ITR Filing Deadline 2025: A Comprehensive Guide to Filing Your Income Tax Return

Filing your Income Tax Return (ITR) is a critical financial responsibility for every individual, business owner, and professional in India. With the Financial Year (FY) 2024–25 set to conclude soon, it’s time to understand the ITR filing process, key deadlines, eligibility criteria, and best practices to ensure timely and error-free filing. Whether you are filing for the first time or are a seasoned taxpayer, this detailed guide covers everything you need to know about ITR filing in 2025.

📊 What is Income Tax Return (ITR) Filing?

An Income Tax Return (ITR) is a document through which taxpayers report their income, deductions, and taxes paid to the Income Tax Department of India. Filing the ITR ensures transparency, helps the government monitor taxable income sources, and determines tax liabilities or refunds. It also forms a crucial part of your financial record.

Who Should File an ITR?

You must file your ITR in 2025 if you fall under any of these categories:

- Your total income exceeds ₹2.5 lakh during the financial year.

- You earn income from capital gains such as property or stocks.

- You are self-employed, a freelancer, or run a business.

- You have foreign income or foreign assets.

- You want to claim a refund of excess tax deducted at source (TDS).

- You wish to carry forward losses (e.g., business or capital loss).

- You are a salaried individual and wish to maintain a clean tax record.

📅 ITR Filing Deadline for FY 2024–25 (AY 2025–26)

For most individual taxpayers and businesses not subject to audit, the Income Tax Return filing deadline is 31st July 2025.

Extended Deadlines

For FY 2024-25 (AY 2025-26), the last date to file ITR for non-audit taxpayers is 15 September 2025, extended from the original 31 July 2025 deadline. If you miss this date, you can file a belated return until 31 December 2025, but late filing fees and interest will apply.

The government may extend deadlines due to exceptional circumstances (like natural disasters or system outages). Always check the official Income Tax Department Portal or announcements to stay updated.

⏳ Importance of Filing ITR on Time

Filing ITR before the deadline provides multiple advantages:

- ✔️ Avoid late filing penalties of up to ₹10,000.

- ✔️ Claim eligible tax refunds quickly.

- ✔️ Maintain a clean compliance history.

- ✔️ Carry forward losses to future years for tax benefit.

- ✔️ Avoid interest on due taxes (Section 234A).

- ✔️ Get loans, credit cards, and visas easily with documented income records.

⚠️ Consequences of Missing the Deadline

Failing to file your ITR by the deadline can lead to:

- Late filing fee of up to ₹10,000 under Section 234F.

- Interest payable on outstanding tax dues.

- Delay or forfeiture of tax refunds.

- Ineligibility to carry forward business or capital losses.

- Increased risk of tax department scrutiny.

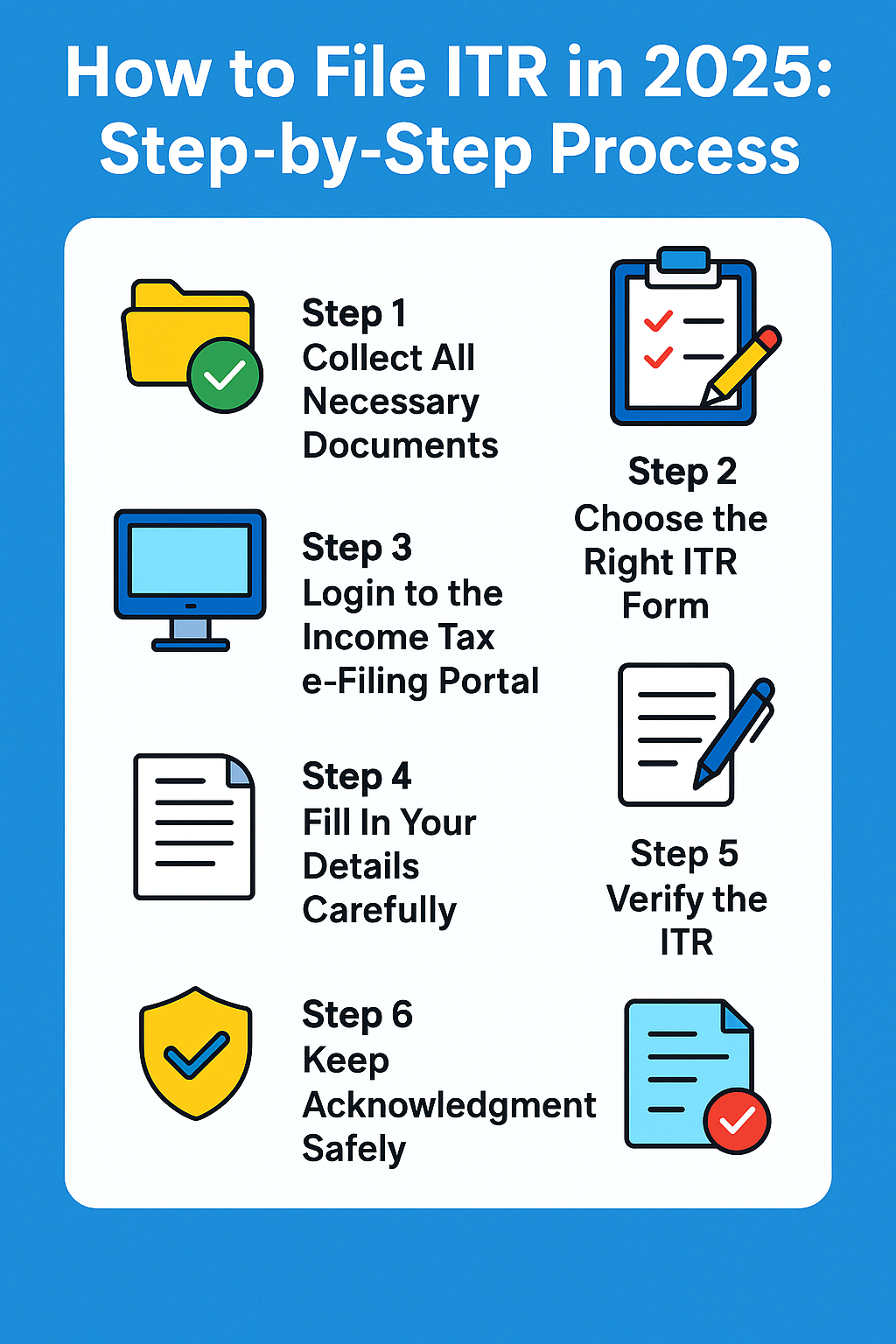

📝 How to File ITR in 2025: Step-by-Step Process

Step 1: Collect All Necessary Documents

Before starting your ITR filing process, ensure you have the following documents:

- Form 16: Issued by your employer (if salaried).

- Form 26AS: Tax credit statement showing TDS details.

- Bank Statements.

- Investment Proofs (for claiming deductions under Sections 80C, 80D, etc.).

- Capital Gains Statements (if applicable).

- Rental Income details (if any).

- Loan Statements (if claiming deductions).

- Aadhaar linked details.

Step 2: Choose the Right ITR Form

Based on your income sources, select the appropriate ITR form:

- ITR-1 (Sahaj): For salaried individuals with simple income sources.

- ITR-2: For individuals with income from capital gains, multiple sources, or foreign assets.

- ITR-3: For individuals with business or professional income.

- ITR-4 (Sugam): For small businesses opting for presumptive taxation.

- ITR-5, 6, 7: For companies, trusts, and other complex entities.

Step 3: Login to the Income Tax e-Filing Portal

Visit the official Income Tax e-Filing Portal.

- Login or register using your PAN and password.

- Select the applicable ITR form.

- You can either:

- Fill the form online and submit directly.

- Download the applicable ITR utility (Java or Excel), fill it offline, and upload the XML file.

Step 4: Fill In Your Details Carefully

- Enter your personal details (Name, PAN, Address).

- Fill in income details as per Form 16 and Form 26AS.

- Declare deductions under various sections (80C, 80D, etc.).

- Validate your calculations carefully.

Step 5: Verify the ITR

After submission, verify your return using one of these methods:

- Aadhaar OTP.

- Net Banking.

- EVC (Electronic Verification Code).

- Demat Account Number.

- Sending signed physical ITR-V to CPC Bangalore (if online verification fails).

Step 6: Keep Acknowledgment Safely

After successful filing and verification, download the ITR Acknowledgment (ITR-V). It serves as proof of filing and can be useful for future reference.

✅ Common Deductions to Claim

✔️ Section 80C – Investments in PPF, LIC, NSC, ELSS (Max limit: ₹1.5 lakh).

✔️ Section 80D – Health Insurance Premium.

✔️ Section 24(b) – Home Loan Interest on a self-occupied property.

✔️ Section 10(14) – House Rent Allowance (HRA).

✔️ Section 80E – Interest on Education Loan.

Make sure to collect and upload proof of investments and payments to maximize tax benefits.

🧱 Special Cases in ITR Filing

🔸 NRIs (Non-Resident Indians) – Must report India-sourced income and foreign assets.

🔸 Business Owners – Need to maintain books of accounts and file detailed statements.

🔸 Capital Gains from Property or Stocks – Proper documentation of acquisition, sale, and taxes paid is essential.

🚀 Benefits of Filing ITR on Time

- Faster processing of tax refunds.

- Valid document proof of income for loan applications.

- Good compliance record helps in government schemes.

- Easier visa approvals for travel abroad.

❓ Frequently Asked Questions (FAQs)

👉 Q1. What happens if I file my ITR after the deadline?

You may be liable for a late fee, and you will lose the option to carry forward losses for the year.

👉 Q2. Is ITR filing mandatory for everyone?

Not everyone. Only individuals whose income exceeds ₹2.5 lakh or have other taxable income sources must file ITR.

👉 Q3. Can I revise my ITR after filing?

Yes, you can revise your ITR before the end of the Assessment Year (March 31, 2026, for AY 2025–26).

✅ Final Thoughts

Filing your ITR timely and accurately is not just a legal obligation—it is a step towards better financial health. The ITR filing deadline for FY 2024–25 is 31st July 2025 for most individuals and businesses. Ensure you gather all relevant documents, claim eligible deductions, select the right ITR form, and verify your return post-filing.

👉 Stay organized, plan in advance, and avoid last-minute rush. Use the official Income Tax Department Portal for seamless e-filing.

![]()