Understanding Smart Retirement Planning Strategies for Millennials

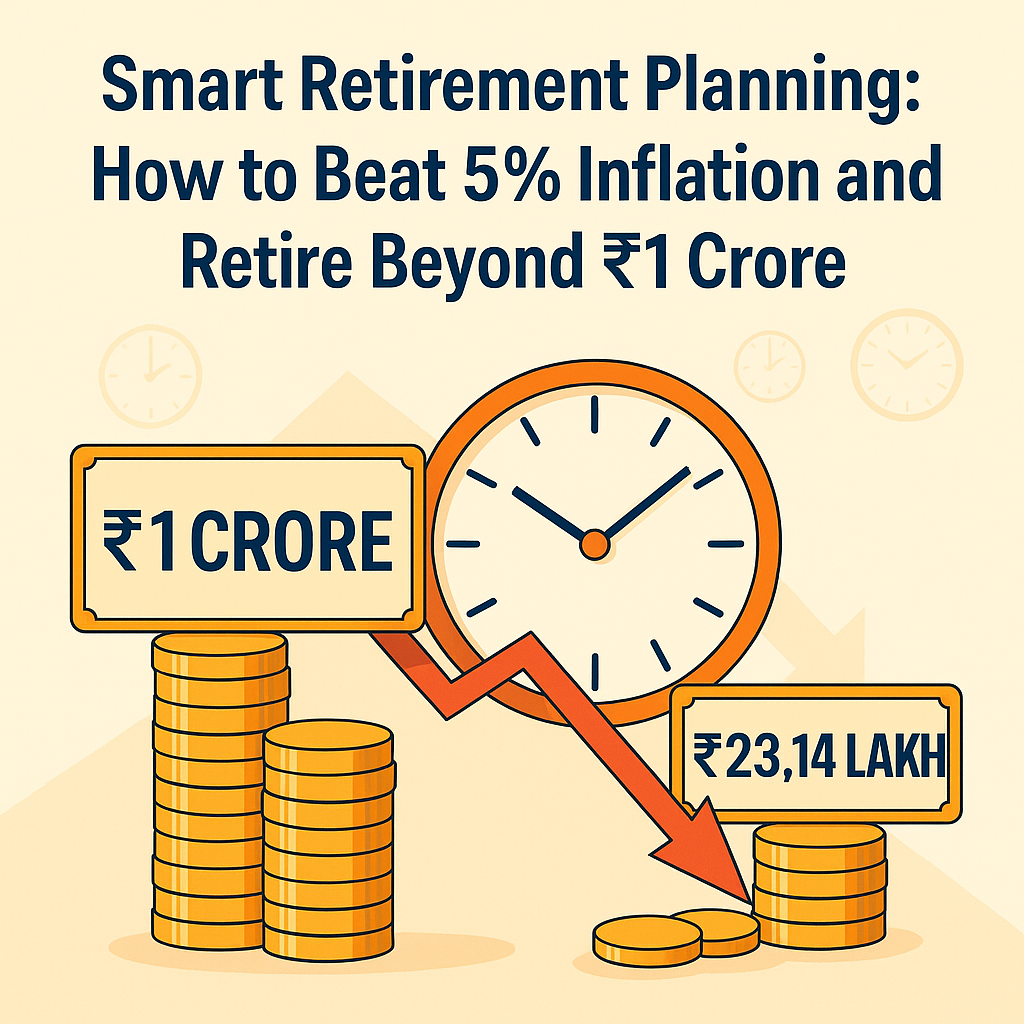

Why Millennials Must Rethink Retirement Millennials—those born between 1981 and 1996—are facing a unique financial landscape. With unstable job markets, rising inflation, and increasing life expectancy, retirement planning isn't just…