Retirement Math Mistakes: How Small Errors Today Can Derail Your Future Plans

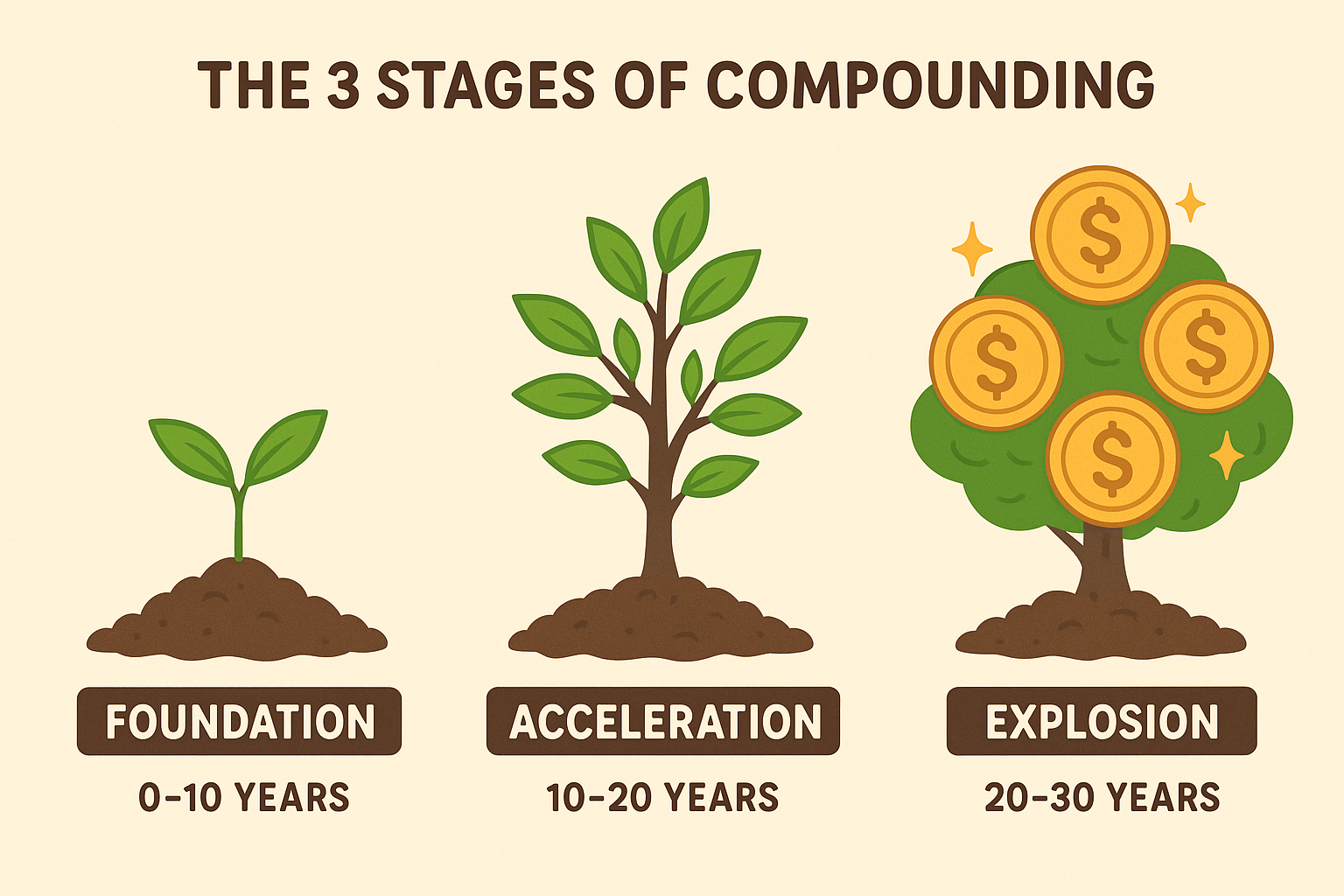

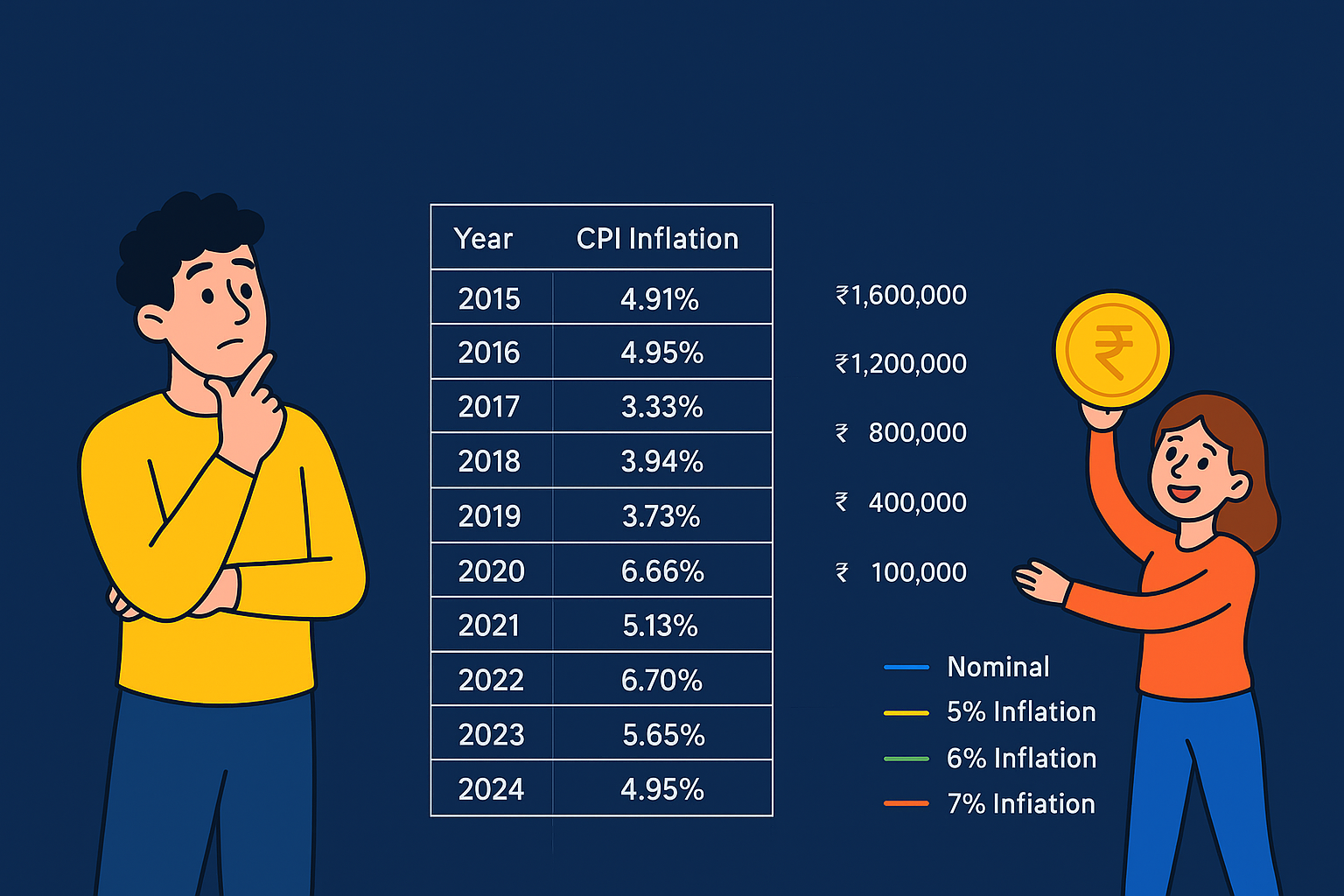

When it comes to planning for retirement, even tiny errors in your math today can cascade into massive shortfalls decades later. Many people assume retirement is just a numbers game…