Key Takeaways:

Flexicap mutual funds offer flexibility to invest across large, mid, and small caps.

Rolling returns show consistent performance over time, not just one-time spikes.

Top performers like HDFC, Parag Parikh, and Quant Flexicap show strong 3- and 5-year returns.

Choose funds with steady returns and low expense ratios for 3–5-year goals.

Always align fund choice with your time horizon and risk tolerance.

What are Rolling Returns & Why They Matter

Rolling returns (or trailing returns) refer to the returns achieved over past periods (like 1-year, 3-year, 5-year) recalculated continuously. They smooth out timing effects, reduce bias from picking a particular start date, and help compare how flexicap mutual funds have performed over different market cycles.

Methodology

-

We look at 1-year, 3-year, 5-year annualised rolling returns.

-

Funds are selected from India’s flexicap category.

-

Data is taken from recent published sources.

-

The ranking is based primarily on the 3-year rolling return, but 1-year and 5-year returns also critically important.

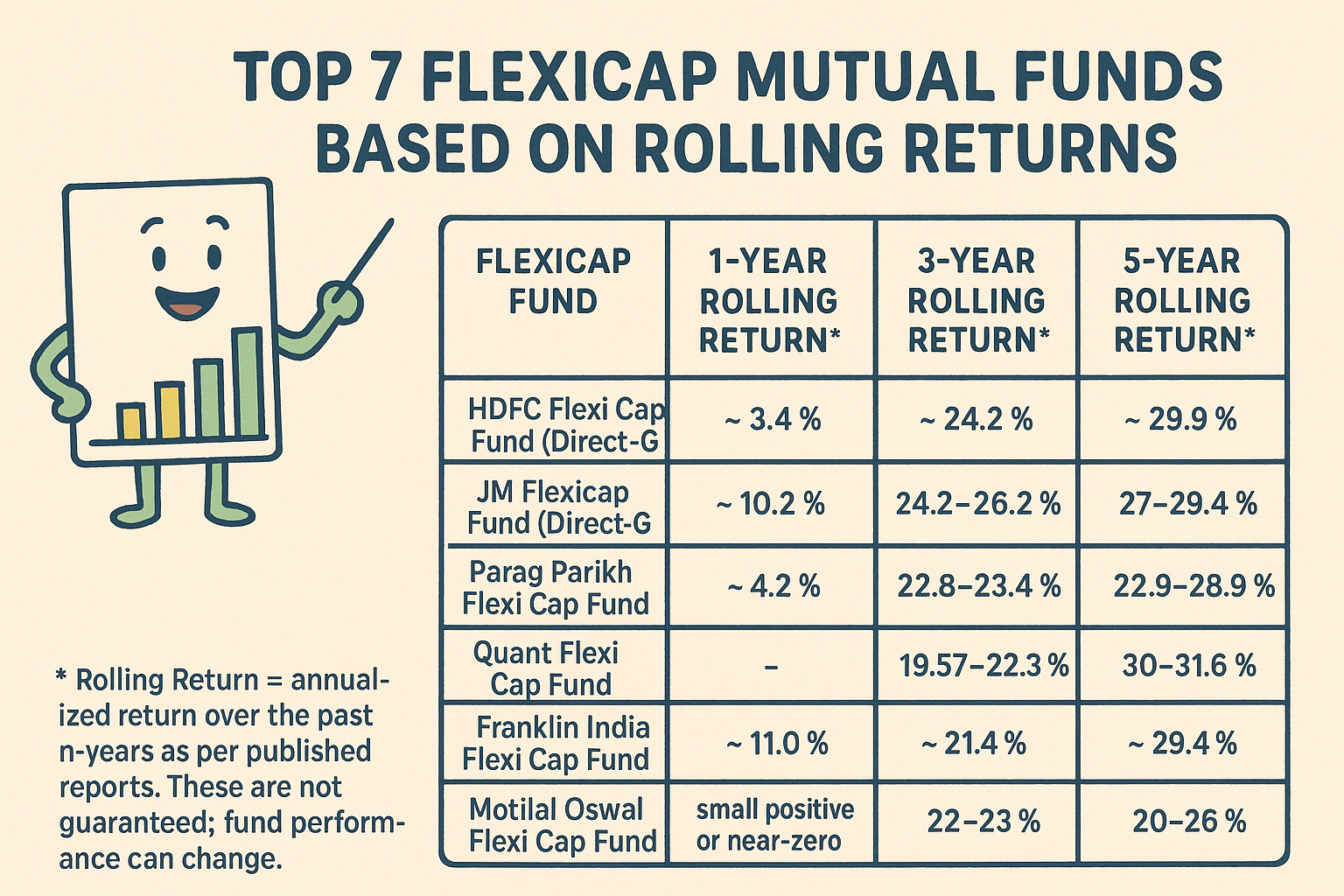

The Top 7 Flexicap Mutual Funds (Example Data)

Here’s a scrollable table of 7 flexicap mutual funds with their current rolling returns. (Note: Data approximate; verify with latest sources before investing.)

| Flexicap Fund | 1-Year Rolling Return* | 3-Year Rolling Return* | 5-Year Rolling Return* |

|---|---|---|---|

| HDFC Flexi Cap Fund (Direct-G) | ~ 3.4 % | ~ 24.2 % | ~ 29.9 % |

| JM Flexicap Fund (Direct-G) | ~ −10.2 % | ~ 24.2-26.2 % | ~ 27-29.4 % |

| Parag Parikh Flexi Cap Fund | ~ 4.2 % | ~ 22.8-23.4 % | ~ 22.9-28.9 % |

| Quant Flexi Cap Fund | (not always provided for 1-year) | ~ 19.57-22.3 % | ~ 30-31.6 % |

| Franklin India Flexi Cap Fund (Direct-G) | ~ 11.0 % | ~ 21.4 % | ~ 29.4 % |

| Motilal Oswal Flexi Cap Fund Direct | ~ small positive or near-zero in 1-year in many cases | ~ 22-23 % | ~ 20-26 % depending on source |

| Bank of India Flexi Cap Fund Direct | ~ slightly negative or low in recent 1-year in some sources | ~ 23-24 % | ~ 26-27 % |

* “Rolling Return” = annualised return over the past n-years as per published reports. These are not guaranteed; fund performance can change.

Key Insights

-

Variability across time-horizons: Some funds show strong 5-year returns but relatively weak 1-year returns, highlighting short-term volatility.

-

Consistency matters: Funds that deliver stable 3-year and 5-year returns tend to have better risk-adjusted profiles.

-

Fund size / management quality: Larger AUM funds often have more stability, but sometimes smaller flexicap funds outperform in rising markets (though carry higher risk).

-

Expense ratio & allocation: Lower expense ratio helps; also how much exposure the fund has to mid/small cap vs large cap impacts return & volatility.

How to Use This to Choose Flexicap Mutual Funds

-

Match with risk-profile & horizon: If you have 5+ years, emphasize 5-year rolling returns. Shorter period? 3-year or 1-year data more relevant.

-

Look for consistency: A fund that has moderately good returns in 1, 3, 5 years is usually safer than one with a big spike then a drop.

-

Check allocation & strategy: Understand how the fund manager rotates between large, mid, small caps. A flexicap mutual fund should flexibly shift based on valuations.

-

Compare with benchmark: Always compare with indices like NIFTY 500 TRI or BSE 500 TRI to see if outperformance is real after costs.

Limitations & What to Watch Out For

-

Past performance ≠ future guarantee.

-

Rolling returns smooth timing risk, but still affected by market regime changes.

-

High mid/small cap exposure can boost upside but also increase drawdowns.

-

Expense ratio, exit loads, tax impact, fund house reputation all matter.

Conclusion

Flexicap mutual funds offer flexibility and opportunity across market-caps. But picking the “top” ones depends on balancing returns & risk over multiple rolling periods. The 7 funds above are strong contenders — but always check the latest return data, expense costs, and your own financial goals before committing.

![]()

Pingback: Top 7 Mutual Funds Based on Rolling Return in 2025 - Cash Babu