Posted inMutual Fund

How to Apply the 7 Habits of Highly Effective People in Mutual Fund SIP Investments There are so many people who read the book "7 habits of highly effective people".…

Posted inInvestment & Savings Mutual Fund

Investing in a Mutual Fund Investing in mutual funds offers a convenient and effective way for individuals to grow their wealth while minimizing risk through diversification. Mutual funds pool money…

Posted inMutual Fund

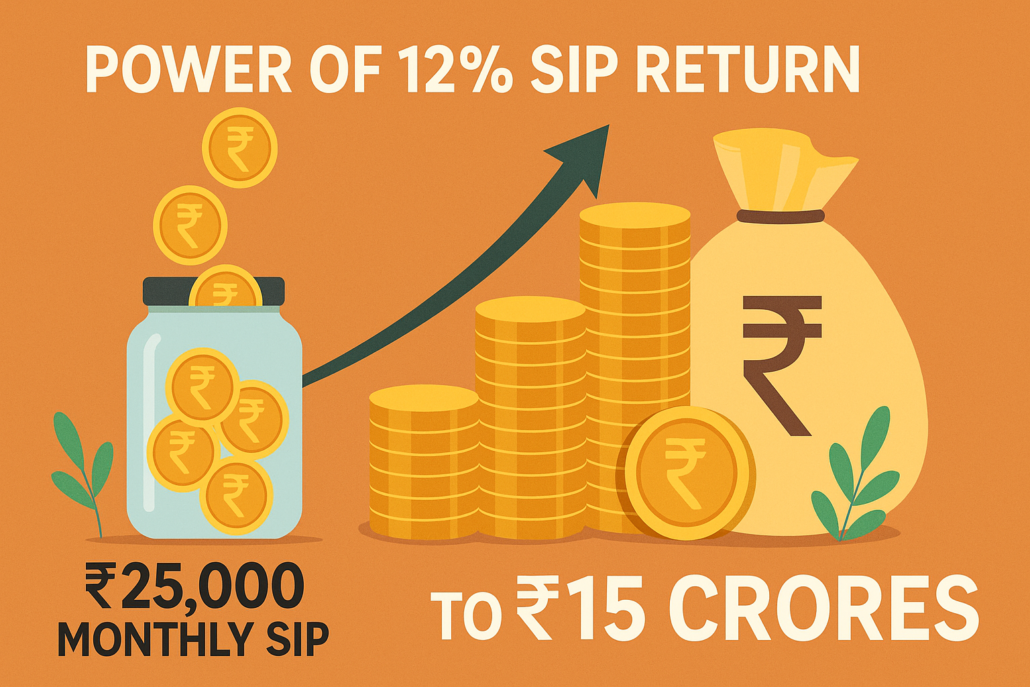

Understanding the power of 12 percent SIP return Have you ever imagined that a simple ₹25,000 monthly investment could make you a crorepati? With a 12 percent SIP return, your…

Posted inMutual Fund

Why Middle-Class Dreams Deserve Billionaire Thinking Have you ever sat on a crowded train, holding a tiffin in one hand and a dream in the other? The truth is —…

Posted inMutual Fund

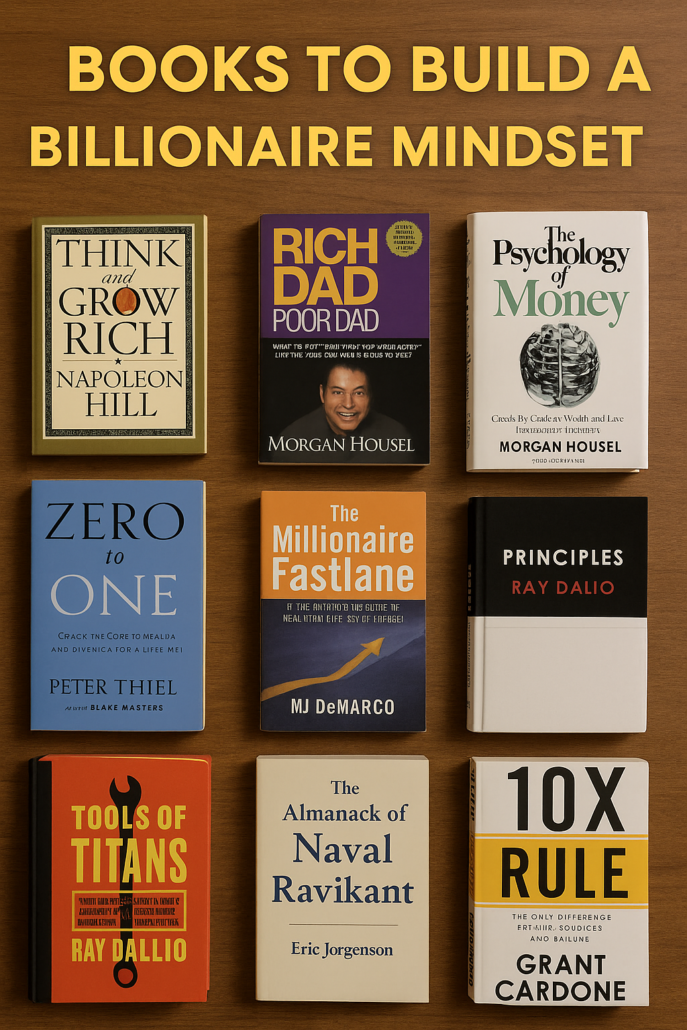

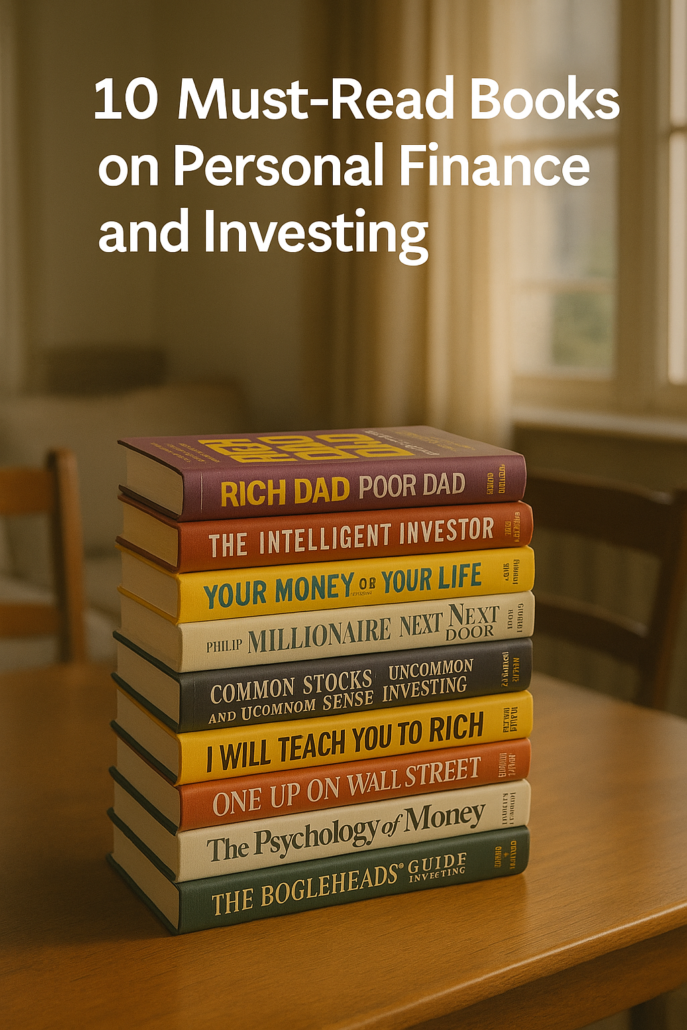

Why Should Middle-Class Investors Trust Books Over Financial Advisors? Have you ever left a meeting with a financial advisor more confused than before?You’re not alone. Most middle-class investors need simple,…

Posted inMutual Fund

Understanding Robert Kiyosaki's Financial Collapse Warning Robert Kiyosaki, renowned author of "Rich Dad Poor Dad," has consistently cautioned about an impending financial collapse. He emphasizes the importance of investing in…

Posted inMutual Fund

Why Daily Positive Affirmations for Financial Peace Matter More Than Ever Middle-class life is tough — job stress, family pressure, rising costs. We often ignore emotional health while chasing financial…

Posted inMutual Fund

The dream of ₹90 lakh – Is it really possible for a middle-class investor? Absolutely. With the power of compounding in SIP, even a modest SIP of ₹4000, ₹6000, or…

Posted inMutual Fund

Why is One Time Investment for Monthly Income a Middle-Class Dream? In every middle-class home, dreams run larger than incomes.Retirement planning feels like a far-off mountain.That's why one time investment…