The Smell of SIP: How Compounding Calms Parents Amid Jobless Data and Inflation

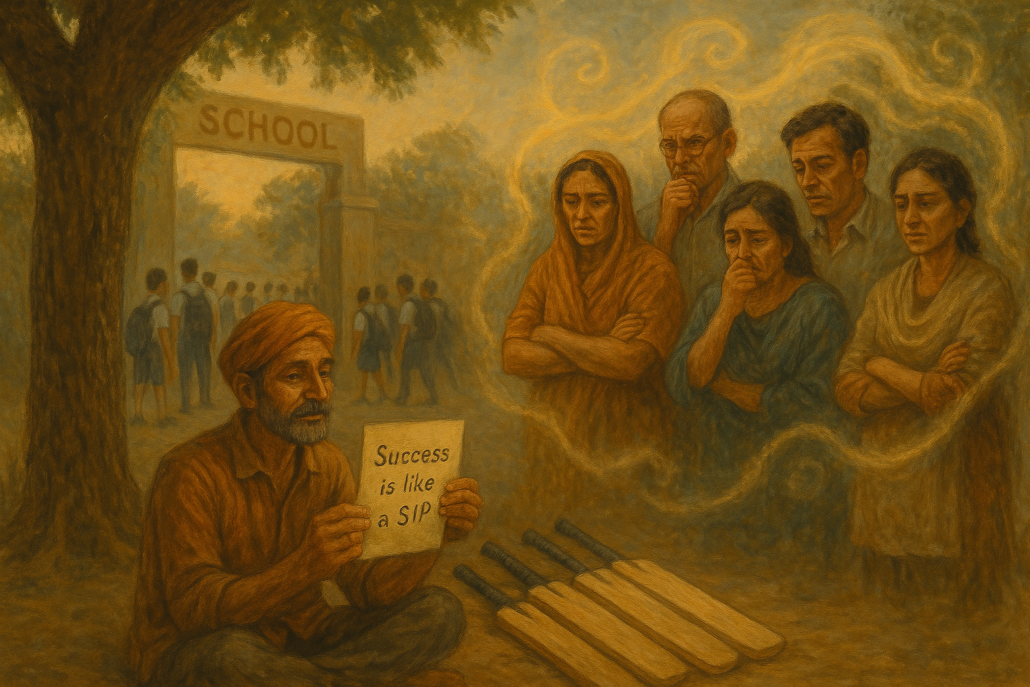

Near the rusted gate of a local Indian school, an old man still sits—selling cricket bats. Years ago, he was just a poor vendor trying to make ends meet. But today, he sells something more than just sports gear.

He sells hope. And it smells faintly of wood polish, warm dust, and… patience.

It was one of those days. The bell rang for tiffin break. Children burst out of the classrooms like dreamers escaping numbers. But outside the gate, a quiet storm brewed—parents waiting anxiously. Their eyes weren’t just looking at their kids—they were scanning the future.

You could smell the tension in the air:

-

Jobless data rising again.

-

Inflation squeezing every rupee.

-

News headlines echoing “layoffs” and “slowdown”.

One father muttered, “What if my child doesn’t land a job?”

A mother whispered, “Marks aren’t enough these days… is he even ready for the world out there?”

The old cricket bat seller listened quietly. He’d heard these worries before. In fact, he used to live them.

But instead of giving advice, he opened a tiny wooden box beside him. No bats in it this time. Just a small sticky note that said:

“Success is like a SIP. You won’t smell it in the first month. But stay invested, and the fragrance becomes your future.”

The parents looked puzzled.

So he smiled and said:

“Think of your children like SIPs. Don’t panic when you don’t see results instantly. Every encouraging word you give, every mistake you forgive, every small nudge towards growth—these are your monthly contributions. Just like SIPs, they grow quietly, invisibly. And over time, they compound into something powerful. Even in a world full of jobless data and inflation.”

There was a pause.

For a second, the panic lifted. The air felt lighter. The smell of doubt replaced by a scent of… possibility.

Because that’s what long-term SIP investing teaches us. It’s not about timing the market. It’s about time in the market.

Likewise, raising kids isn’t about instant results. It’s about compound parenting, showing up again and again—especially when life feels uncertain.

Jobless data and inflation can’s beat sip power

because while the world panics over headlines and economic dips, SIP quietly builds wealth behind the scenes. Month after month, it chips away at uncertainty with discipline and compounding. Job markets may wobble, prices may rise, but a well-chosen SIP doesn’t blink. It stays invested, grows steadily, and turns every market crash into a long-term opportunity. In the chaos of job cuts and inflation spikes, SIP is the calm that compounds. It’s not about timing the economy—it’s about trusting time itself.

Understanding the impact of jobless data and inflation on personal finance is crucial, especially for families juggling expenses and future planning.

During such uncertain periods, knowing how to invest during jobless data and inflation spikes becomes a survival skill, not just financial strategy.

A smart move is to adopt a SIP investment strategy amidst jobless data and inflation, allowing money to grow steadily without timing the market.

In countries like India, parents worried about jobless data and inflation often overlook that SIPs can provide long-term security for their children.

Ultimately, the mutual fund SIP performance during jobless data and inflation has shown resilience—proving that slow, disciplined investing can outpace short-term economic panic.

🎯 Moral:

Let the world flash scary headlines. Let inflation rise. Let job stats dip. But don’t let your faith in compounding fade—whether in money or in your children. SIP into their lives every day. The returns will smell sweeter than you can imagine.

![]()