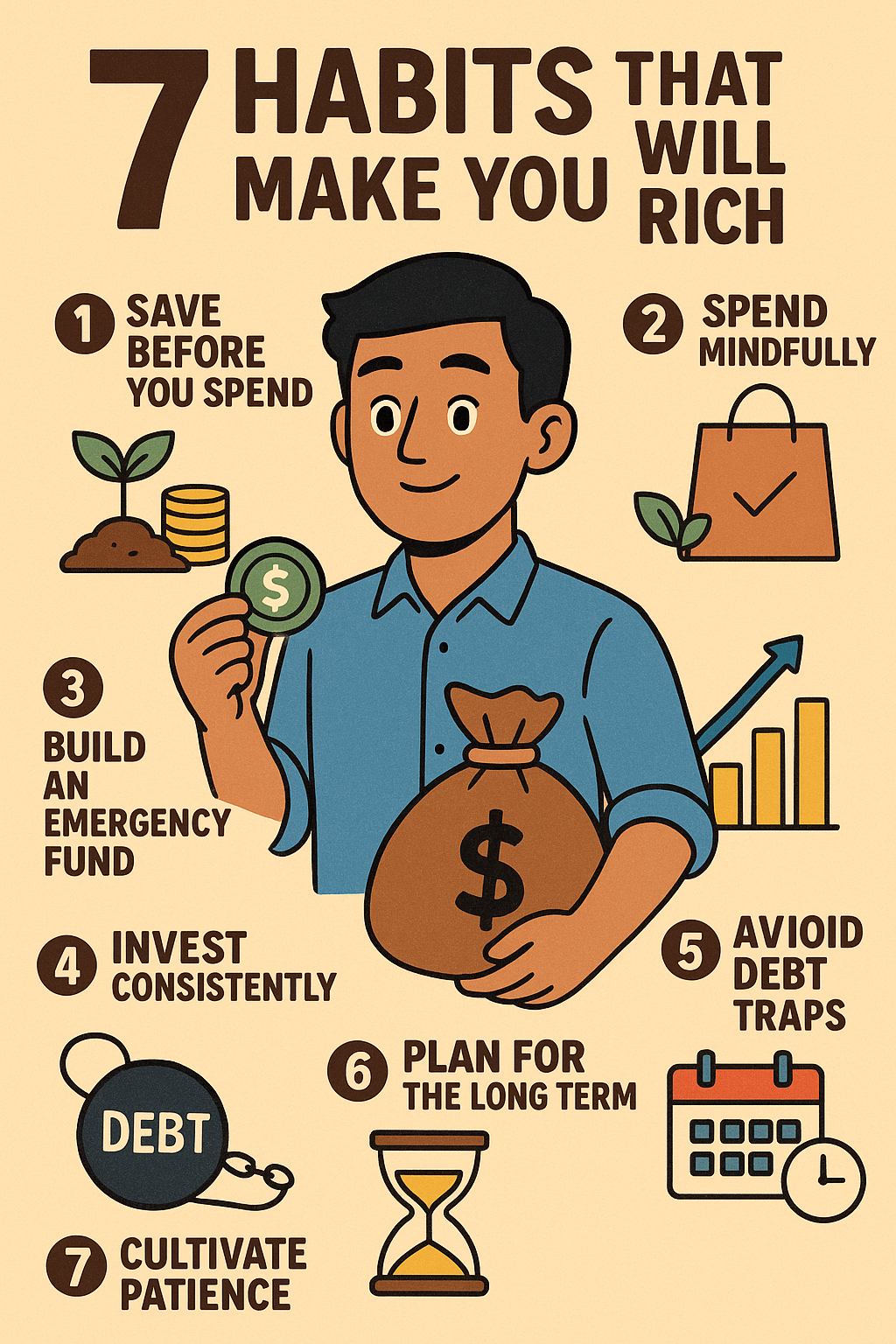

✅ Key Takeaways (Very Short & Clear) from this blog – 7 habits that will make you rich

Save before you spend — Treat savings as your first priority, not the leftover.

Spend wisely — Separate needs from wants to avoid unnecessary expenses.

Build an emergency fund — Keep 3–6 months’ expenses for financial security.

Invest consistently — Use SIPs or long-term investments to grow wealth.

Avoid debt traps — Stay away from high-interest loans and unnecessary EMIs.

Plan long-term — Set clear money goals and work steadily towards them.

Be patient and consistent — Wealth grows slowly through discipline and time.

What these 7 habits truly mean for someone like you and me

We grow up hearing that hard work is enough to succeed. But sometimes, despite working hard, we still feel stuck. This Blog “7 Habits That Will Make You Rich” — shows something more: that becoming financially secure doesn’t just mean making money. It means building habits that help money grow, stay, and stay useful.

If you belong to the middle-class — juggling responsibilities, dreams, and a modest income — these habits can gently steer you toward long-term financial freedom.

Habit 1: Save before you spend — treat your income like a seed

Most of us wait to save after paying bills and living expenses. But what if we flipped the order?

The first habit the video recommends: save first, spend later. As soon as your salary comes, set aside a portion — even if small — before you touch the rest.

-

It becomes a discipline, not a leftover.

-

It protects you from impulsive spending.

-

Over time, small savings turn into a cushion you won’t regret.

For a middle-class family, this seed can grow into the support net you never knew you needed.

Habit 2: Spend mindfully — differentiate between needs and wants

It’s easy to get tempted — new phones, branded clothes, weekend treats. But the video emphasises: spend intentionally.

Ask yourself before buying: Do I really need this, or do I just want it?

Mindful spending doesn’t mean you never enjoy. It means you enjoy without hurting your future savings or dreams.

Habit 3: Build an emergency fund — safety net for life’s surprises

Life doesn’t run smoothly always. There are job uncertainties. Medical emergencies. Unexpected repairs.

The video urges creating an emergency fund — a reserve that can handle 3–6 months of expenses.

For a working-class or middle-class household: this could mean peace of mind. Illness, job loss, or a sudden financial need — this fund can safeguard the family from debt or stress.

Habit 4: Invest consistently — let money work for you

Saving is good. But to beat inflation and grow real wealth, saving isn’t enough. The video recommends: regular investing.

Whether it’s mutual funds, SIPs (Systematic Investment Plans), or long-term instruments — invest a portion of your savings regularly.

-

Even small monthly investments add up over time.

-

Over years, these grow quietly — without you feeling the pinch.

-

Helps build a substantial corpus — maybe for children’s education, home, or retirement.

Habit 5: Avoid debt traps — steer clear of high-interest debt

One of the biggest enemies of wealth is debt — especially high-interest loans, Credit card debt, and impulsive EMIs.

The video warns: don’t let short-term desires lead you to heavy debt.

If you have debts: make clearing them a priority. Debt eats away savings, and weakens your financial foundation.

Habit 6: Plan for the long-term — have big dreams, and a roadmap

Real richness isn’t just about today’s comfort. It’s about tomorrow’s security.

The video encourages setting big goals — children’s education, retirement fund, owning a home — and then working backwards to build a roadmap.

With saving, investing, and careful spending, you can steadily move toward those dreams.

Habit 7: Cultivate patience and consistency — growth takes time

Perhaps the most important — and most neglected — habit: be patient and stay consistent.

We live in times of quick results. But for financial growth, especially from modest incomes, consistency matters more than speed.

-

Regular saving and investing.

-

Avoiding impulse expenses.

-

Letting compounding do its magic.

Over years — not overnight — you may look back and find yourself in a much stronger, better place.

Why these habits resonate for middle-class families

-

Relatable real life: Many middle-class families don’t earn much, but live on tight budgets. These habits don’t ask for luxury — they ask for discipline, small daily choices, and consistency.

-

Steady progress: You may not get rich overnight, but you build financial peace and security over time.

-

Protects against shocks: Emergencies, inflation, job instability — these habits build a cushion, ensuring you don’t fall off when life wobbles.

-

Builds genuine wealth, not just show: It’s not about buying the flashiest things. It’s about building a stable, stress-free financial future.

A possible path forward — your small first steps

-

As soon as you receive salary — move 5–10% into savings or investment.

-

Track all monthly expenses — and find small leaks (e.g., unnecessary subscriptions, eating out too often).

-

Prioritise emergency fund — collect at least 3 months’ expenses.

-

Open a SIP or a recurring deposit — something you can maintain without feeling the pinch.

-

Avoid impulsive EMI-driven purchases — ask: Will this help my financial future, or harm it?

Final thought — wealth is more than money

Money matters. But real wealth is peace of mind. It’s the ability to handle life’s surprises without fear. It’s the freedom to fulfil dreams — children’s education, a home, a secure retirement.

This video’s 7 habits don’t promise magic. They promise something better: a steady, quiet journey toward financial dignity.

For families like ours — working hard, dreaming big, living modestly — that journey matters more.

If you start today — with small savings, discipline, and patience — you might one day look back and see how far you’ve come.

![]()