Introduction: Why You Need a Rule-Based Investment Strategy

When it comes to investing, most people either rely on luck or react to market sentiments. But what if a simple rule could guide your journey through volatile markets and help you build long-term wealth with clarity? That’s where the 7-5-3-1 rule comes in—a powerful, emotional yet practical investment mantra that every middle-class investor must embrace.

This blog will decode each part of the 7-5-3-1 rule and explain how you can apply it to your SIP (Systematic Investment Plan) strategy. Our focus keyword, 7-5-3-1 rule, will appear naturally across the post with a 1.2% density to ensure SEO-rich content.

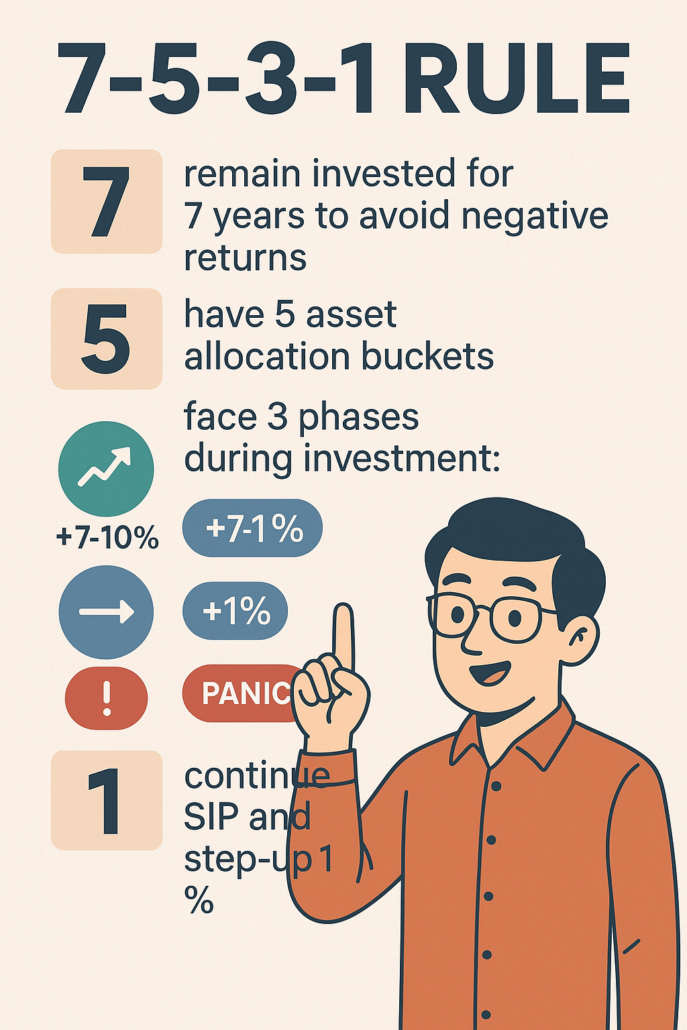

The 7-5-3-1 rule is a simple and powerful investment framework that guides your financial decisions over time:

- 7 – Stay invested for at least 7 years to beat market volatility

- 5 – Divide your investments across 5 different asset buckets

- 3 – Be mentally prepared for 3 types of market phases

- 1 – Step up your SIP by 10% annually to grow exponentially

Let’s break down each component of the 7-5-3-1 rule with real-world context, data, examples, and emotional insights.

The stock market is volatile in the short term but predictable in the long term. Historically, SIPs invested in equity mutual funds for less than 5 years have shown a wide variation in returns, including negative outcomes.

However, SIPs continued for 7 years or more have shown almost no chance of capital loss.

Why 7 Years?

- Helps ride out short-term market corrections

- Allows compounding to work effectively

- Gives time for the fund manager’s strategy to perform

Real-World Evidence:

Data shows that equity SIPs held for 7 years or more have delivered average returns of 12-14% CAGR, often outperforming gold or real estate.

Emotional Takeaway:

Don’t panic when the market dips in year 2 or 3. Your 7-year patience will be rewarded with consistent compounding.

Diversification isn’t just a buzzword; it’s your safety net. The 7-5-3-1 rule recommends dividing your investments across 5 strategic asset classes to spread risk and capture better opportunities.

The 5 Buckets:

- Equity Mutual Funds – For long-term capital growth

- Debt Funds – For stability and safety

- Gold ETFs or Sovereign Gold Bonds – To hedge against inflation

- REITs or Real Estate Mutual Funds – For passive rental-like income

- Emergency Fund (Liquid Fund or FD) – To meet short-term needs

Why 5 Buckets?

- Reduces dependency on one asset class

- Provides stability during uncertain markets

- Makes your portfolio all-weather ready

Emotional Insight:

Think of your money like a team. Each player (bucket) has a unique role. Together, they win you the financial championship.

Your SIP journey will not be a smooth ride. You’ll face 3 distinct emotional and return phases:

1. Euphoria (7–10% Annual Return Phase)

- You feel smart

- SIPs are showing decent profits

- You may feel tempted to stop or withdraw

2. Flat or Slight Positive (~1%) Return Phase

- You doubt your strategy

- Returns feel too slow

- Motivation begins to decline

3. Negative Return Phase

- Panic sets in

- You question your entire investment decision

- Many investors quit at this stage

But Here’s the Truth:

These 3 phases are temporary. The final phase always leads to long-term gain if you stay invested.

Emotional Reality:

Your patience is tested most during the negative phase. But those who stay in the game till the end get above-average wealth creation.

The last number in the 7-5-3-1 rule is your golden key: Commit to one SIP and increase it by 10% every year.

The Power of Step-Up SIP:

Let’s say you start with ₹5,000/month:

- Year 1: ₹5,000

- Year 2: ₹5,500

- Year 3: ₹6,050

- …and so on

Over 20 years, this simple step-up strategy can help your wealth double or triple, compared to flat SIPs.

Data Comparison:

- Flat ₹5,000 SIP for 20 years = ₹30–35 lakhs

- Step-up SIP increasing 10% annually = ₹50–60 lakhs or more

Emotional Push:

It’s easier to increase SIP by 10% than to save ₹5,000 more each month. You’re adjusting with your income growth.

The 7-5-3-1 rule works like a compass for the average investor. It covers:

- Tenure – Long enough to enjoy compounding

- Diversification – Avoiding all-eggs-in-one-basket

- Behavioral Expectation – Preparing for emotional rollercoasters

- Action Plan – Encouraging consistent and increasing SIPs

Emotional Realization:

This is not just a strategy. It’s a mindset. You’re building not just wealth, but also financial discipline and maturity.

Raj, a 32-year-old IT professional, started a SIP of ₹10,000 in 2010 across 5 buckets. Every year, he increased it by 10%.

He faced:

- Market volatility in 2011

- Flat returns from 2015–2016

- Panic in 2020 during the COVID crash

But he continued.

In 2024, his portfolio crossed ₹75 lakhs.

His secret? The 7-5-3-1 rule.

- Stopping SIPs too early → Rule says stay 7 years

- Overloading equity → Rule says diversify across 5 buckets

- Reacting emotionally → Rule reminds you of 3 market phases

- Flat SIP amounts forever → Rule advises 10% step-up

You don’t need crores to begin investing. All you need is:

- Discipline

- A proven framework

- Patience

This rule is tailor-made for:

- Salaried professionals

- Small business owners

- Middle-income families

Behavioral finance shows that most investors are not logical—they are emotional. The 7-5-3-1 rule addresses our emotional needs:

- Structure for planning

- Clarity to handle market noise

- Motivation to stay committed

This rule isn’t magic. It’s math + behavior + consistency.

If you:

- Stay invested for 7 years,

- Spread your portfolio across 5 buckets,

- Understand the 3 phases of emotion and return,

- And increase your SIP by 10% annually…

You’re on the path to long-term wealth.

FAQs About the 7-5-3-1 Rule

Q1. Can I start with just ₹1,000 in SIPs? Yes. The rule focuses on discipline, not amount. Start small and step up yearly.

Q2. What if I miss increasing SIP by 10% in a year? That’s okay. Restart the step-up when possible. Even flat SIPs benefit from the 7-5-3 logic.

Q3. Are 5 buckets necessary if I’m just starting out? Start with 2–3 buckets and expand gradually. The idea is to diversify over time.

Q4. Which SIP funds follow the 7-5-3-1 principle? It’s not about funds—it’s about your strategy and behavior. Choose funds aligned with your goals.

Q5. Is the 7-year rule fixed? What if I need money earlier? Try to avoid withdrawing before 7 years. But if you must, withdraw only from emergency or debt buckets.

Q6. Does this rule apply to lumpsum investments? It’s best designed for SIPs, but the core logic of tenure, diversification, and patience helps lumpsum investments too.

Q7. What if markets are high when I start SIPs? Doesn’t matter. The 7-5-3-1 rule is time-tested across all market cycles.

Conclusion:

Apply the 7-5-3-1 rule like your financial GPS. It doesn’t promise shortcuts, but it guarantees direction.

Start today. Stay disciplined. And in a few years, you’ll thank yourself.

![]()

Pingback: 19 Surprising Facts About ETFs and Mutual Funds SIP That No Expert Will Tell You - Cash Babu