Introduction ELSS vs PPF

Choosing between an Equity Linked Savings Scheme (ELSS) and a Public Provident Fund (PPF) is a pivotal decision when crafting a smart tax-saving strategy under Section 80C of the Income Tax Act. While ELSS attracts investors with the potential for higher, market-linked returns and a relatively short 3-year lock-in, PPF stands out as a government-backed, risk-free investment with guaranteed returns and a 15-year lock-in period. Your choice between these two instruments should align with your financial goals, risk appetite, and liquidity needs.

What is ELSS?

ELSS (Equity Linked Savings Scheme) is a type of mutual fund primarily investing in equities and equity-related instruments. Being market-linked, ELSS offers potential for higher returns, albeit with associated risks due to market volatility.

🔹 Why Invest in ELSS?

-

Short lock-in period of 3 years – the shortest among tax-saving instruments.

-

Tax deduction of up to ₹1.5 lakh under Section 80C.

-

Long-term wealth creation through equity investments.

🔹 How to Invest in ELSS:

-

Through online mutual fund platforms.

-

Using an existing Demat account.

-

By visiting mutual fund registrars.

-

Consult with an investment advisor or agent.

What is PPF?

PPF (Public Provident Fund) is a long-term savings scheme introduced by the Government of India. It is aimed at promoting disciplined retirement savings by offering tax benefits and guaranteed, risk-free returns.

🔹 Why Invest in PPF?

-

Government-backed, completely risk-free investment.

-

Fixed interest rate, currently ranging between 7% to 8%, revised quarterly.

-

Tax benefits under Section 80C, and interest earned is tax-free.

-

Suitable for long-term financial goals, such as retirement.

🔹 How to Invest in PPF:

-

Open an account at any authorized post office or bank.

-

Online PPF account facilities are available through major banks.

-

Contribute via lump-sum or monthly SIPs (systematic investment plans).

ELSS vs PPF: Key Differences

| Feature | ELSS | PPF |

|---|---|---|

| Type | Equity Mutual Fund | Government Savings Scheme |

| Lock-in Period | 3 years | 15 years (extendable by 5 years) |

| Returns | Market-linked, potentially high | Fixed, moderate (7–8%) |

| Risk Level | Moderate to high | Very low / risk-free |

| Tax Benefit | Up to ₹1.5 lakh under 80C, LTCG taxed | Up to ₹1.5 lakh under 80C, fully tax-free |

| Liquidity | Withdraw after 3 years | Partial withdrawals after 5 years |

| Ideal For | Investors with higher risk appetite | Conservative investors seeking safety |

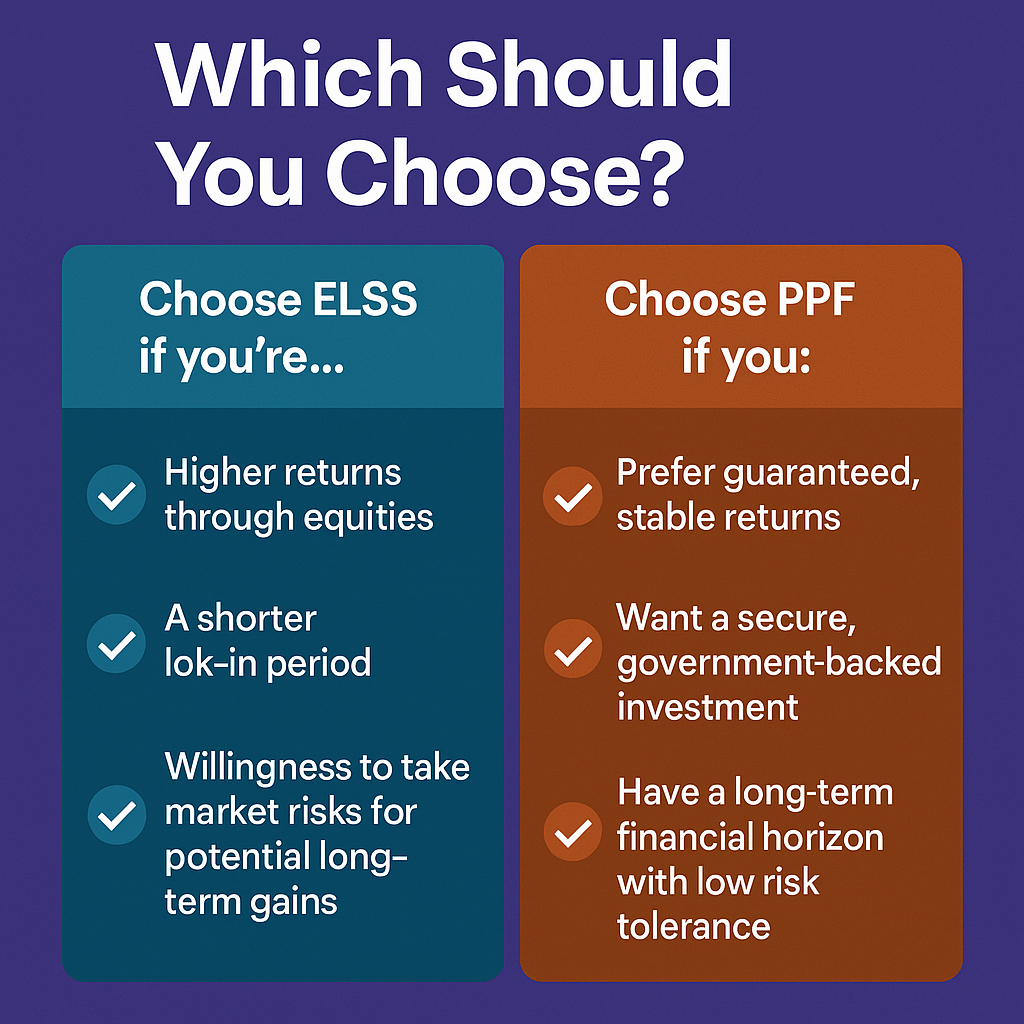

ELSS or PPF: Which Should You Choose?

The decision between ELSS and PPF depends on several personal factors:

-

Choose ELSS if you’re looking for:

-

Higher returns through equities

-

A shorter lock-in period

-

Willingness to take market risks for potential long-term gains

-

-

Choose PPF if you:

-

Prefer guaranteed, stable returns

-

Want a secure, government-backed investment

-

Have a long-term financial horizon with low risk tolerance

-

Conclusion

Both ELSS and PPF offer unique advantages, and there’s no one-size-fits-all answer when it comes to tax-saving investments. ELSS is well-suited for investors seeking higher returns through equity market exposure, coupled with a shorter three-year lock-in period. This makes it an attractive option for individuals with a moderate-to-high risk appetite and a desire to grow wealth over the medium to long term while benefiting from tax deductions under Section 80C.

On the other hand, PPF is an excellent choice for conservative investors who prioritize safety, stable returns, and long-term capital preservation. Its 15-year lock-in and government backing ensure guaranteed, tax-free interest, making it a reliable component for retirement planning or future financial security.

Ideally, a balanced investment strategy could incorporate both ELSS and PPF, allowing investors to benefit from equity-driven growth through ELSS and steady, risk-free income via PPF. This approach helps diversify risk while optimizing returns and tax benefits. Ultimately, your decision should align with your overall financial objectives, risk tolerance, investment horizon, and the level of liquidity you may require in the future.

![]()