Introduction

Every investor, at some point, faces a dilemma: Should I invest in equities for high growth or in debt for stability? While equities can deliver impressive returns in the long run, they also bring volatility. Debt, on the other hand, provides stability but with limited growth potential. Striking the right balance between these two asset classes is the real challenge.

This is where Balanced Advantage Funds (BAFs), also known as Dynamic Asset Allocation Funds, come into play. These funds intelligently switch between equity and debt based on market conditions, allowing investors to enjoy the best of both worlds.

But the big question remains—are they the right fit for you?

In this in-depth guide, we’ll explore everything you need to know about Balanced Advantage Funds: their definition, working mechanism, benefits, risks, suitability, and things to keep in mind before investing. By the end, you’ll be in a much better position to decide whether these funds deserve a place in your portfolio.

What are Balanced Advantage Funds?

Balanced Advantage Funds (BAFs) are hybrid mutual funds that dynamically manage their allocation between equity and debt. Unlike traditional hybrid funds that maintain a fixed ratio, BAFs adjust their exposure based on market valuations and trends.

- When markets are overvalued (expensive): They reduce equity exposure and move towards debt to safeguard capital.

- When markets are undervalued (cheap): They increase equity allocation to capture potential growth.

This flexible strategy helps investors participate in market rallies while cushioning the downside during corrections.

Key Characteristics of BAFs

📌 Category: SEBI-defined hybrid mutual fund.

📌 Equity Allocation: Can range anywhere from ~30% to 80%.

📌 Debt Allocation: Adjusted dynamically to manage risk.

📌 Taxation: Despite being hybrid, most BAFs enjoy equity taxation benefits (long-term capital gains after 1 year taxed at 10%).

In short, BAFs act like an auto-pilot system for asset allocation, removing the need for investors to constantly monitor and rebalance their portfolios.

How do Balanced Advantage Funds Work?

The core principle of BAFs is dynamic asset allocation, which is guided by valuation models and market indicators.

- Valuation-Based Allocation

Most funds use valuation indicators like Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, or yield spreads to decide whether equities are expensive or cheap.- High P/E → Reduce equity exposure.

- Low P/E → Increase equity exposure.

- Trend Following / Momentum Indicators

Some BAFs use moving averages or market momentum to determine the direction of equity allocation. - Arbitrage Component

Many BAFs maintain a portion of equity through arbitrage (buying and selling the same stock in cash and futures markets) to qualify for equity taxation. This ensures that investors benefit from equity-like tax treatment even if effective equity exposure is low. - Debt Allocation

When reducing equity, funds allocate more to debt instruments such as government securities, corporate bonds, or money market instruments. This stabilizes returns during volatile times.

Benefits of Balanced Advantage Funds

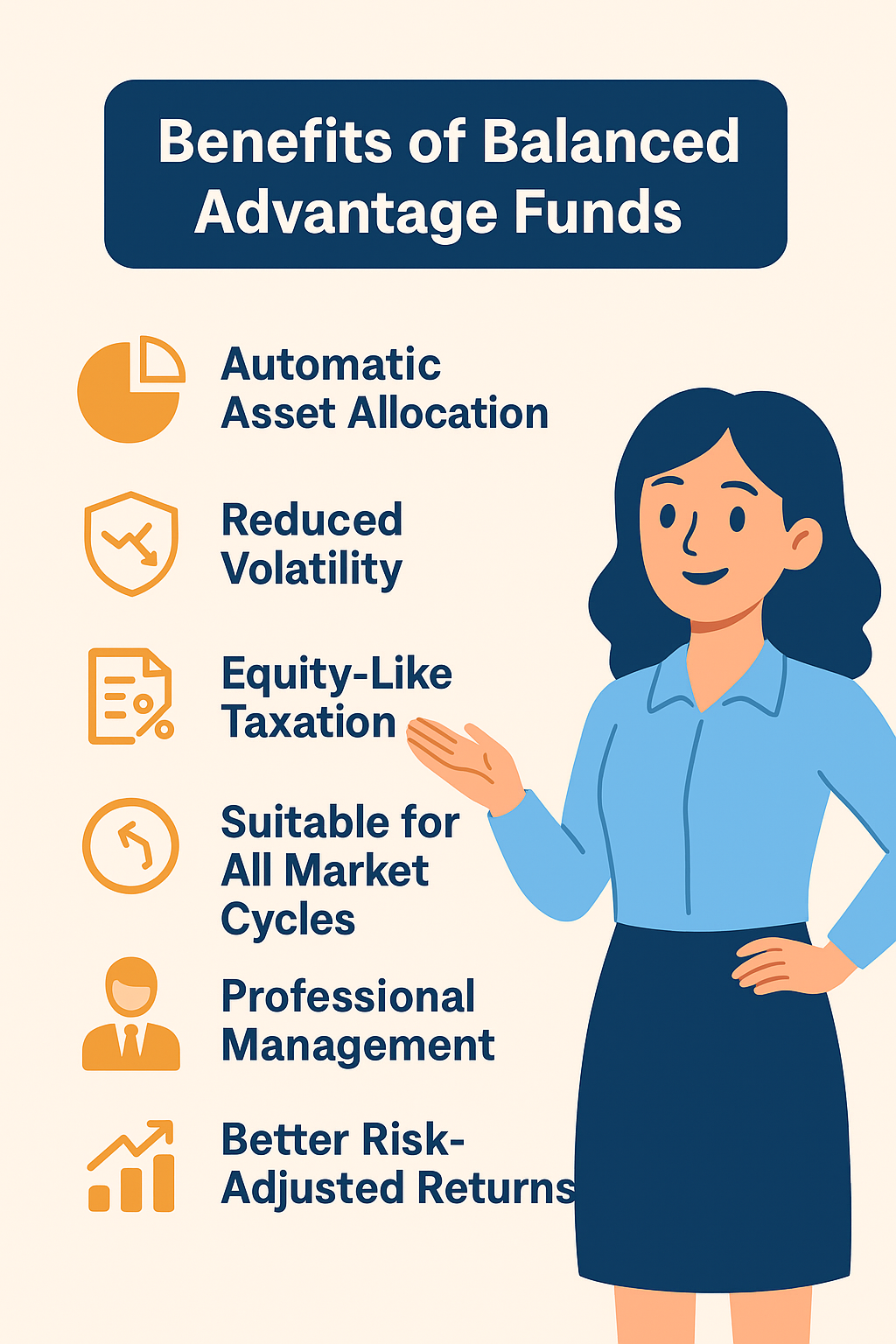

BAFs have gained popularity because they offer several advantages:

1. Automatic Asset Allocation

Investors often struggle with timing the market. BAFs solve this by letting fund managers dynamically rebalance between equity and debt, ensuring you don’t have to make those tough calls.

2. Reduced Volatility

Debt allocation acts as a cushion during market downturns. While equity may fall sharply, the debt component helps reduce overall portfolio volatility.

3. Equity-Like Taxation

Even though BAFs may at times hold less equity exposure, they are structured to qualify for equity taxation, which is more favorable than debt taxation.

- Long-term capital gains (after 1 year): 10% (above ₹1 lakh).

- Short-term capital gains (within 1 year): 15%.

4. Suitable for All Market Cycles

Unlike pure equity or debt funds, BAFs can adapt to bullish, bearish, and sideways markets, making them versatile.

5. Professional Management

Fund managers use data-driven models and market research to rebalance, which is far more efficient than individual guesswork.

6. Better Risk-Adjusted Returns

By balancing risk and reward, BAFs aim to provide smoother wealth creation, making them ideal for conservative-to-moderate investors.

Risks of Balanced Advantage Funds

Like any investment, BAFs also come with certain risks:

1. No Guaranteed Returns

Though designed to reduce volatility, BAFs are still market-linked. In sharp downturns, they may also deliver negative returns.

2. Complex Strategy

The asset allocation models are not fully transparent. Investors may not always understand why equity exposure has been reduced or increased.

3. Moderate Returns in Bull Markets

During strong bull runs, BAFs may underperform pure equity funds since a part of their portfolio remains invested in debt.

4. Fund Manager Dependence

The success of a BAF largely depends on the efficiency of fund managers and their valuation models. A wrong call can impact performance.

5. Expense Ratio

Dynamic allocation involves active management, which may result in higher expense ratios compared to passive funds.

Who Should Invest in Balanced Advantage Funds?

BAFs are not suitable for every investor. They are designed for those who:

✅ First-Time Investors

New investors who want exposure to equities but fear high volatility.

✅ Conservative Investors

People who prefer better returns than fixed deposits but want lower risk than pure equity funds.

✅ Long-Term Investors (5+ Years)

Investors with a medium-to-long horizon who want wealth creation with risk management.

✅ Those Who Don’t Want to Time the Market

Investors who prefer automatic rebalancing instead of making tactical calls.

✅ Retirees and Risk-Averse Investors

People looking for smoother returns and downside protection in volatile times.

Things to Keep in Mind Before Investing in Balanced Advantage Funds

Before putting your money into Balanced Advantage Funds (BAFs), it’s essential to understand a few critical factors that can impact your returns and overall investment experience.

1. Check Past Performance Across Market Cycles

Do not judge a Balanced Advantage Fund only by its performance in the last 1–2 years. Instead, evaluate how the fund has behaved in different market conditions—bull phases (rising markets), bear phases (falling markets), and sideways markets (range-bound). A good BAF should show consistency in protecting downside risks during market corrections while still participating reasonably well in rallies.

2. Expense Ratio Matters

Every mutual fund charges an expense ratio, which is the cost of managing the fund. Since BAFs actively switch between equity and debt, their expense ratio may be slightly higher than pure index funds or debt funds. A higher expense ratio directly reduces your net returns. Therefore, always compare expense ratios across different fund houses offering BAFs before making a decision.

3. Match Your Investment Horizon

Balanced Advantage Funds are designed for investors with a medium- to long-term horizon. They are not suitable if you’re looking for quick short-term gains. Ideally, you should stay invested for at least 5 years to allow the fund’s dynamic asset allocation strategy to play out effectively and deliver stable risk-adjusted returns.

4. Don’t Treat BAFs as a Pure Equity Substitute

While BAFs do invest in equities, they are not the same as pure equity funds. Aggressive investors seeking maximum growth should not rely solely on BAFs to meet their long-term wealth creation goals. Instead, BAFs should be seen as a stability-oriented allocation that balances risk and return, not as a replacement for dedicated equity exposure.

5. Diversify Across Asset Classes

Even if you choose to invest in Balanced Advantage Funds, do not put all your money into them. True wealth creation comes from diversification across multiple asset classes—such as equity funds, debt funds, gold, or even international exposure. BAFs can be a core holding in your portfolio, but they should work alongside other investments to reduce risks and enhance overall returns.

Popular Balanced Advantage Funds in India (2025)

While specific recommendations depend on individual risk profiles, some of the well-known BAFs include:

- ICICI Prudential Balanced Advantage Fund

- HDFC Balanced Advantage Fund

- Nippon India Balanced Advantage Fund

- Aditya Birla Sun Life Balanced Advantage Fund

- SBI Balanced Advantage Fund

(Note: Always consult with a financial advisor before investing.)

Comparison: BAFs vs. Other Hybrid Funds

| Feature | Balanced Advantage Fund | Aggressive Hybrid Fund | Conservative Hybrid Fund |

|---|---|---|---|

| Equity Allocation | 30–80% (dynamic) | ~65–80% (fixed) | ~10–25% |

| Debt Allocation | Adjusted dynamically | ~20–35% | ~75–90% |

| Taxation | Equity taxation | Equity taxation | Debt taxation |

| Flexibility | High | Medium | Low |

| Suitable For | Moderate investors | Aggressive investors | Conservative investors |

Balanced Advantage Funds in Different Market Conditions

One of the biggest advantages of Balanced Advantage Funds (BAFs) is their ability to adjust dynamically to changing market conditions. By shifting between equity and debt, they aim to protect investors from extreme volatility while still ensuring reasonable growth. Let’s see how they behave across different phases of the market:

1. Bull Market – Participation with Controlled Risk

In a strong bull market, stock prices rise steadily, and equity funds often deliver high returns. Balanced Advantage Funds also participate in this growth by maintaining a higher allocation to equities. However, since they are not 100% invested in equities (like pure equity funds), their returns may be slightly lower than those of aggressive equity schemes. The trade-off, though, is reduced risk exposure—investors still enjoy good growth but with less volatility.

-

Example: During a market rally, if equity funds generate 20% returns, a BAF may generate around 14–16% but with lower risk.

2. Bear Market – Cushion Against Heavy Losses

In a bear market, when stock prices decline sharply, pure equity investors often face steep losses. Balanced Advantage Funds step in with their dynamic allocation strategy, shifting a larger portion of the portfolio into debt instruments and arbitrage opportunities. This reduces equity exposure and cushions investors from significant downside risk. While the fund may still post small negative returns, the losses are typically much smaller compared to pure equity funds.

-

Example: If equity funds fall by 25%, a BAF may restrict the fall to around 8–12%, depending on its debt exposure.

3. Sideways Market – Steady and Moderate Returns

Markets don’t always move up or down; sometimes they remain range-bound or sideways for extended periods. In such conditions, pure equity funds may struggle to generate meaningful returns. Balanced Advantage Funds, however, can still deliver moderate returns through:

-

Tactical asset rebalancing between equity and debt.

-

Arbitrage strategies, which capture small but steady gains from market inefficiencies.

This makes them a reliable choice for generating reasonable, consistent returns even when markets are stuck in consolidation phases.

Why This Matters

This adaptability across bull, bear, and sideways markets makes Balanced Advantage Funds a well-rounded investment option. They are particularly suitable for investors who want a balance between growth and stability, without having to worry about timing the market or constantly rebalancing their portfolio themselves.

Case Study 1: ICICI Prudential Balanced Advantage Fund – Growth

Historical Performance Highlights

-

10-Year Annualized Return: ~11.36%.

-

5-Year Annualized Return: ~14.07%

-

3-Year Annualized Return: ~13.09%

-

1-Year Return: ~6.15%

-

Since Inception (Dec 2006): ~11.35% annualized.

Additional perspective:

-

ET Money reports this fund often ranks among the highest-returning Dynamic Asset Allocation schemes, noting it achieved a 10-year annual return with outperformance in 70% of 5-year holding scenarios.

-

Economic Times lists trailing returns as approximately 14.31% for 5 years, 13.38% for 3 years, and since-launch return of about 11.38%

Stability & Risk Metrics

-

Sharpe Ratio: 1.28

-

Alpha: 6.27

-

Beta: Very low at 0.11 (indicating limited volatility relative to the market).

SIP Analysis

-

A ₹1,000/month SIP over 10 years would have grown to approximately ₹2,25,859—translating to ~12.15% annualized returns

Case Study 2: HDFC Balanced Advantage Fund – Direct / Regular Growth

Historical Performance Highlights

-

Since Inception (varies by plan): ~15.53% annualized, effectively doubling investments every 5 years

-

10-Year Annualized Return: ~15.53%

-

5-Year Annualized Return: ~22.84%—exceptionally strong.

-

3-Year Annualized Return: ~19.58% .

-

1-Year Return: ~1.01%—modest, possibly reflecting recent market lull.

-

Fund Age & Size: Launched (~January 2013)—12 years 7 months old, with AUM over ₹1 lakh crore (₹1,01,773 Cr).

-

Expense Ratio: ~0.74%—relatively competitive for active management mentioned in ET Money.

Stability & Risk

-

Valueresearch indicates the fund carries “Very High” risk as mentioned in the website Value Research Online.

-

SIP returns: A ₹4,60,000 investment via SIP over 3 years would grow to ~₹6,20,336 (approx. 16.77% annualized)

Case Study 3: SBI Balanced Advantage Fund

The SBI Balanced Advantage Fund is one of the newer entrants in the dynamic asset allocation space (launched Aug 2021). Despite its shorter history compared to ICICI and HDFC, it has gained strong investor attention thanks to SBI MF’s brand reputation and disciplined strategy.

Fund Snapshot

-

Launch Date: Aug 2021

-

Fund House: SBI Mutual Fund (India’s largest AMC by AUM)

-

Category: Dynamic Asset Allocation / Balanced Advantage

-

Fund Manager(s): Dinesh Ahuja & others

-

Assets Under Management (AUM): ~₹25,000 Cr (as of Aug 2025)

-

Expense Ratio: ~0.80% (Direct plan)

-

Risk Rating: Moderately High

Historical Performance (as of Aug 2025)

| Time Period | Fund Return | Category Avg | Nifty 50 TRI |

|---|---|---|---|

| 1 Year | ~13.2% | ~11.9% | ~15.1% |

| 3 Years (since launch) | ~12.7% CAGR | ~11.2% | ~14.0% |

(Source: Moneycontrol, ET Money, Valueresearch — August 2025)

SIP Growth Example

-

₹10,000/month SIP since launch (3 years): ~₹4.2 lakh invested → ~₹4.9 lakh value (~12% annualized).

How SBI BAF Allocates Assets

SBI follows a valuation + trend-following approach:

-

Valuation-Based Allocation

-

Uses P/E and yield spreads to decide equity vs. debt.

-

Low valuations → higher equity.

-

High valuations → equity cut back.

-

-

Momentum Indicators

-

Uses moving averages to confirm market direction.

-

-

Debt Portfolio Quality

-

Invests mainly in government securities and AAA corporate bonds for stability.

-

-

Equity Arbitrage

-

Maintains a minimum portion in arbitrage to qualify for equity taxation.

-

Strengths of SBI Balanced Advantage Fund

✅ Disciplined Allocation Framework: Transparent process combining valuation & momentum filters.

✅ Smoother Risk Profile: Debt-heavy in volatile phases, equity tilt in rallies.

✅ Equity-Like Taxation: Enjoys same tax benefits as ICICI & HDFC BAFs.

✅ Trusted AMC: SBI MF has credibility and strong research teams.

Limitations / Risks

⚠️ Short Track Record: Only ~3 years old, so lacks long-term performance history.

⚠️ Underperformance Risk in Strong Bull Runs: Like ICICI, it may lag pure equity in surges due to partial debt allocation.

⚠️ Dependence on Models: Allocation decisions rely heavily on valuation + momentum; if models fail, performance may suffer.

Suitability

SBI Balanced Advantage Fund works best for:

-

New or Conservative Investors who want exposure to equity with downside protection.

-

Medium-Term Investors (3–5 years) seeking smoother compounding.

Quick Comparison (ICICI vs HDFC vs SBI BAF)

| Fund | 3-Year CAGR | 5-Year CAGR | 10-Year CAGR | Expense Ratio | Risk Style |

|---|---|---|---|---|---|

| ICICI BAF | ~13.1% | ~14.0% | ~11.3% | ~1.4% (Regular) | Balanced, steady |

| HDFC BAF | ~19.6% | ~22.8% | ~15.5% | ~0.74% (Direct) | Aggressive, equity-tilted |

| SBI BAF | ~12.7% (since launch) | N/A | N/A | ~0.80% | Conservative, newer |

Takeaway:

-

ICICI BAF = Stability & consistency across cycles.

-

HDFC BAF = Aggressive, higher returns in rallies but riskier.

-

SBI BAF = New, conservative, brand-backed, smoother ride.

Conclusion: Should You Invest in Balanced Advantage Funds?

Balanced Advantage Funds (BAFs) are no longer just another category in the mutual fund universe — they are increasingly becoming a core solution for investors who seek balance, flexibility, and peace of mind.

At their heart, these funds are designed to solve one of the biggest dilemmas in investing: Should I be in equity for growth or debt for safety? Instead of forcing you to choose, they dynamically manage the mix for you.

Why They Deserve a Place in Your Portfolio

-

Protection in Downturns:

When markets fall sharply, BAFs automatically scale down equity exposure and shift to safer debt instruments. This cushions your portfolio and prevents deep drawdowns that pure equity funds may suffer. -

Participation in Rallies:

When markets look attractive, these funds lean more heavily into equities — allowing you to capture a good share of the upside. -

Equity-Like Taxation Benefits:

Even though allocations vary, most BAFs qualify as equity-oriented schemes, meaning you enjoy the favorable tax treatment usually reserved for equity funds. -

Professional & Disciplined Management:

Fund managers apply valuation models, momentum indicators, and market research to rebalance portfolios. This takes the stress of market timing away from you and puts it in the hands of seasoned professionals. -

Smoother Investment Journey:

The real strength of BAFs lies in the psychological comfort they offer — a steady hand through volatile times, letting investors stay invested for longer horizons.

The Big Picture: Lessons from ICICI, HDFC & SBI BAFs

-

ICICI Prudential BAF: Known for consistency and stability. It shines in protecting the downside and provides steady compounding.

-

HDFC BAF: More aggressive in equity allocation, which makes it a star performer in bullish cycles, though with slightly higher risk.

-

SBI BAF: A newer entrant but quickly gaining traction thanks to SBI MF’s credibility and its conservative, rules-based strategy.

Together, these case studies demonstrate that BAFs can adapt to different investor needs — from conservative savers to growth-oriented long-term players.

Who Should Seriously Consider BAFs?

-

First-Time Mutual Fund Investors: You want equity exposure but fear sharp volatility.

-

Conservative Investors: You seek better-than-FD returns but without taking full equity risk.

-

Long-Term Wealth Creators: You’re happy to stay invested 5+ years and prefer smoother returns.

-

Busy Professionals: You don’t want the stress of following markets daily or timing your entries and exits.

Final Word

Balanced Advantage Funds are not a magic bullet. They won’t always beat pure equity funds in roaring bull runs, nor will they completely shield you in severe crashes. But they are among the most practical, flexible, and emotionally reassuring investment options available to retail investors today.

If you’re the kind of investor who values:

✅ Growth with discipline

✅ Downside protection in uncertain markets

✅ Tax efficiency and professional rebalancing

… then a Balanced Advantage Fund deserves serious consideration in your portfolio.

✨ If you want a smoother, stress-free investment journey without daily market worries, a Balanced Advantage Fund may just be the right choice for you.

![]()