Understanding Income Plus Arbitrage Funds

Have you ever wondered how to earn more than a fixed deposit but with less risk than equities? That’s where Income Plus Arbitrage Funds come in. These funds combine low-risk debt instruments with arbitrage opportunities to provide stable and tax-efficient returns.

Why Should Middle-Class Investors Consider These Funds?

You, as a middle-class investor, often find yourself stuck between wanting better returns and fearing market volatility. These funds can bridge that gap. With minimal equity exposure and favorable tax treatment, you get peace of mind and decent returns. Especially if you’re in the 20% or 30% tax bracket, your post-tax income gets a strong boost.

How Do Income Plus Arbitrage Funds Work?

Imagine you’re buying a stock in one market for Rs. 100 and selling it in another for Rs. 101. That Re. 1 is your arbitrage profit. Now multiply that over thousands of transactions and combine it with interest from bonds. That’s how these funds make money—with reduced risk.

Tax Efficiency: A Key Advantage

If you invest for over 3 years, you enjoy long-term capital gains with indexation. Compare that to FDs taxed at your slab rate. You could save up to 20% in taxes.

Tax Impact Example:

| Investment Type | Investment Amount | Return (%) | Pre-tax Value | Tax (%) | Post-tax Return |

|---|---|---|---|---|---|

| Fixed Deposit | Rs. 5,00,000 | 7% | Rs. 5,35,000 | 30% | Rs. 5,24,500 |

| Income Plus Arbitrage Fund | Rs. 5,00,000 | 7% | Rs. 5,35,000 | 10% | Rs. 5,31,500 |

In this example, you end up earning Rs. 7,000 more with an Income Plus Arbitrage Fund.

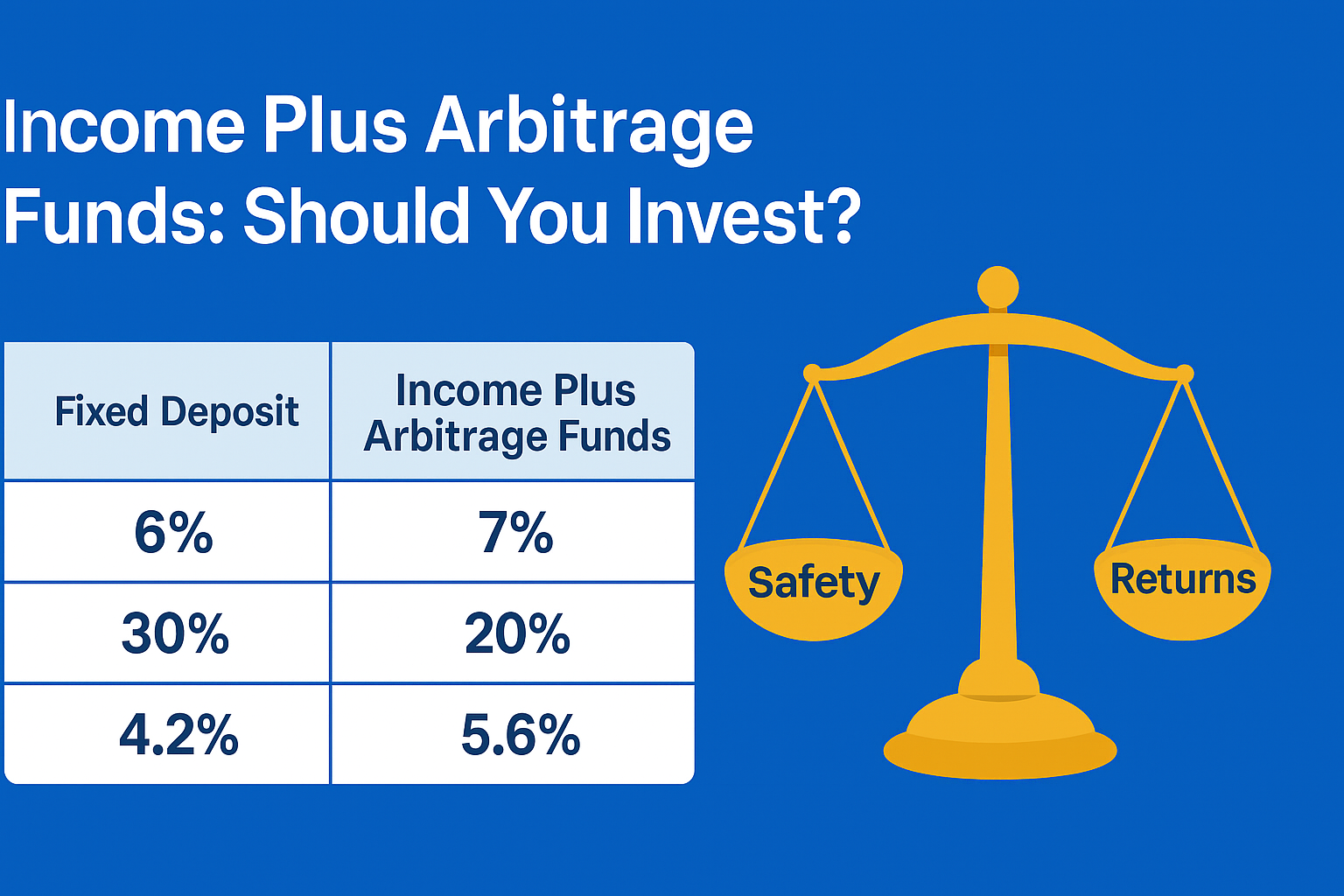

Comparing Returns: Income Plus Arbitrage Funds vs. Fixed Deposits

Let’s break it down for you:

- Fixed Deposits: Safe but taxed heavily.

- Income Plus Arbitrage Funds: Equally safe and taxed efficiently.

In short, your net gain is higher with these funds.

Risk Profile: Understanding the Safety Net

You must be wondering, “Are these safe?” Yes. These funds primarily invest in short-term debt and use hedged equity positions, making them ideal for conservative investors like you.

Who Should Invest in Income Plus Arbitrage Funds?

Are you a salaried person looking to avoid equity shocks but still want better-than-FD returns? Then this is for you. Also suitable if you’re nearing retirement and want safety with smart returns.

Potential Drawbacks to Consider

Every product has limitations. High expense ratios, limited arbitrage opportunities during stable markets, and slightly lower liquidity compared to FDs are key drawbacks. But if you’re investing for 1-3 years, it’s still worth it.

Selecting the Right Fund: Factors to Evaluate

You should always check:

- Fund Performance

- Expense Ratio

- Fund Manager’s experience

- Portfolio Allocation

These help you pick a winning fund.

Steps to Invest in Income Plus Arbitrage Funds

Follow this roadmap:

- Choose a reputed fund house.

- Opt for Direct Plans to lower expenses.

- Start with SIPs or lumpsum depending on your goals.

- Track your fund quarterly.

Real-Life Scenario: Middle-Class Investor’s Perspective

Let’s say Ramesh, a schoolteacher, earns Rs. 8 lakh annually. He parked Rs. 5 lakh in an arbitrage fund for 3 years and earned a 7% CAGR. Thanks to indexation, his tax was negligible. Had he chosen an FD, he would’ve paid over Rs. 10,000 in taxes.

Frequently Asked Questions

Q1: Is it better than FD for someone in the 30% tax bracket?

Yes, because of tax efficiency, your post-tax returns will be higher.

Q2: How long should I stay invested?

Ideally 1-3 years, but tax benefits increase after 3 years.

Q3: Can I withdraw anytime?

Yes, though some funds may have exit loads for short periods.

Q4: Is this same as Balanced Advantage Fund?

No. Balanced Advantage Funds take equity calls. Arbitrage Funds hedge completely.

Q5: What are current returns like?

Around 6.5% to 7.5%, similar to FDs but more tax-friendly.

Q6: Can I start with Rs. 1000 SIP?

Yes, most AMCs allow you to start low and build gradually.

Q7: Any hidden charges?

Just check the expense ratio. No hidden charges otherwise.

Cashbabu Gyan

You deserve a plan that works for your goals and your tax slab. Income Plus Arbitrage Funds may not be flashy, but they are smart. They give you peace of mind, stability, and a little extra in your pocket—which goes a long way for your family’s dreams. Be strategic. Be calm. Be consistent. That’s how wealth is built.

![]()