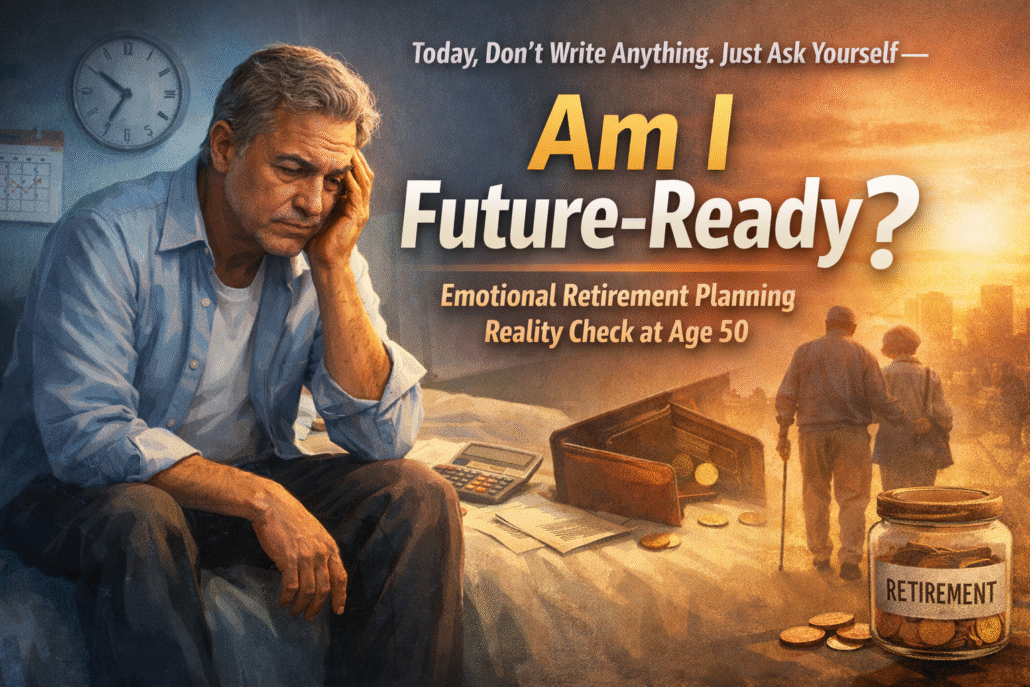

There comes a silent moment in life—usually around age 50—when this question hits harder than any market crash or salary slip.

“Am I future-ready?”

Not future-rich.

Not future-luxury.

Just… future-ready.

At 50, responsibilities may reduce, but worries quietly increase. Children are almost independent, careers are near their peak, and retirement is no longer a distant word. Yet, many people realize—sometimes painfully—that future-ready retirement planning was always postponed for “later.”

And now, later is here.

The Emotional Wake-Up Call at 50

At 30, retirement feels optional.

At 40, it feels adjustable.

At 50, it feels urgent.

You may have earned well. You may have saved something. But deep inside, there’s a discomfort:

-

“Will my money last longer than me?”

-

“What if medical costs rise suddenly?”

-

“What if I outlive my savings?”

This is not fear.

This is reality knocking.

Future-ready retirement planning is not about crores—it’s about confidence.

Why Most 50-Year-Olds Feel Unprepared

The biggest regret at this stage isn’t low income.

It’s delayed decisions.

People focused on:

-

Children’s education

-

Home loans

-

Family responsibilities

Retirement was assumed to “manage itself.”

But it doesn’t.

Without future-ready retirement planning, retirement becomes dependent on:

-

Children

-

One medical emergency wiping out years of savings

And that thought hurts more than numbers ever could.

The Cost of Not Being Future-Ready

At 50, time becomes expensive.

Every year delayed now means:

-

Higher monthly savings required

-

Lower risk capacity

-

Fewer correction opportunities

Future-ready retirement planning is no longer optional—it’s corrective.

You’re not starting late.

You’re starting aware.

And awareness is powerful.

What “Future-Ready” Really Means at 50

Being future-ready does NOT mean quitting life’s pleasures.

It means:

-

A predictable monthly income post-retirement

-

Protection against inflation

-

Medical safety net

-

Peace of mind for both you and your spouse

Future-ready retirement planning is about dignity, not deprivation.

Retirement Is Not the End of Income—It’s the End of Salary

This truth shocks many.

Salary stops.

Expenses don’t.

That’s why future-ready retirement planning focuses on:

-

Systematic investing

-

Balanced asset allocation

-

Gradual risk reduction

Not panic decisions.

The Emotional Weight of Depending on Others

No parent wants to be a burden.

No self-made individual wants to ask for help.

Yet, without future-ready retirement planning, dependency becomes accidental—not intentional.

Planning today is not selfish.

It’s responsible love.

The Good News No One Tells You

Even at 50, it’s not too late.

With the right approach:

-

SIPs can still work

-

Hybrid funds can reduce volatility

-

Goal-based planning can restore control

Future-ready retirement planning is less about age and more about action.

One Honest Question to End the Denial

If retirement started tomorrow…

👉 Would you be calm—or scared?

That answer tells you everything.

Start Where You Are, Not Where You Should Have Been

Regret wastes time.

Action rebuilds confidence.

Future-ready retirement planning begins with:

-

Accepting the gap

-

Measuring reality

-

Taking structured steps

The future doesn’t need perfection.

It needs preparedness.

FAQs on Future-Ready Retirement Planning (Age 50)

1. Is 50 too late for future-ready retirement planning?

No. It’s late—but still workable with disciplined planning.

2. How much retirement corpus should I target at 50?

It depends on lifestyle, inflation, and longevity—not guesswork.

3. Should I stop taking equity exposure now?

No. Smart equity exposure is essential for future-ready retirement planning.

4. Are fixed deposits enough for retirement security?

FDs alone usually fail to beat inflation long-term.

5. How do I manage medical expenses post-retirement?

Health insurance plus emergency corpus is non-negotiable.

6. Can SIPs still help after age 50?

Yes. SIPs are powerful tools even in late-stage future-ready retirement planning.

7. What if I haven’t tracked my savings properly?

Start now. Clarity is more important than perfection.

8. Should I involve my spouse in retirement planning?

Absolutely. Future-ready retirement planning is a shared journey.

9. How often should I review my retirement plan?

At least once a year, or after major life changes.

10. What’s the biggest mistake people make at 50?

Ignoring reality and hoping things will “somehow work out.”

![]()