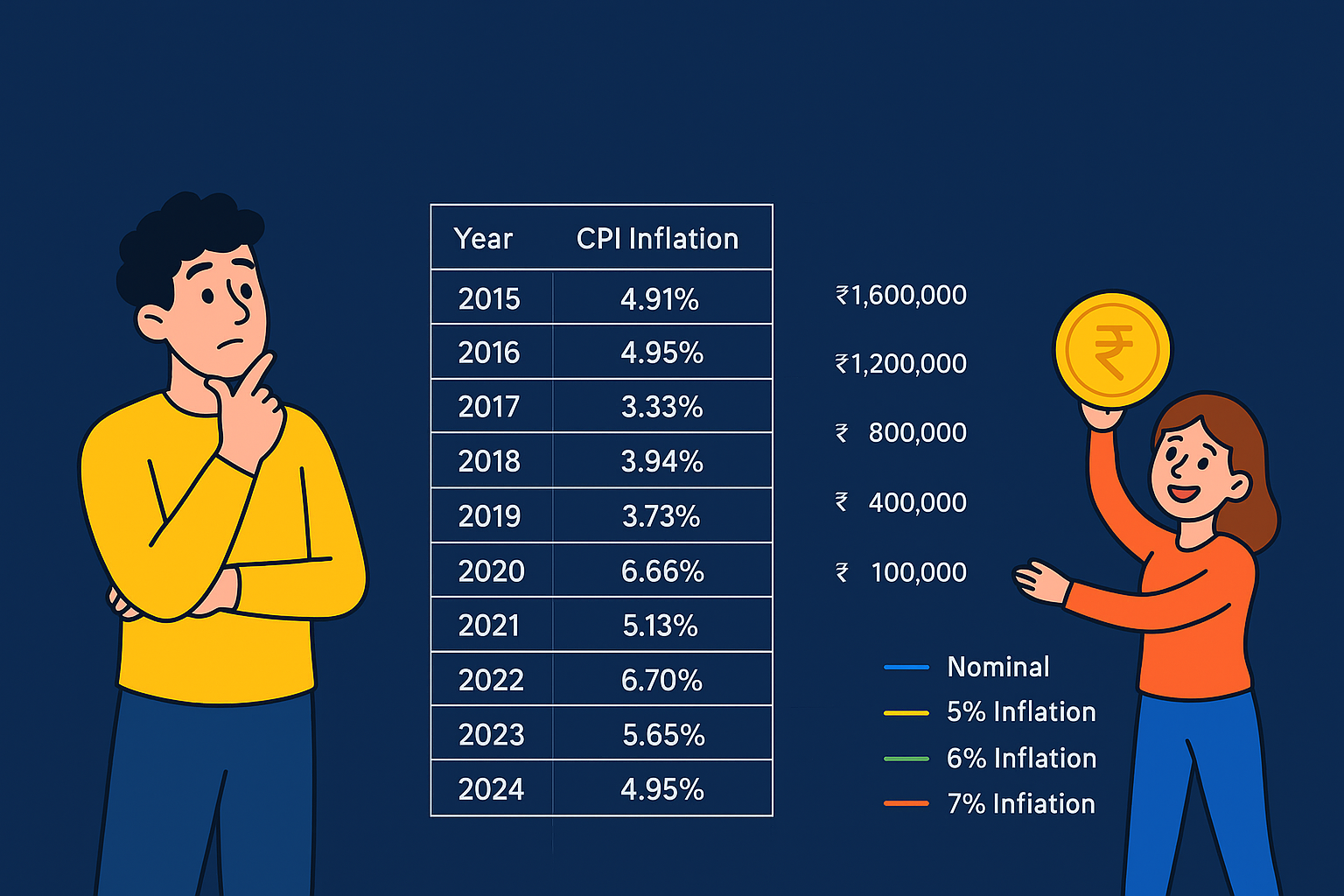

Inflation is called the silent wealth killer for a reason. Even at 6% annual inflation, your ₹1 lakh expense today will become nearly ₹3.2 lakh in 20 years. If your retirement planning ignores this reality, your comfort could turn into financial stress.

Why 10% return can still leave you broke

Even if your mutual fund gives a 10–12% CAGR, inflation at 6% cuts your real return to only 4–6%. That’s why wealth creation is not about big numbers — it’s about real purchasing power after inflation.

The shocking impact of ignoring inflation

Imagine you plan to retire at 60 and live for 25 years. A monthly expense of ₹60,000 today becomes ₹1.93 lakh at 6% inflation. Without proper retirement planning, your ₹1 crore corpus could vanish in just 9–10 years. That’s the power of inflation — it burns quietly, but fast.

How to calculate your retirement corpus wisely

Start by calculating your inflation-adjusted expenses. Use this simple approach:

-

Estimate your current monthly expense.

-

Assume 6% inflation.

-

Multiply it for the number of years left before retirement.

Then plan your SIPs or mutual fund investments to reach that inflation-adjusted goal, not just your current expense target.

Why early retirement planning always wins

The earlier you start, the more time works as your ally. A 30-year-old investing ₹10,000 monthly for 30 years at 12% return creates over ₹3.5 crore. But starting at 40 gives you only ₹1.2 crore. Time isn’t just money — it’s peace, dignity, and independence.

How to beat inflation through smart investing

To defeat inflation, your money must grow faster than prices. Equity mutual funds, SIPs, and diversified asset allocation are your best weapons. Avoid locking too much in fixed deposits that can’t outpace inflation.

Why cutting expenses alone won’t save your retirement

Retirement planning isn’t about saving ₹100 here and there — it’s about strategic investing. If inflation runs at 6%, your savings must grow at 10–12%. Cutting expenses can help, but only disciplined, long-term investing can protect your lifestyle.

The emotional cost of bad retirement planning

There’s nothing worse than depending on children or relatives for money after 60. It’s not about pride — it’s about peace of mind. Good retirement planning ensures you never have to compromise your self-respect.

Retirement planning is not optional — it’s survival

If you think retirement planning can wait, remember — inflation doesn’t wait. Every year you delay, inflation quietly steals from your future comfort. Plan today, because financial freedom is earned, not gifted.

Final takeaway: Build inflation-proof wealth

Retirement planning isn’t just math — it’s vision. Account for inflation, health costs, and lifestyle changes. Create a disciplined SIP plan that grows faster than prices. The earlier you act, the louder your money will speak when your salary stops.

FAQs on Retirement Planning

Q1. What is retirement planning in simple terms?

Retirement planning means saving and investing today to create enough wealth to sustain your lifestyle after you stop earning.

Q2. Why is inflation called the silent wealth killer?

Because it quietly reduces the value of your savings. What costs ₹1 lakh today may cost ₹3 lakh in 20 years.

Q3. Is the 80% rule accurate for India?

It’s a starting point, but not enough. Rising healthcare and lifestyle costs mean you may need 90–100% of your current income in retirement.

Q4. What’s the best way to beat inflation in retirement planning?

Invest in SIPs, mutual funds, and equities that deliver inflation-beating returns over the long term.

Q5. How much should I start investing monthly for retirement?

Begin with at least 20% of your income. Increase your SIP amount every year with salary hikes to stay ahead of inflation.

Q6. What happens if I delay retirement planning?

Each year of delay increases your target corpus significantly — meaning you’ll need to invest double to achieve the same goal later.

Q7. Can I retire comfortably with ₹1 crore?

It depends on your expenses and inflation rate. For most middle-class families, ₹1 crore may last only 8–10 years without inflation-adjusted planning.

![]()

Pingback: Are You Truly Retirement Ready? Discover the “350x Rule” for a Secure Future - Cash Babu

Pingback: 7 Habits That Will Make You Rich: Simple Daily Habits for Long-Term Financial Success - Cash Babu