The Truth Hidden in Plain Sight

Have you ever felt like you’re missing something crucial when it comes to investing in ETFs and Mutual Funds SIP? You’re not alone. While experts often give you the basics, the real game-changing insights remain untold. This blog pulls back the curtain on 19 surprising facts about ETFs and Mutual Funds SIP that even seasoned advisors seldom share. We’re diving into truths that can dramatically impact your long-term wealth creation, risk management, and decision-making journey. Let’s expose the myths, decode the jargon, and get brutally honest about what really matters to the middle-class Indian investor.

ETFs Are Not Always Cheaper in the Long Run

Everyone says ETFs are low-cost. Yes, the expense ratio is lower, but what they don’t tell you is the hidden cost of frequent trading and demat account fees. Every time you buy or sell ETFs, you pay brokerage, transaction charges, and even STT. Over time, this can silently eat into your returns—especially for those who invest monthly like a SIP but via ETFs. The automation and zero-transaction nature of mutual fund SIPs can actually be more cost-effective.

SIPs Can Beat Lump Sum Even in a Bull Market

Experts love to glorify lump sum investing during market corrections. But disciplined SIPs often outperform even in long-term bull runs due to cost averaging. In fact, a 10-year SIP in a consistent performing mutual fund can beat lump sum investments with better risk-adjusted returns. The real surprise? SIPs often work better even when markets are rising—because you’re not trying to time it.

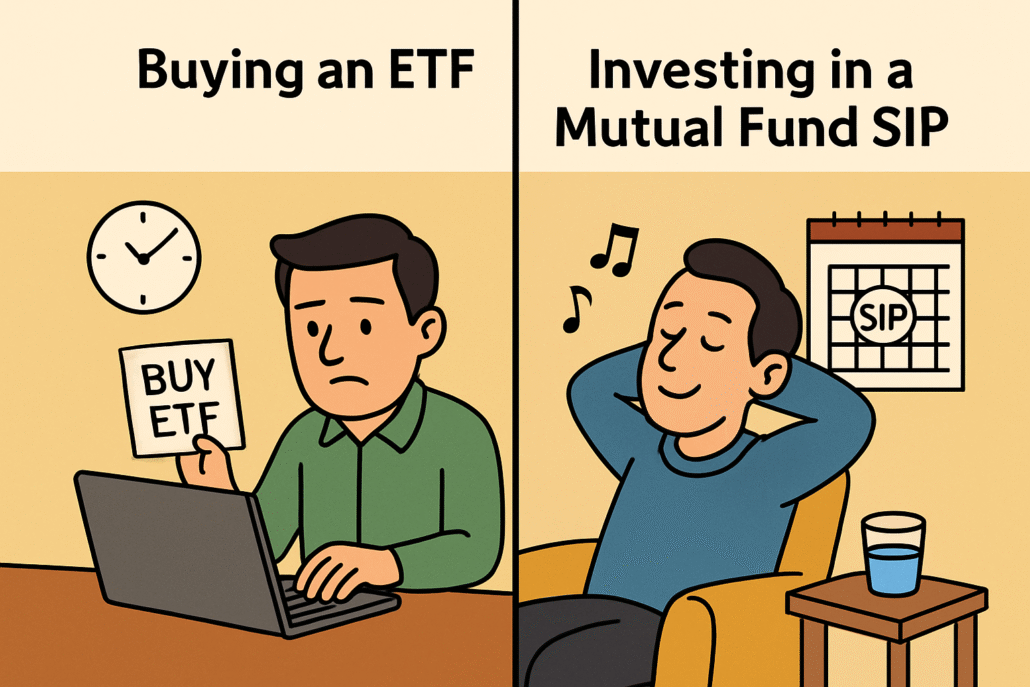

ETFs Don’t Offer SIP Automation—And That’s a Big Deal

One of the biggest surprising facts about ETFs and Mutual Funds SIP is that ETFs don’t support auto-debit SIPs from your bank account. You have to manually buy every month through a demat platform. Missing a month due to a holiday or forgetfulness? Your investment journey takes a hit. Mutual fund SIPs, on the other hand, run silently and smoothly without your constant involvement.

Expense Ratio Lies—It’s Not the Only Cost You Pay

Both ETFs and mutual funds highlight low expense ratios. But they don’t mention exit loads, front-end loads, brokerage fees, transaction charges, demat charges, fund management fees, and more. Especially in ETFs, where you transact through stock exchanges, there are hidden trading charges that add up without you realizing it.

SIPs in Mutual Funds Offer Goal-Linked Planning—ETFs Don’t

When you do a SIP in mutual funds, you can assign it to specific goals—child’s education, retirement, travel. Most mutual fund platforms even allow goal tracking and rebalancing. ETFs don’t offer this benefit. They are naked investments—you need to mentally tag and manage them separately.

ETFs Are Not Always More Transparent

A popular belief is that ETFs are more transparent because they replicate an index. But what about tracking error? ETFs may not fully reflect the underlying index performance due to rebalancing lags and operational inefficiencies. On the other hand, many active mutual funds disclose full portfolios monthly, with detailed commentary by fund managers. That’s true transparency.

SIPs Help Develop Financial Discipline

One of the less spoken surprising facts about ETFs and Mutual Funds SIP is how SIPs instill long-term investing behavior. You commit a fixed amount monthly, ignoring noise and market ups and downs. ETFs, unless done manually every month with dedication, don’t help build this habit. And without consistency, compounding collapses.

ETFs Are Prone to Intraday Volatility

Since ETFs trade like stocks, they fluctuate throughout the day. If you buy at the wrong time of the day, you may end up buying at a high price, hurting your returns. Mutual fund SIPs, on the other hand, are based on end-of-day NAV. This reduces emotional trading and market timing mistakes.

ETFs May Suffer From Low Liquidity

Not all ETFs are created equal. Some popular ones have good trading volumes, but many suffer from low liquidity. You might have to sell at a lower price than the actual NAV due to poor demand. Mutual funds don’t have this problem—you always get the NAV value, irrespective of market interest.

SIPs Provide Rupee Cost Averaging Without Effort

Rupee Cost Averaging is one of the cornerstones of SIP success. Whether the market goes up or down, your SIP buys more units when prices fall and fewer units when prices rise. ETFs require manual purchases—you have to actively buy at lower prices, which very few investors can do consistently.

ETFs Lack the Human Touch of Fund Managers

ETFs follow index strategies. There’s no fund manager watching over your investment. Mutual funds, especially active ones, have experienced fund managers adjusting portfolios during market crises. In volatile conditions, this human judgment can protect your capital better than passive ETFs.

Mutual Fund SIPs Offer Tax Saving Options Like ELSS

ETFs don’t offer tax-saving benefits under Section 80C. Mutual funds, on the other hand, offer Equity Linked Saving Schemes (ELSS) with a 3-year lock-in. These not only help save taxes but also deliver market-linked returns. This is one of the most ignored surprising facts about ETFs and Mutual Funds SIP.

Systematic Withdrawal Plan (SWP) Advantage with Mutual Funds

While ETFs offer liquidity, only mutual funds offer Systematic Withdrawal Plans (SWP)—a powerful feature for retirees or those wanting monthly income. It allows you to withdraw a fixed amount regularly while your remaining corpus continues to grow.

SIPs Can Be Started With Just ₹100

Mutual fund SIPs allow you to begin investing with as little as ₹100. ETFs, due to their trading nature, require you to buy at least one unit, which can cost ₹150 to ₹10,000 depending on the index. For beginners, mutual fund SIPs are far more accessible.

ETFs Have No Free Advisory Support

Most mutual fund platforms offer free investment advisory, planning tools, and fund selection support. When you invest in ETFs, especially via brokers, you’re on your own. There’s no tailored advice or assistance for portfolio building unless you hire a paid advisor.

Mutual Fund SIPs Allow STP and Switch Options

Switching from equity to debt or changing funds mid-way is easy with mutual funds. You can set up a Systematic Transfer Plan (STP) or switch funds with minimal cost and effort. ETFs don’t offer any internal switch facility. You have to sell and re-buy, triggering taxes and brokerage.

ETFs Don’t Offer Direct Plan Benefits Easily

Mutual fund SIPs come with direct plans, which have lower expense ratios compared to regular plans. ETFs technically act like direct plans but don’t come with guidance or platforms like MF Utility or AMC portals. This lack of ecosystem makes them harder to manage for DIY investors.

SIP Pausing and Flexibility is Better in Mutual Funds

Need to pause your SIP for a month or two? Mutual fund platforms let you do it with a click. You can modify, pause, increase, or reduce your SIPs as your income fluctuates. ETFs have no such flexibility unless you manually stop or change your strategy on your own.

ETFs Aren’t Ideal for Sector Rotation

If you want to switch between sectors—say from Pharma to Banking—mutual funds offer easy sector/thematic funds and switches. With ETFs, you must sell entire units and buy new sector ETFs. That means more brokerage, more taxes, and more confusion.

ETFs Don’t Work Great with Small Ticket SIPs

Let’s say you want to do a ₹1,000 SIP into Nifty ETF. If the price of the ETF is ₹250, you can buy only 4 units. But next month, if the price jumps to ₹300, you can only buy 3 units, and ₹100 stays unused. This rounding-off issue results in inefficient investing. Mutual fund SIPs use every rupee and buy fractional units too.

Cashbabu Final Word

You’ve just unlocked 19 surprising facts about ETFs and Mutual Funds SIP that most advisors won’t whisper in your ears. Why? Because these truths challenge popular narratives. The middle-class Indian investor deserves clarity, not confusion. SIPs in mutual funds offer automation, emotional stability, tax benefits, flexibility, and goal tracking—all wrapped into one disciplined package. ETFs have their place for savvy investors, but they demand attention, time, and a deeper understanding. Choose the path that suits your lifestyle, your patience, and your financial dreams. Let Cashbabu guide you to make money the peaceful way—without panic, without gimmicks. Because in the world of finance, it’s not about how much you know—it’s about what truths you’re brave enough to act on.

FAQs

Q1. Are ETFs better than mutual funds SIP for long-term investment?

Not always. Mutual funds SIPs offer better automation, rupee cost averaging, and goal tracking. ETFs suit active investors.

Q2. Can I do SIP in ETFs?

Not in the true sense. You have to manually buy units every month. There’s no auto-debit system like mutual fund SIPs.

Q3. Which one is more cost-effective in the long run—ETF or mutual fund SIP?

Mutual fund SIPs may be more cost-effective when considering hidden charges, transaction fees, and missed SIPs in ETFs.

Q4. What happens if I miss a SIP in ETFs?

Nothing happens automatically. You need to track and buy manually again. There’s no penalty, but you miss the compounding opportunity.

Q5. Are ETFs safer than mutual funds?

ETFs track indices, so they’re transparent but not necessarily safer. Active mutual funds are curated and may manage risks better during volatility.

Q6. Can I switch from ETFs to mutual funds easily?

Only by selling ETFs and buying mutual funds separately. There is no internal switch system like in fund houses.

Q7. Are there any tax benefits with ETFs?

No. Mutual funds offer ELSS tax-saving schemes, which ETFs lack.

Q8. Which one suits beginners—ETFs or mutual funds SIP?

Mutual funds SIPs are ideal for beginners due to their automation, low entry barrier, and support systems.

![]()