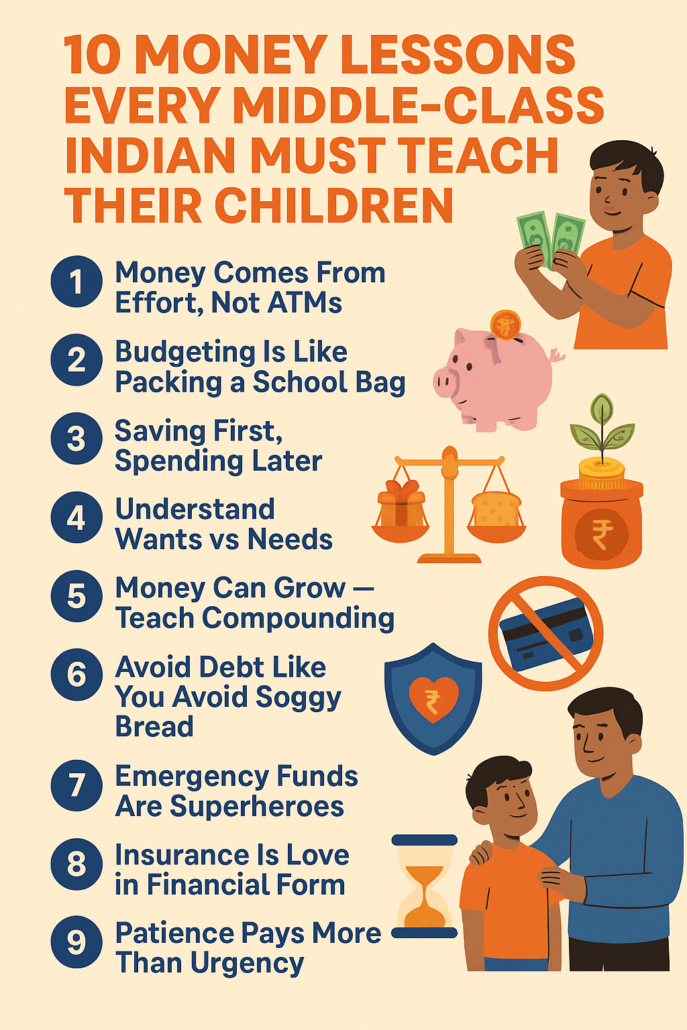

Have you ever asked the question to yourself how 10 Powerful Money Lessons Every Indian Middle-Class Parent Must Teach their kids for financial freedom?

Introduction

Every rupee earned by a middle-class Indian comes with a story—of hard work, compromise, and dreams. But are we passing this value to our children?

Your child doesn’t need to become a financial genius overnight. But they do need to grow up knowing what you’ve painfully learned over the years—that money is not magic, but management.

Here are 10 life-shaping money lessons every Indian child from a middle-class family must learn, straight from your dinner table conversations.

1. Money Comes From Effort, Not ATMs

Your child sees you swipe your card and get things. But they need to know: money is earned, not plucked from a machine.

Explain how your job, your daily efforts, and even your stress help keep the lights on and the fridge full.

Tip for parents: Let them earn small rewards for chores. Let effort connect to earning.

2. Budgeting Is Like Packing a School Bag

Just like they pack notebooks, lunch, and water carefully, tell them your wallet needs planning too.

Budgeting means dividing money wisely before spending—some for now, some for later, some just in case.

Tip: Give them a small weekly allowance and help them create a fun “Spend–Save–Give” jar system.

3. Saving First, Spending Later

This is golden. Teach them to save before they spend, not the other way around.

Middle-class families survive on this rule—whether it’s saving for Diwali or for education.

Tip: Make saving exciting. Create goals like “Buy your own toy car in 2 months.”

4. Understand Wants vs Needs

Do they “need” a new video game, or do they “want” it?

This lesson builds wisdom. It prevents future credit card traps and impulse buying as adults.

Tip: During shopping, let them help you sort “must-buy” vs “can-wait” items.

5. Money Can Grow—Teach Compounding

Teach them early that money can multiply if saved and invested wisely.

Tell them stories of how your PPF, SIPs, or FDs grew over time. Introduce them to the magic of compounding—“Money earns money”.

Tip: Show them a ₹1 coin growing to ₹10 in a piggy bank and then explain interest in simple terms.

6. Avoid Debt Like You Avoid Soggy Bread

Taking loans for homes and education is fine. But borrowing to buy the latest mobile? Not wise.

Teach them that loans must be respected, not taken casually.

Tip: Share your own EMI story—how every rupee of debt limits your monthly dreams.

7. Emergency Funds Are Superheroes

Bad times don’t knock. Be ready.

Explain that saving for emergencies is like carrying an umbrella on a sunny day—just in case the clouds surprise you.

Tip: Create a family emergency jar and let them contribute Rs. 10 a week from their pocket money.

8. Insurance Is Love in Financial Form

Let your kids know that your life insurance isn’t about dying, it’s about protecting dreams if something happens.

Health insurance is not a cost; it’s security.

Tip: When paying premiums, tell your child, “This is how Papa ensures we’re never helpless in a hospital.”

9. Patience Pays More Than Urgency

They must learn: not everything comes instantly.

Delayed gratification means waiting, working, and then enjoying—the most powerful financial mindset.

Tip: Reward them more if they save their treat money for a month rather than spending it all in one go.

10. Lead by Example—They’re Always Watching

Your spending habits, your attitude toward money, your emotions after a financial loss—they learn from watching you.

Tip: Show them how you plan for retirement or track your monthly budget. Include them in small financial talks.

Final Words From Cashbabu

Teaching kids money lessons isn’t about lectures. It’s about daily conversations, habits, and living what you preach.

Middle-class families can give their children the strongest financial backbone—not by giving them wealth, but by giving them wisdom.

Pass these 10 golden lessons, and you won’t just raise children—you’ll raise financially confident future adults.

Frequently Asked Questions (FAQs) on 10 Powerful Money Lessons Every Indian Middle-Class Parent Must Teach

Q1: How can I start teaching my child about money?

Begin with simple concepts like saving from pocket money, understanding needs vs. wants, and the importance of budgeting.

Q2: What percentage of income should be saved monthly?

Aim to save at least 20% of your monthly income. Adjust based on your financial goals and obligations.

Q3: Is investing in mutual funds safe for middle-class families?

Yes, when chosen wisely and aligned with your risk appetite, mutual funds can be a beneficial investment avenue.

Q4: How do I create an emergency fund?

Start by saving a small, fixed amount monthly in a separate account until you accumulate 3-6 months’ worth of living expenses

Q5: Should I involve my children in family financial decisions?

Involving them in age-appropriate discussions can enhance their understanding and appreciation of financial planning.

Q6: How can I reduce unnecessary expenses?

Track your spending, identify non-essential expenditures, and set limits or eliminate them altogether.

Q7: What is the importance of financial goals?

Financial goals provide direction, motivation, and a roadmap for your saving and investment strategies.

![]()