Axis Bank My Zone Credit Card Benefits in 2025: A Smart Lifestyle Choice

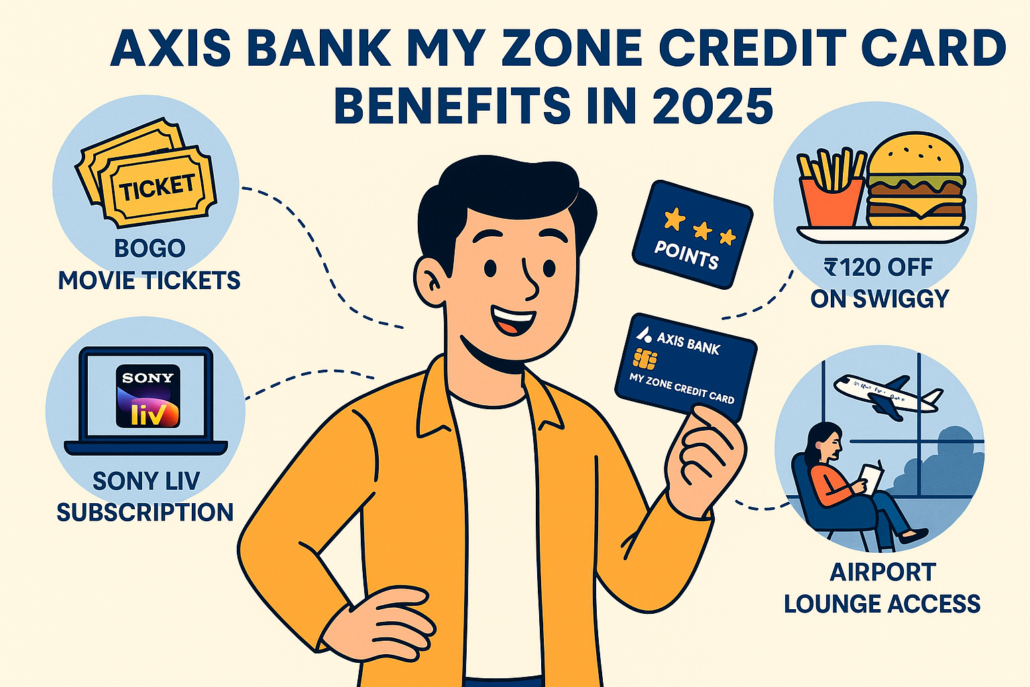

The Axis Bank My Zone Credit Card benefits in 2025 are perfectly tailored for those who want to enjoy real-life savings on food, entertainment, shopping, and travel. Whether you’re a young professional, student, or family user, this lifestyle credit card delivers big on small spends with valuable cashback, points, and easy redemptions.

Key Lifestyle Benefits You’ll Use Often

One of the most popular Axis Bank My Zone Credit Card benefits is the Buy One Get One Free movie ticket offer. Every month, you can get up to ₹200 off on movie bookings via the Zomato app by using the coupon code. This benefit alone pays for the card’s fee if used regularly.

If you’re a Swiggy user, you can save ₹120 twice a month on orders above ₹500. Just apply the promo code. The card excludes a few outlets like Haldiram’s, but overall, it’s a great way to save on food deliveries.

Dining out with friends or family also becomes rewarding. You get up to 15% off on EazyDiner partner restaurants on bills of ₹2,500 and above, once per month. This benefit enhances your social life and gives you more value for each dine-out experience.

Fashion shoppers will love the AJIO discount: ₹1,000 off on spends of ₹2,999 or more using the code. The Axis Bank My Zone Credit Card benefits truly touch every corner of modern lifestyle needs.

Earn EDGE Reward Points and Bonus Benefits

The reward structure of this card is straightforward. You earn 4 EDGE Reward Points for every ₹200 spent on eligible categories. Points are not awarded on spends like fuel, rent, utility bills, wallet loads, or movie bookings, but most daily expenses do qualify.

When you spend ₹1.5 lakh annually, Axis Bank rewards you with 1,000 bonus EDGE points. These can be redeemed for vouchers, travel bookings, electronics, and more. The redemption process is easy through the Axis EDGE Rewards portal, where each point holds an approximate value of ₹0.20.

Streaming and Airport Perks That Make a Difference

One of the most loved Axis Bank My Zone Credit Card benefits in 2025 is the complimentary 1-year Sony LIV Premium subscription worth ₹1,499. You get this after your first transaction within 30 days of receiving the card. The subscription renews annually if you spend ₹1.5 lakh in a year.

For those who travel domestically, you get one free airport lounge visit every quarter. To qualify, you need to spend ₹50,000 in the previous 3 months. For new users, Axis often waives this condition initially.

Practical Everyday Savings

Another underrated but essential benefit is the 1% fuel surcharge waiver. Fuel transactions between ₹400 and ₹4,000 qualify for the waiver. While GST is not covered, it still helps frequent commuters reduce monthly fuel costs.

Worried about big-ticket purchases? With this card, any spend above ₹1,500 can be converted into easy EMIs. This adds financial flexibility and control, especially during high-spend months.

Your transactions are secured with EMV chip and PIN technology, providing an additional layer of protection.

Affordable Fees and Clear Charges

The Axis Bank My Zone Credit Card benefits come with minimal costs. The joining fee is ₹500, and the annual renewal fee is ₹500 as well. These fees are often waived for life during special Axis Bank promotions.

If you pay your card bills in full, you’ll enjoy all benefits without any extra cost. However, carrying a balance results in finance charges of 3.75% per month (roughly 45% per year). Late payment fees range from ₹500 to ₹1,200 based on the outstanding balance.

Who Can Apply and How to Qualify

You are eligible to apply if you’re between 18 and 70 years of age and a resident or NRI of India. Required documents include PAN card, income proof (salary slip or ITR), and address proof.

How to Redeem EDGE Reward Points

Redeeming reward points is simple. Just log into the EDGE Rewards portal and choose from vouchers, travel offers, gift items, and more. The points-to-rupee value and redemption steps are transparent, making it easy even for first-time credit card users.

How It Compares to Other Credit Cards

Compared to other entry-level cards like Axis Neo or Axis Rewards, the Axis Bank My Zone Credit Card benefits focus more on lifestyle. While Neo might give better cashback on specific e-commerce platforms, My Zone leads with movie tickets, Swiggy discounts, lounge access, and OTT benefits.

If your spends are more entertainment-focused, this card will outperform many others in the same category.

Key 2025 Updates You Should Know

As of June 20, 2025, Axis Bank has changed its reward calculation method. Rewards are now excluded based on category type rather than merchant codes. This brings more clarity but may limit earnings in a few areas.

From April 1, 2026, the Sony LIV subscription will be discontinued and replaced with 1,000 bonus EDGE points on annual spending of ₹1.5 lakh. Stay updated with these changes to make the most of your card usage.

Read also:- How I use Axis Bank Indian Oil Credit Card benefits?

Should You Get the Axis Bank My Zone Credit Card in 2025?

If your monthly habits include ordering food, watching movies, traveling occasionally, and shopping online, this card will serve you well. The Axis Bank My Zone Credit Card benefits offer unbeatable lifestyle value for just ₹500 annually—or even for free during certain offers.

It’s not ideal for those whose primary expenses are fuel, groceries, or rent. But if your goal is to get entertainment, convenience, and rewards for regular lifestyle expenses, then this is a smart financial tool to keep in your wallet.

Frequently Asked Questions

Is the airport lounge access available in the first month?

Yes, Axis Bank may waive the spend condition for new users, offering early access to this perk.

How can I get the Sony LIV subscription?

Make your first card transaction within 30 days of issuance to receive a 1-year subscription.

What purchases are excluded from earning reward points?

Fuel, wallet loads, rent, government services, utility bills, and movie tickets.

Is this card better than Axis Neo?

Yes, if you prioritize entertainment and lifestyle over grocery cashback and e-commerce rewards.

Can I get this card lifetime free?

Sometimes, yes. Axis Bank often runs offers that waive both joining and annual fees.

Final Thoughts

The Axis Bank My Zone Credit Card benefits in 2025 make it one of the most attractive entry-level credit cards for lifestyle users. With features that reward your everyday choices—whether it’s watching a movie, ordering food, or shopping online—you can save more, earn more, and enjoy more. If you want a card that blends utility and lifestyle without burning a hole in your pocket, this is the one to get.

![]()