🔑 Key Takeaways

1. Liquid funds are safe, short-term parking for money

They invest in very short-term debt instruments (maturity up to 91 days), making them stable and easy to redeem whenever needed.

2. After April 2023, liquid funds have NO long-term tax benefit

A major rule change means all gains from liquid funds are treated as Short-Term Capital Gains (STCG) — no matter how long you hold them.

3. All capital gains are taxed as per your income tax slab

Whether you withdraw in 1 month or 10 years, the gain is added to your annual income and taxed at 5%, 20%, or 30%, depending on your slab.

4. Dividends from liquid funds are fully taxable

Dividend (IDCW) payouts are taxed under “Income from Other Sources.”

If total dividend exceeds ₹5,000 in a year, 10% TDS is deducted by the fund house.5. Returns are stable but modest

Liquid funds offer safety and liquidity, not high returns. After tax + inflation, real returns may be low.

6. Best for emergency funds & temporary parking

Use liquid funds for:

Emergency fund

Money kept aside for a short period

Cash waiting for deployment

Not ideal for long-term investment goals due to tax treatment.

7. High-slab investors must plan redemptions carefully

If you fall in the 30% tax bracket, the tax bite on gains can be significant. Redeem only when needed, and avoid frequent withdrawals.

8. Liquid funds remain useful — but with changed expectations

They still offer safety and liquidity, but the earlier tax advantage is gone. Investors must adjust their strategy accordingly.

Table of Contents

ToggleWhat exactly are liquid funds?

If you’re like many of us — juggling salary, family expenses, savings, dreams — you want a place to park your extra money somewhere safe yet accessible. That’s where liquid funds come in. Liquid funds are a type of debt mutual fund that invest in short-term debt instruments (like treasury bills, commercial paper, certificates of deposit) that typically mature within 91 days.

Because of this short maturity, liquid funds aim for stability and liquidity rather than high returns. You can often redeem your units quickly when you need cash, making them ideal for emergency funds, short-term goals, or parking money temporarily.

Why understanding tax on liquid funds matters

You might think — “If I’m only keeping money for a few months, what’s the big deal?” But tax rules can quietly eat into your returns. Even though liquid funds are low-risk and easy to access, any gain you make when you redeem units is taxable. So, knowing how tax applies helps you plan better, avoid surprises at ITR-filing time, and keep more of your hard-earned money.

How does the government decide how much tax you pay?

The tax depends on when you redeem your liquid fund units — i.e. the holding period. That determines whether the gain is considered Short-Term or Long-Term Capital Gains (STCG or LTCG).

But — there’s a big catch after 1 April 2023: even long-held debt funds (including liquid funds) are now treated as short-term for taxation.

What are Short-Term Capital Gains (STCG) on liquid funds?

-

If you redeem your liquid fund units (bought on or after 1 Apr 2023) at any time, the profit is taxed as STCG.

-

STCG gains are added to your total income for the year and taxed according to your income tax slab rate (for example, 5 %, 20 %, or 30 %, depending on your income).

-

So, if you invest ₹ 10,000 and redeem at ₹ 12,000 (gain ₹ 2,000) while in 30% slab, you’ll pay ₹ 600 as tax (₹ 2,000 × 30%).

What about Long-Term Capital Gains (LTCG) on liquid funds — is that gone?

Yes. As per the update effective from 1 April 2023, all gains from debt mutual funds (including liquid funds) are considered short-term, regardless of how long you held them.

Before April 2023, if you held units for more than 24 months, the gain would qualify for LTCG treatment; generally taxed at a favorable rate.

But under the current rules, LTCG as a separate category for debt funds no longer applies – everything is taxed under slab rates. This means even if you kept the investment for many years, you don’t get the long-term benefit anymore.

What about dividends from liquid funds?

Some liquid funds may distribute “dividends” (in past called IDCW).

-

Dividends from liquid funds are taxed as income from other sources.

-

If your dividend income from mutual funds exceeds ₹ 5,000 in a year, the fund house will deduct TDS at 10%.

So dividend income is not tax-free — you pay as per your slab rate (plus potential cess/surcharge).

A real-life example to show the impact

Scenario 1: Redeem quickly (within months)

-

You invest ₹ 10,000 on 1 Jan 2025.

-

On 1 April 2025, you redeem and get ₹ 12,000 (gain ₹ 2,000).

-

Since redemption is within a year, it’s STCG. If you fall under 20% slab, tax = ₹ 400.

Scenario 2: Redeem after many years (say 4 years)

-

You invest ₹ 50,000 in 2021. On 1 April 2025, you redeem for ₹ 65,000 (gain ₹ 15,000).

-

Even though you held for many years, under new rules, it’s treated as STCG. If you are in 30% slab, tax = ₹ 4,500.

This shows how the 2023 rule change can significantly affect long-term planning with liquid funds.

What’s changed from the old regime — and why it matters

Before April 2023:

-

Redeeming liquid funds after 24 months qualified for LTCG.

-

LTCG from debt funds was taxed at a lower “preferential” rate (e.g. 10–12.5%).

After April 2023:

-

All gains from debt funds (liquid included) are taxed as STCG, regardless of how long you held the units.

-

No special LTCG benefit — the gain is added to your income and taxed per slab.

Why it matters: If you were treating liquid funds as a “safe parking for long-term money with low tax rate,” that strategy is no longer valid. You need to be more careful and tax-aware while redeeming.

Who should still consider liquid funds — and who should think twice?

Good candidates for liquid funds:

-

People who want temporary parking of surplus cash, like money lying idle for a few months.

-

Investors looking for emergency fund or gap funds (e.g., when you are switching jobs, waiting for next salary, or do not want your cash lying idle in savings account with low interest).

-

Those who value liquidity and safety over high returns.

Think twice if:

-

You hoped to hold liquid funds for many years to benefit from long-term tax advantage — that benefit is gone.

-

You are in a high tax slab — then STCG tax at slab rate could eat a meaningful portion of your gains.

-

You expect inflation beating returns — liquid funds are stable but returns are modest; after tax and inflation, real return may be low.

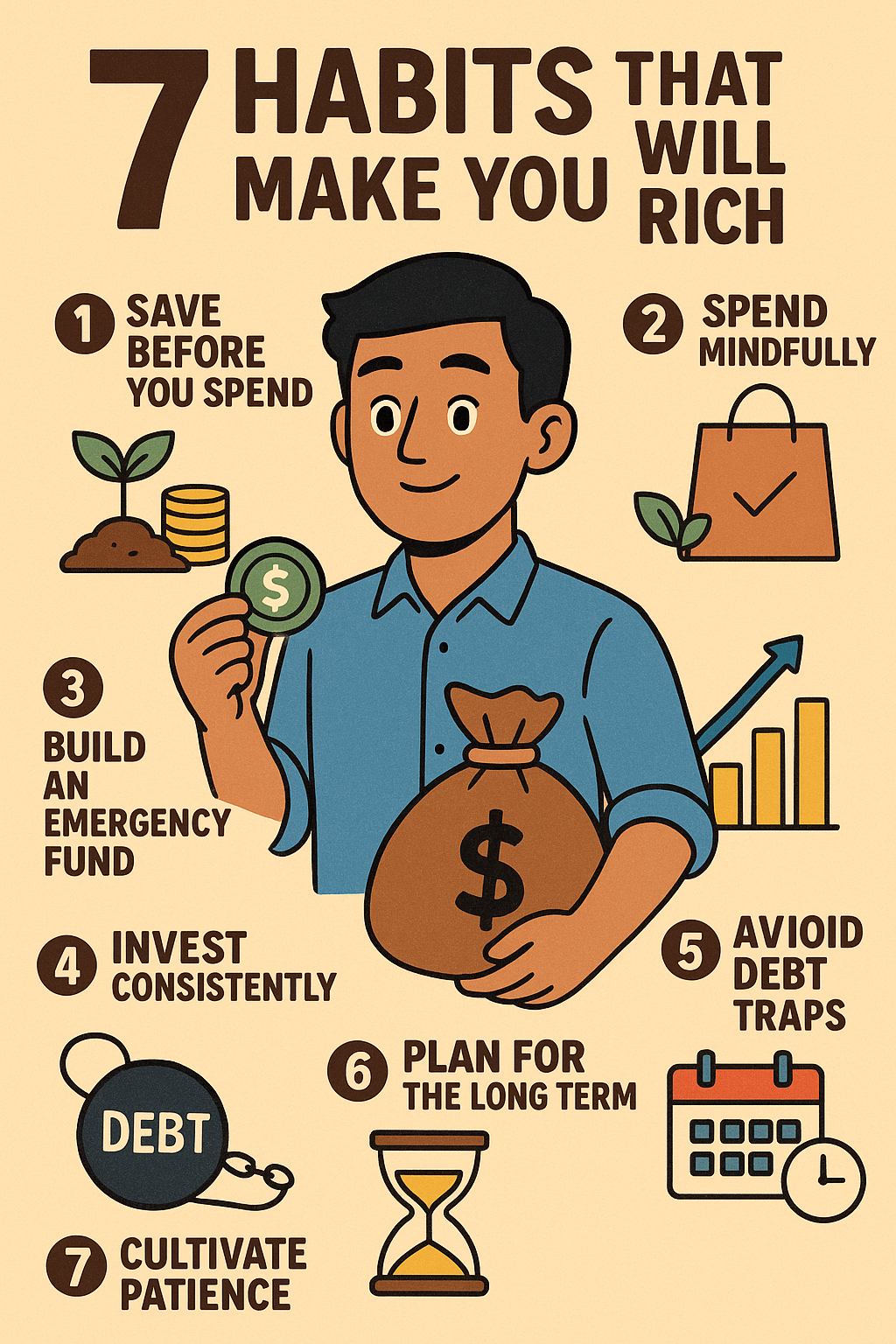

Smart tips before you redeem — to reduce tax impact

-

Try to redeem only when needed — avoid frequent redemptions for minor gains.

-

Keep an eye on how the redemption gain adds to your total income (salary + other income) — especially if you cross a higher tax slab.

-

If you receive dividends, plan to claim them along with other income and account for TDS deducted.

-

When you need to park money for longer term, consider other investment options (e.g. balanced funds, hybrid funds) — but be aware of their risk & taxation too.

What this means for middle-class investors like you and me

For a salaried middle-class family, liquid funds may feel like a “safe piggy bank” — but post-2023 tax rules, the tax bite has changed. The old comfort of lower long-term tax isn’t there anymore.

If you treat liquid funds as a temporary parking place — that’s fine. But if you are hoping for long-term conservative growth with low tax — you might want to rethink.

As someone who dreams of building a small nest egg, paying for children’s education, or upgrading family lifestyle — knowing these tax details becomes important. Because every rupee of tax you save is a rupee more toward your family’s security and dreams.

FAQ — Common questions on tax for liquid funds

Q: Is there any tax on liquid funds?

A: Yes. When you redeem your liquid fund units, the gain is taxable under capital gains. Dividends (if any) are taxed under “income from other sources.”

Q: What’s the difference between STCG and LTCG for liquid funds?

A: As of now (post-Apr 2023), all gains from debt funds (including liquid funds) are treated as short-term capital gains (STCG), irrespective of holding period.

Q: What tax rate applies on gains from liquid funds?

A: The gain is added to your total income and taxed as per your income tax slab rate (e.g. 5%, 20%, 30%).

Q: What about dividend (IDCW) from liquid funds — is it tax-free?

A: No. Dividend is taxed as per your slab rate under “income from other sources.” Also, if dividends exceed ₹ 5,000 in a year, the fund house deducts 10% TDS.

Q: Does holding liquid funds for many years give me any long-term tax benefit?

A: No. Because of the rule change from April 2023, there’s no separate LTCG benefit for debt funds now. All gains are taxed as STCG.

Q: When should I use liquid funds — and when should I avoid them?

A: Use liquid funds when you need temporary parking of cash (for few days, months). Avoid relying on them for long-term growth — because returns are modest and tax treatment is not favourable now.

![]()