Posted inETFs Mutual Fund

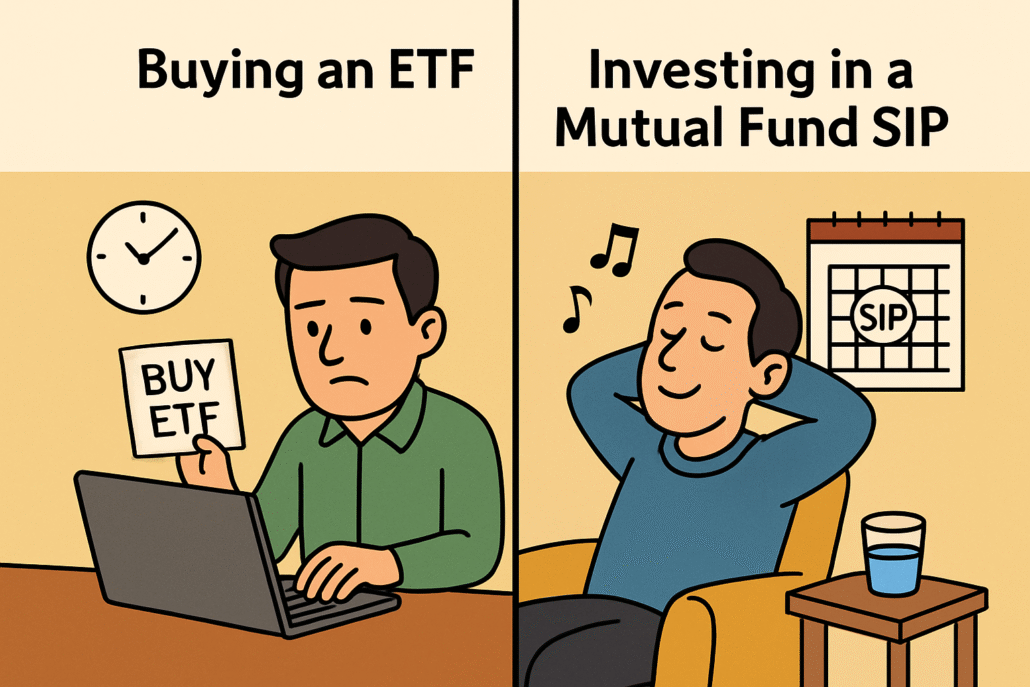

19 Surprising Facts About ETFs and Mutual Funds SIP That No Expert Will Tell You

The Truth Hidden in Plain Sight Have you ever felt like you're missing something crucial when it comes to investing in ETFs and Mutual Funds SIP? You're not alone. While…