Key Takeaways:

India’s inflation has averaged around 5–6% over the past decade, steadily eroding purchasing power. However, long-term investments in Mutual Fund small-cap schemes delivering around 15% CAGR can easily outpace inflation, creating strong real wealth. The key is patience, consistency, and a horizon of 10–15 years to let compounding do its magic.

Introduction

Inflation India is not just a number in a newspaper — it quietly eats into your savings every day. For a middle-class investor, watching the cost of groceries, utilities or education rise faster than your income can feel like a slow drain on hope. But by combining awareness of the inflation India trend, and the right investing strategy – such as a mutual fund small cap long term return of around 15% CAGR – you can build a cushion against rising prices and protect your future.

What is the current inflation India rate?

As of September 2025, the inflation India (measured by CPI) stood at 1.54 % year-on-year.

This is unusually low compared to past years, driven by falling food inflation and favourable base effects.

While that may sound reassuring, the reality is that lower inflation may not last, and the long-term impact of earlier years still matters.

Inflation India: the last 5 years

Here are approximate annual inflation India figures:

| Year | Approximate CPI inflation |

|---|---|

| 2024 | ~ 4.95 % |

| 2023 | ~ 5.65 % |

| 2022 | ~ 6.70 % |

| 2021 | ~ 5.13 % |

| 2020 | ~ 6.66 % |

What this tells us is that for many recent years inflation India hovered in the 5-7 % range. Over a decade, even 5 % inflation means your money loses real purchasing power if returns don’t beat it.

Why inflation India matters for you and your family

• If inflation India is 5 % and you earn 10 lakh ₹ this year, next year those same 10 lakh will buy what ~9.5 lakh buys today.

• Your savings, if kept as cash or low interest, shrink in value in real terms.

• To secure future dreams – children’s education, retirement, home upgrades – you need investments that outpace inflation India, ideally by comfortable margin.

How mutual fund small cap long term return of 15% CAGR helps

Imagine you invest in a well-chosen small-cap oriented mutual fund aiming for ~15 % compounded annual growth rate (CAGR). Here’s how that strategy can help defeat inflation India:

-

If inflation India is ~5-6 %, a 15 % return yields a real return of ~9-10 %.

-

Over 20 years, ₹1 lakh invested at 15 % grows to ~₹16.4 lakh (CAGR effect). Real value after subtracting inflation India (~5 %) would still grow significantly.

-

By staying invested long term (10-15+ years), you give compounding and the small-cap flavour time to deliver.

-

It helps middle-class families stay ahead of rising costs – inflation India becomes less of a burden and more of a background fact.

Key things to keep in mind

-

“Small cap” means higher volatility: ensure you are comfortable with ups and downs.

-

Time horizon: you need to stay invested for long term (preferably 10-15 years) to smooth out market cycles.

-

Diversification: don’t put all your money in one fund or only in small caps; mix with other asset classes.

-

Charges and fund quality matter: pick a fund with good track record, reasonable fees, and a sober fund manager.

-

Reinvesting and staying disciplined matters more than trying to time the market.

A simple numerical illustration

Suppose inflation India averages 5.5% annually. You invest ₹1 lakh in a small-cap mutual fund with 15% annual growth. After 15 years you’d have:

Future value = ₹1 lakh × (1.15)^15 ≈ ₹1 lakh × 8.14 ≈ ₹8.14 lakh

If inflation India eats away at 5.5% each year, the real value of ₹8.14 lakh will be larger than what ₹1 lakh buys today by a considerable margin. That gap gives you breathing room for life goals.

What this means for middle-class India

If you are a salaried person, or running a small business, or a modest investor, you might feel squeezed by inflation India each year – prices go up, income might not keep pace. But by consciously choosing a long-term investing path in mutual fund small cap long term return frameworks, you can turn the tables. Instead of just hoping you keep up with inflation India, you aim to beat it.

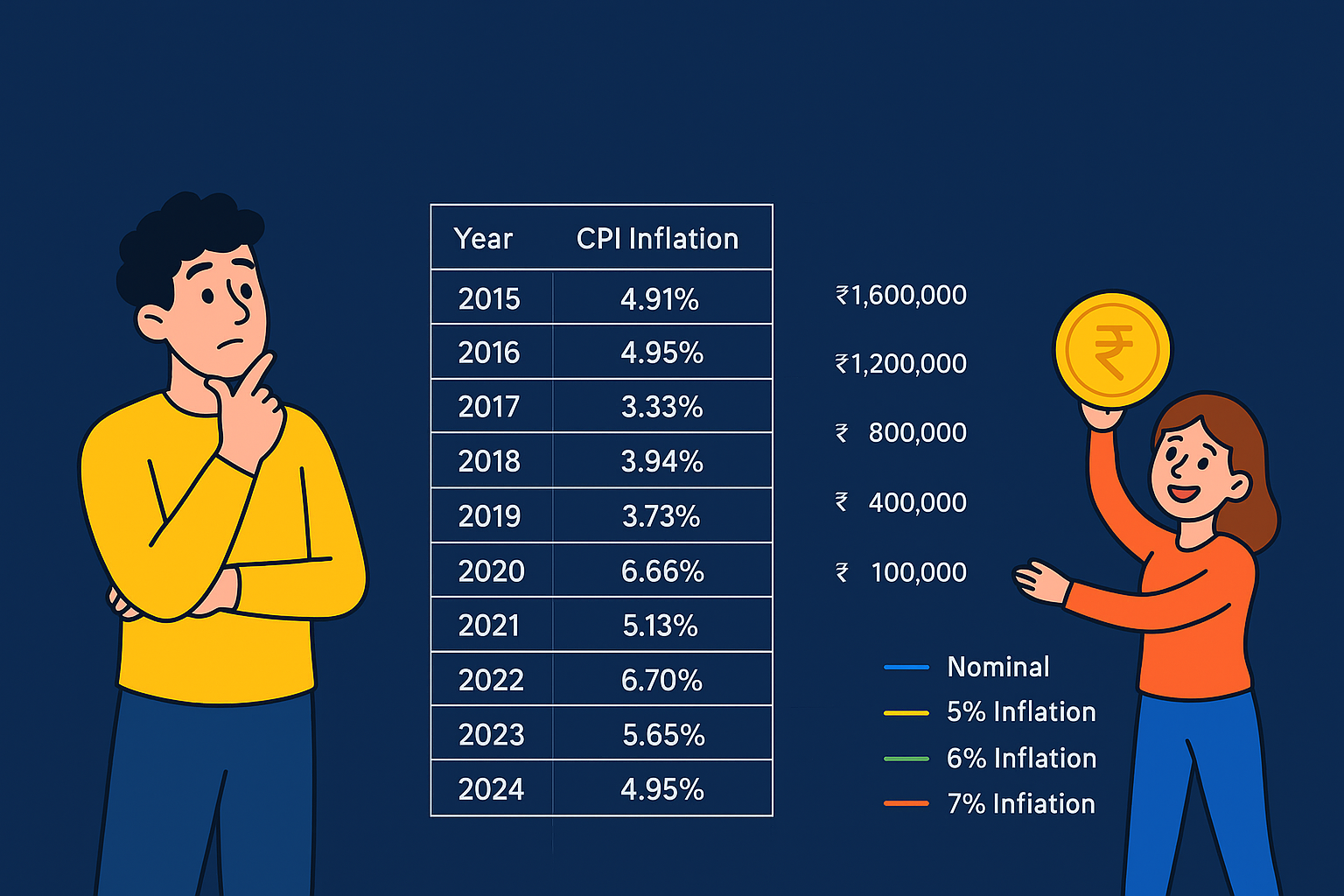

Investment illustration (₹1,00,000 at 15% CAGR)

Nominal future values (rounded):

-

5 years → ₹201,136

-

10 years → ₹403,355

-

15 years → ₹814,447

-

20 years → ₹1,635,986

Real future values after subtracting average inflation (approx):

-

After 15 years:

-

vs 5% avg inflation → ~₹389,000 (real purchasing power)

-

vs 6% avg inflation → ~₹339,000

-

vs 7% avg inflation → ~₹295,000

-

(Exact numbers are shown in the table I generated and are used for the chart above.)

India CPI inflation (2015–2024) — quick view (annual % used in table)

2015: 4.91%

2016: 4.95%

2017: 3.33%

2018: 3.94%

2019: 3.73%

2020: 6.66%

2021: 5.13%

2022: 6.70%

2023: 5.65%

2024: 4.95%

Short takeaways

-

Historic inflation India has mostly been in the ~3.3%–6.7% range (2015–2024). Use a conservative planning inflation rate of 5–6% for long-term goals.

-

A mutual fund small-cap strategy targeting ~15% CAGR (nominal) can produce a comfortable positive real return vs typical inflation scenarios (5–7%), but:

-

small-cap funds are volatile — you need a long horizon (10–15+ years) and discipline,

-

diversify and review fund quality/fees,

-

past returns don’t guarantee future 15% CAGR.

-

Final thoughts

Inflation India might today be unusually low at ~1.54 % (September 2025), but past years and future uncertainty remind us that inflation is real. For the middle-class household, acknowledging inflation India and aligning investments that target returns (say ~15 % CAGR through small caps) is a powerful way to protect dreams and build tomorrow. Remember: patience, discipline and the long horizon make the difference.

FAQs

Q1. What if inflation India suddenly rises to 8 %?

A: If inflation India rises, then your real returns fall unless your investments beat that higher rate. That’s why targeting higher returns (15 %+ CAGR) provides a buffer.

Q2. Are small-cap mutual funds safe for this?

A: “Safe” is relative. Small-cap funds are more volatile, but with long-term (10-15 years) horizon the risk may reduce. It’s important to assess your risk-tolerance.

Q3. Does a 15% CAGR guarantee beating inflation India?

A: No guarantee. Equity markets fluctuate. Past performance isn’t a promise for future. But aiming higher than inflation India gives you a margin of safety.

Q4. Can I just keep money in bank savings instead?

A: If you keep money in savings accounts or fixed deposits that return less than inflation India, then your real purchasing power falls. So you may ‘preserve nominal value’ but you lose actual value.

Q5. Should I monitor inflation India every year?

A: Yes. Knowing the current inflation India rate helps you review your investment strategy, assess if your returns are keeping pace with rising costs.

Q6. What if inflation India stays very low like today (~1.5 %)?

A: That’s welcome, but you shouldn’t count on it always. Historically it has been higher. Planning for moderate inflation India (~5-6 %) is safer.

![]()