Why Concentration Matters in Mutual Fund SIP Investing

Investing in a Mutual Fund SIP may sound automatic and hands-off, but your mental discipline and concentration are what decide whether it’s a success story or a regret. SIPs demand consistency, patience, and long-term commitment, all of which rely on your focus. Just like going to the gym or sticking to a diet, you need to train your mind to stay on track with your investments—even when markets misbehave or life throws curveballs.

Can You Lose Money in SIPs If You’re Not Mentally Focused?

Yes. Not because SIPs are risky—but because humans are.

People pause SIPs during market falls, redeem early, or switch funds impulsively, all due to loss of focus and panic. Staying mentally strong ensures you ride volatility, benefit from compounding, and avoid unnecessary exit loads or taxation.

That’s why improving concentration on your Mutual Fund SIP is not a luxury—it’s survival.

Is It Hard to Stay Focused in a Long-Term SIP?

Let’s be honest: YES.

10–20 years is a long haul.

Distractions like market noise, job loss, EMIs, peer pressure, or even fake YouTube “tips” can derail your investment journey.

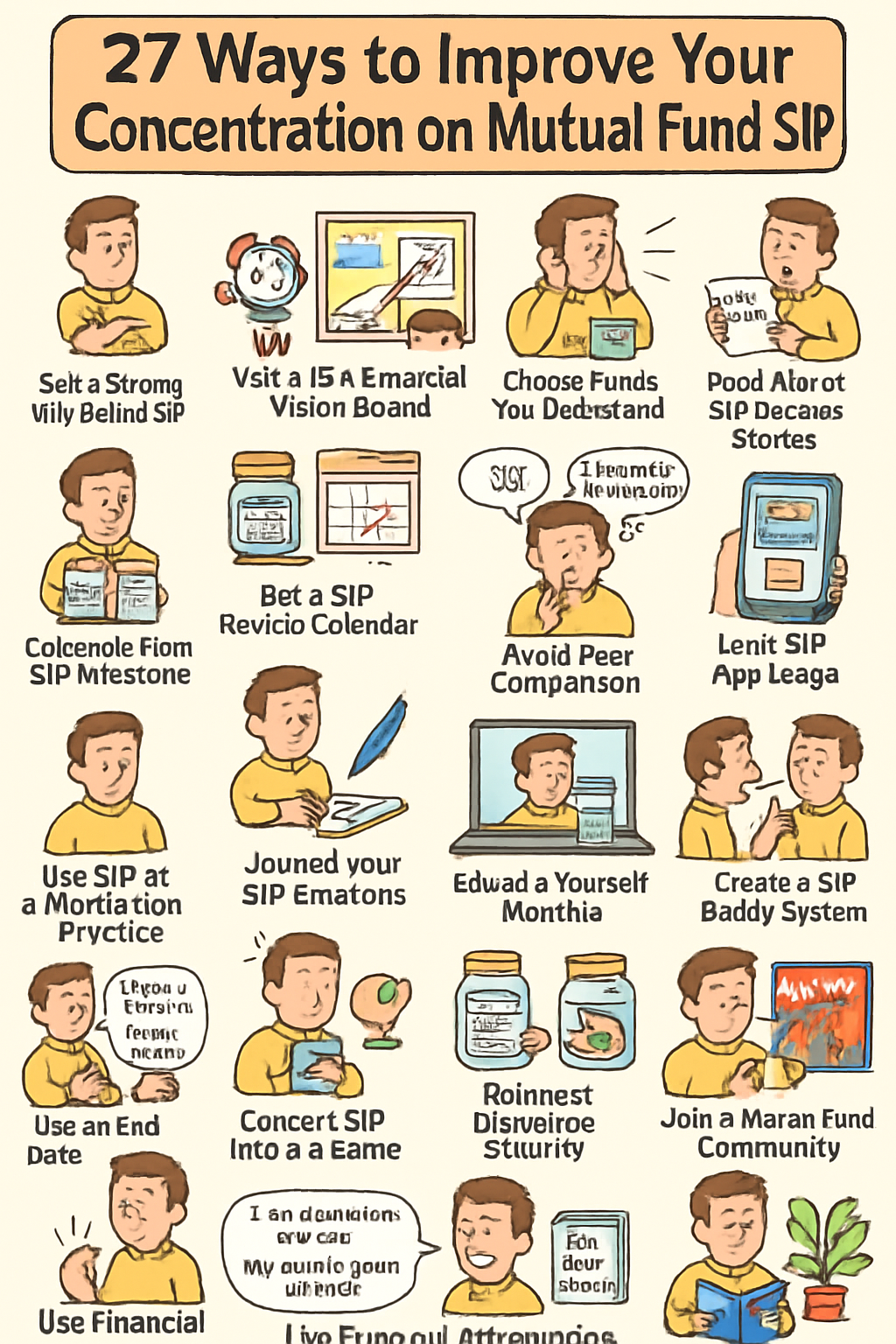

But the good news? You can train your mind like a disciplined investor—just like successful athletes train their focus. Let’s dive into the 27 powerful ways to improve concentration on your SIP.

Set a Strong Why Behind Your SIP

Your SIP isn’t just ₹5,000 a month—it’s your daughter’s college fund, your retirement home, or your way out of financial stress.

When your “why” is strong, your focus becomes unshakable. Write your goals down. Put them on your mirror. Remind yourself every month.

Automate but Don’t Forget

Auto-debit is a great tool, but don’t mentally check out.

Every month, when your SIP is deducted, take 30 seconds to reflect:

“This money is going to work for me. I’m building wealth, silently.”

This small ritual keeps your awareness alive.

Use Visual Tracking Charts

Track your SIP growth with a colorful, visual chart.

Print it, pin it, or use an app—but see your progress grow month-by-month. It creates emotional satisfaction and keeps your eyes on the prize.

Create a Financial Vision Board

Get creative. Paste photos of:

-

Your dream home

-

Your child graduating

-

Retirement in the hills

Make a board of what your SIPs are buying for future-you.

When your brain sees it daily, it fuels your motivation.

Celebrate Every SIP Milestone

Completed 6 months of SIP? Celebrate.

1 year? Treat yourself.

Small celebrations anchor the habit into your identity.

Just don’t spend the reward from your SIP fund!

Turn Off Market Noise

Unsubscribe from daily market panic.

Stop checking Nifty 50 daily.

Focus on long-term news, like budget updates or fund strategy—not daily NAVs.

Choose Funds You Understand

If you don’t understand what you’re investing in, your brain stays distracted and doubtful.

Choose SIPs where you know:

-

Fund manager strategy

-

Risk profile

-

Sector focus

This creates confidence = better concentration.

Read About SIP Success Stories

Regularly read real stories of people who became crorepati through SIP.

This creates emotional faith in the system.

What your mind believes, your money will follow.

Assign a Name to Each SIP

Don’t just call it “Axis Bluechip SIP”.

Call it “My Daughter’s Wedding Fund”.

Personal names create personal emotion—which sharpens focus and reduces random exits.

Set a SIP Review Calendar

Don’t ignore your investments completely.

Set twice a year SIP review dates. Not monthly, not weekly—just twice a year.

This structured review helps maintain interest and understanding without anxiety.

Avoid Peer Comparison

Your SIP is your journey. Don’t compare it to your friend’s crypto or your cousin’s FD.

Comparison creates envy, which kills focus.

Stay in your lane—and keep your eyes on your own goal.

Limit SIP App Usage

Ironically, checking your mutual fund app daily can hurt focus.

Too much checking = anxiety = impulsive behavior.

Delete the app if needed. Review only on fixed dates.

Use SIP as a Meditation Practice

Yes, sounds strange—but hear this out.

Each SIP deduction is an act of surrender.

Train your brain to say:

“I trust the process. I release the money. I grow wealth.”

This mantra builds emotional control.

Journal Your SIP Emotions

Market crash? Journal how you feel.

SIP up by 15%? Journal again.

Putting your emotions on paper prevents emotional investing and improves self-awareness.

Educate Yourself Monthly

Read one article or watch one video every month about SIP investing.

Consistent knowledge = consistent confidence = consistent SIP discipline.

Create a SIP Buddy System

Have a friend or spouse investing alongside you?

Check in monthly. Share growth charts. Motivate each other.

Accountability multiplies concentration.

Use SIP to Teach Kids

Tell your kids, “This is your education fund. Daddy invests ₹2,000 every month.”

Their curiosity and questions will inspire you to stay committed.

Set an End Date

SIP feels infinite and tiring unless you put a timestamp.

“I’m investing till 2040.”

This gives your brain a goal finish line, which enhances focus.

Convert SIPs into a Game

Gamify it. How many uninterrupted SIPs can you complete?

Set goals like:

-

No skipping for 12 months

-

Raise SIP by 10% annually

Score yourself. Gamification keeps boredom away.

Don’t Chase Quick Returns

Concentration weakens when you chase fast profits.

SIPs aren’t jackpots—they’re compounders.

Stick to your lane. Focus on time, not timing.

Use Financial Affirmations

Daily, say out loud:

-

“I am a consistent investor.”

-

“I stay calm during volatility.”

-

“My wealth grows silently.”

Your subconscious listens—and adapts.

Limit SIP Portfolio to 3–5 Funds

Too many funds scatter attention.

Choose a core portfolio of max 5 SIPs.

This improves tracking, understanding, and mental bandwidth.

Reinvest Dividends Smartly

Don’t withdraw dividends. Reinvest them.

This practice reinforces the compounding mindset—and keeps your eyes on growth, not withdrawal.

Follow SIP Investors on Social Media

Curate your feed. Follow:

-

Financial educators

-

Long-term SIP champions

-

Real investors sharing their journey

Positive SIP content boosts your focus.

Join a Mutual Fund Community

Online SIP forums or WhatsApp groups help you:

-

Learn from others

-

Share doubts

-

Stay emotionally committed

You are who you hang out with.

Take SIP Breaks Mindfully

If you must pause SIPs due to financial emergency, do it mindfully—not emotionally.

Set a restart date. Tell yourself, “This is a pause, not a surrender.”

Read Books on Long-Term Thinking

Books like “The Psychology of Money”, “Atomic Habits”, “Think and Grow Rich” build your financial patience muscles.

Mental fitness = SIP discipline.

Practice Patience During Market Crashes

This is your ultimate test.

Don’t stop SIPs when the market falls—those are actually discount seasons.

Tell yourself:

“I am buying more units for the same price. This is good.”

Patience during pain creates long-term gain.

SIP Focus Rewards You in Crores

Let’s visualize the difference focus makes:

| Monthly SIP | Period | Return % | Wealth with Discipline | Wealth if Paused 3 years |

|---|---|---|---|---|

| ₹5,000 | 20 yrs | 12% | ₹49.95 Lakhs | ₹30.35 Lakhs |

| ₹10,000 | 25 yrs | 12% | ₹1.74 Crores | ₹1.02 Crores |

| ₹20,000 | 15 yrs | 10% | ₹83.75 Lakhs | ₹56.32 Lakhs |

Discipline adds lakhs—and even crores—to your final corpus.

Conclusion from Cashbabu

Concentration isn’t just about peace of mind—it’s about growing your money with maturity. Mutual Fund SIPs are not magic—but they become powerful when you combine them with mental discipline, long-term focus, and emotional clarity.

You don’t need to monitor your SIP daily. You need to trust your system and train your mind.

With these 27 ways, your SIP will no longer be “just an investment.”

It will become a silent wealth builder—carved out of monthly consistency, backed by rock-solid focus.

Stay focused. Stay invested. Stay wealthy.

FAQs on Improve concentration on Mutual Fund SIP

Q1. Why do I lose interest in SIP after a year?

Because of lack of visible growth. The first few years of SIP feel slow. But remember: compounding is slow at the start, explosive later.

Q2. How can I stay consistent with my SIPs during financial stress?

Keep a small emergency buffer, so you don’t pause SIPs emotionally. Also, scale SIP down temporarily, but don’t stop altogether.

Q3. Should I check my SIP value every day?

No. Check only once every 3 or 6 months. Daily monitoring kills mental peace and concentration.

Q4. What is the biggest mistake SIP investors make?

Stopping SIPs during market dips. That’s when you should continue—or even increase your SIP.

Q5. Can mindset really impact my SIP returns?

Absolutely. Your mindset decides whether you complete your SIP journey or panic midway.

Q6. Is mutual fund SIP risky in the long term?

If you’re diversified and consistent, SIPs in quality mutual funds are less risky over 10–20 years than short-term bets.

Q7. What’s the best way to improve SIP discipline?

Follow a monthly ritual: visualize your goal, log your emotions, and remind yourself of your end date.

![]()

Pingback: At 65: Broke, Still Working, Well-to-Do or Wealthy? How a Retirement Plan SIP Decides Your Category - Cash Babu