First, a hard truth (important) With ₹22 lakh, it is NOT possible to fully fund 35 years of retirement alone with inflation-adjusted income unless: Withdrawal starts very small, and Equity…

There’s no absolute answer — nothing guarantees a “most beaten-down” sector will rebound strongly — but based on recent 2025 data, we can pinpoint sectors that have been hit hard…

Posted inFixed Income Mutual Fund Mutual Fund

🔑 Key Takeaways 1. Liquid funds are safe, short-term parking for money They invest in very short-term debt instruments (maturity up to 91 days), making them stable and easy to…

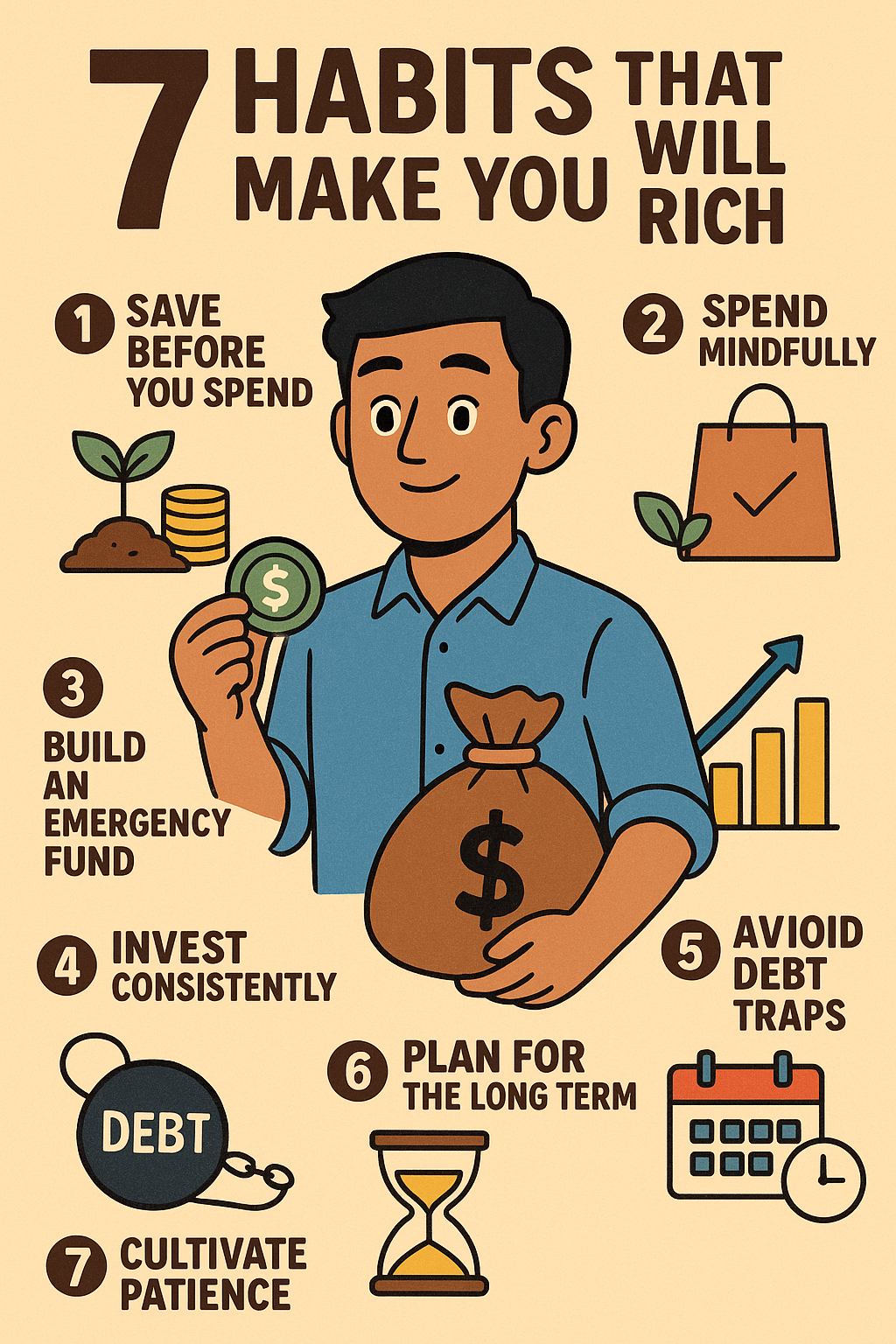

✅ Key Takeaways (Very Short & Clear) from this blog - 7 habits that will make you rich Save before you spend — Treat savings as your first priority, not…

Posted inFinancial Literacy Mutual Fund

The Great SIP Story: How Ratan Babu Outsmarted the Market (and His Own Anxiety) Ratan Babu was your typical middle-class office warrior — expert at making Excel sheets, terrible at…

When it comes to planning for retirement, even tiny errors in your math today can cascade into massive shortfalls decades later. Many people assume retirement is just a numbers game…

Posted inFinancial Literacy Mutual Fund

💡 Key Takeaways 7 5 3 1 Rule in Mutual Fund is a behavioral framework that blends investment strategy with emotional discipline — helping investors stay focused during market ups…

Posted inMutual Fund

Key Takeaways Adding a nominee in your mutual fund is essential to ensure your family can easily access your investments without legal delays. SEBI’s 2025 nomination rules make it mandatory…

Posted inMutual Fund

✅ Key Takeaways The keyword What is the best JIO BlackRock Mutual Fund in 2025 is most relevant for long-term retail investors. Jio BlackRock Nifty 50 Index Fund is the…