Investing in Mutual Funds in India

Investing in mutual funds has become an integral part of the modern Indian investor’s journey toward financial independence. The ability to diversify across sectors and asset classes, managed by professional fund managers, makes mutual funds a powerful tool for both beginners and seasoned investors.

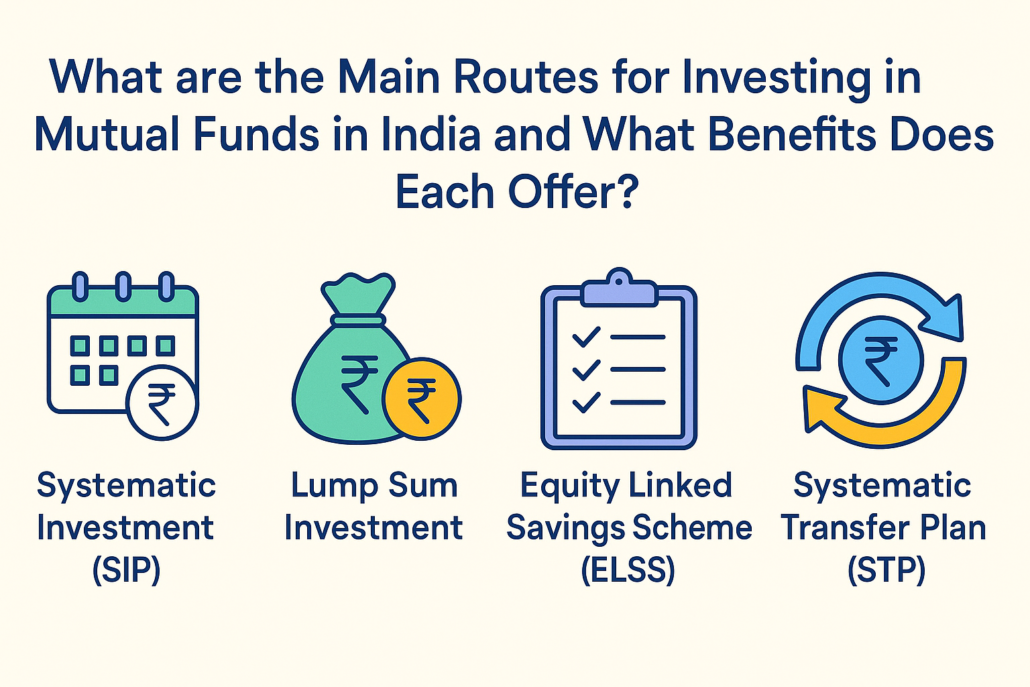

However, how you invest matters just as much as where you invest, whether you choose to invest a fixed amount every month, invest a large sum at once, or opt for tax-saving schemes or automated portfolio transitions, the method of investing can significantly influence your returns, risk exposure, and investment discipline.

This blog explores the various routes for investing in mutual funds in India, including SIP, Lump Sum, ELSS, STP, and others, and delves into the benefits, suitability, and considerations for each.

1. Systematic Investment Plan (SIP)

A Systematic Investment Plan (SIP) is one of the most popular and accessible ways to invest in mutual funds in India. It allows you to invest a fixed amount at regular intervals—typically monthly or quarterly—into a chosen mutual fund scheme. This disciplined approach not only helps build long-term wealth but also cultivates a healthy financial habit.

SIPs are ideal for investors who prefer to contribute gradually, especially when market volatility makes lump-sum investing intimidating. Over time, SIPs can smooth out the effects of market fluctuations and harness the power of compounding to generate substantial wealth.

✅ Key Benefits of SIP

-

Rupee Cost Averaging: SIPs help balance your average investment cost. When the market is low, you buy more units; when it’s high, you buy fewer. This approach reduces the risk of poor market timing and spreads your investment across market cycles.

-

Disciplined Wealth Building: SIPs encourage a habit of regular saving and investing. Once set up, the fixed amount is automatically debited from your account, fostering consistent and goal-oriented investing.

-

Power of Compounding: By reinvesting your returns, SIPs amplify wealth creation over time. The longer you stay invested, the greater your gains through compounding.

-

Low Entry Barrier: You can start investing in mutual funds via SIPs with just ₹500 per month. This makes it perfect for young professionals, students, or anyone with a limited monthly budget.

-

Flexibility and Automation: SIPs are easy to start, pause, or modify. Automation removes the need for monthly reminders and reduces emotional decision-making in volatile markets.

📌 Illustrative Example

Let’s say you invest ₹5,000 every month for 20 years, and your fund delivers an average return of 12% per annum.

-

Total invested: ₹12,00,000

-

Corpus after 20 years: ₹50,00,000+

That’s over four times your principal, purely through consistent investing and the power of compounding.

❗ Who Should Consider SIPs?

-

Salaried individuals with a predictable monthly income.

-

Beginner investors looking for a safe, systematic way to enter the markets.

-

Long-term investors are planning for goals like retirement, children’s education, or home buying.

-

Those seeking a low-stress, hands-off approach to investing.

2. Lump Sum Investment

A Lump Sum Investment refers to investing a substantial amount of money into a mutual fund all at once, rather than spreading it out over time like in a SIP. This route is often chosen when an investor has a significant corpus ready—perhaps from a bonus, inheritance, property sale, or maturity of another investment—and wishes to deploy it immediately in the market.

While lump sum investing can accelerate wealth creation, it also comes with heightened exposure to market fluctuations and timing risks. That’s why understanding when and how to use this approach is key.

✅ Benefits of Lump Sum Investment

-

Immediate Market Exposure: By investing the entire amount upfront, your money starts working for you right away. If the market enters a growth phase, a lump sum investment captures the full upside from the start.

-

Higher Return Potential: A larger principal investment benefits more from compounding. If markets perform well over time, a lump sum investment can deliver superior returns compared to staggered contributions.

-

One-Time Setup, No Ongoing Commitment: Unlike SIPs, which require regular follow-ups and bank mandates, a lump sum is a one-time decision. It’s ideal for investors who prefer simplicity and minimal interaction.

-

Strategic Timing Advantage: Investors with good market knowledge may choose to invest during market dips or corrections, potentially locking in undervalued prices.

❗ Risks and Considerations

-

Market Timing Risk: If you invest a large amount just before a market downturn, your portfolio may experience short-term losses. Unlike SIPs, lump sum investing doesn’t average out buying prices over time.

-

Higher Volatility Exposure: All your capital is subject to immediate market risk, which can cause anxiety during market corrections, especially for risk-averse investors.

-

Not Ideal for Emotional Investors: Sudden market volatility can lead to panic-selling if the investment horizon or risk appetite isn’t clearly defined.

📌 Example Illustration

Suppose you invest ₹5,00,000 in a well-performing diversified equity mutual fund with an average annual return of 12% over 10 years:

-

Final Corpus: Over ₹15.5 lakhs

-

Wealth Gained: ₹10.5+ lakhs in returns (assuming no withdrawals)

This example demonstrates how investing early and allowing compounding to work uninterrupted can multiply your wealth significantly.

❗ Who Should Choose Lump Sum Investing?

-

Individuals who receive large funds from bonuses, inheritances, or asset sales.

-

Experienced investors who can assess market valuations and trends.

-

Those with a long-term horizon (7–10 years+) and the ability to withstand short-term market volatility.

-

Investors who prefer minimal effort after one-time allocation.

3. Equity Linked Savings Scheme (ELSS)

An Equity Linked Savings Scheme (ELSS) is a type of mutual fund that primarily invests in equities while offering tax benefits under Section 80C of the Income Tax Act. It’s one of the few investment options in India that blends tax-saving with wealth creation, making it especially attractive for new and tax-paying investors looking to grow their wealth over time.

Unlike traditional 80C options like Public Provident Fund (PPF) or National Savings Certificate (NSC), ELSS funds have a shorter lock-in period and the potential for higher returns due to market-linked growth.

✅ Benefits of ELSS

-

Tax Deduction up to ₹1.5 Lakh:

Investments in ELSS qualify for tax deductions under Section 80C, with a limit of ₹1.5 lakh per year. If you’re in the 30% tax bracket, this can lead to savings of up to ₹46,800 annually (including cess). -

Shortest Lock-in Among 80C Instruments:

ELSS funds have a lock-in period of just 3 years, compared to:-

PPF: 15 years

-

Tax-saving FD: 5 years

-

NSC: 5 years

-

-

Wealth Creation via Equity Exposure:

As ELSS funds invest in a diversified portfolio of equities, they carry the potential to deliver higher long-term returns than fixed-income tax-saving instruments. Over time, they can significantly outperform traditional options, especially for investors with a moderate to high risk appetite. -

Flexible Investment Options:

You can invest in ELSS through both SIP and lump sum routes. This offers flexibility based on your cash flow and financial planning preferences. -

Dual Benefit – Save Tax & Grow Wealth:

ELSS uniquely combines the advantage of reducing your tax liability while also growing your capital—a rare feature among tax-saving tools.

❗ Drawbacks and Considerations

-

Market-Linked Risks:

Since ELSS is equity-based, returns are not guaranteed. If the market underperforms during or after the lock-in period, returns may fall short of expectations. -

Restricted Liquidity:

The 3-year lock-in period is mandatory, and you cannot redeem ELSS units before this period, even in emergencies. Also, each SIP installment is locked in for 3 years from the date of investment. -

Fund Selection Matters:

Not all ELSS funds perform equally. Selecting the right fund with consistent past performance and skilled fund management is essential.

📌 Use Case Example

Let’s assume you invest ₹1.5 lakh annually in an ELSS fund through a lump sum or monthly SIPs:

-

Tax Saving: You save up to ₹46,800 in taxes if you’re in the highest bracket.

-

Potential Corpus After 5 Years: If the fund delivers 12% CAGR, your ₹7.5 lakh total investment could grow to around ₹11.9–₹12.5 lakhs.

Thus, ELSS serves as a dual-purpose tool for wealth creation and tax efficiency.

❗ Who Should Consider ELSS?

-

Salaried or self-employed individuals who pay income tax and want to optimize their deductions under Section 80C.

-

Young professionals looking to begin their investment journey while also saving taxes early in their career.

-

Investors comfortable with market risk, seeking higher returns than traditional tax-saving avenues.

-

Those who want a shorter lock-in but are ready to remain invested at least for 3 years.

4. Systematic Transfer Plan (STP)

A Systematic Transfer Plan (STP) is a smart investment strategy that enables investors to transfer a fixed amount at regular intervals from one mutual fund scheme to another—most commonly from a debt or liquid fund to an equity fund. STP offers the dual advantage of earning returns on idle funds while mitigating the risks of market volatility when entering equity markets.

STPs are particularly useful for investors who have a large lump sum to invest but want to avoid the risk of investing it all at once in a volatile market.

✅ Key Benefits of STP

- Reduces Market Entry Risk:

By spreading your investment into equity over several months, STP averages out the purchase cost, much like a SIP. This staggered approach helps reduce the risk of entering the market at an unfavourable time (e.g., just before a downturn). - Park Funds in Debt for Interim Returns:

Your lump sum starts working right away by being invested in a liquid or short-term debt fund, which earns better returns than sitting idle in a savings account while you wait to deploy it in equities. - Automatic Rebalancing:

STP can be used to rebalance your portfolio, especially when you want to gradually move funds from equity to debt (e.g., as you approach retirement) or vice versa. It’s a hands-free, automated way to manage your asset allocation. - Better Risk Management:

Compared to a full lump sum equity investment, STP reduces exposure to short-term equity market fluctuations, providing a smoother entry point.

📌 STP Strategy Example

Imagine you receive ₹5 lakhs from a property sale or bonus. Instead of investing the full amount into equity all at once, you:

- Invest ₹5 lakhs into a liquid fund initially.

- Set up a monthly STP of ₹25,000 from the liquid fund to an equity mutual fund.

- Over 20 months, your investment gradually transitions into the equity fund.

This method not only spreads risk but also allows your unallocated capital to earn returns while waiting for deployment.

❗ When Is STP Useful?

- When you receive a windfall, inheritance, or bonus, and want to manage entry into volatile equity markets.

- If you’re nearing retirement or a financial goal and want to shift gradually from equity to debt to protect accumulated wealth.

- When you want to reduce the impact of market volatility while investing a lump sum.

❗ Who Should Consider STP?

- Investors who are risk-averse but have a lump sum to deploy.

- Those who are unsure about current equity valuations and want a cautious, phased approach.

- Financial planners and investors using goal-based investing, who want to transition funds over time from one asset class to another.

🔍 Types of STPs

There are generally three types of STPs based on flexibility:

| STP Type | Description |

|---|---|

| Fixed STP | Transfers a pre-decided fixed amount regularly. |

| Capital Appreciation STP | Transfers only the profit (appreciation) from the source scheme. |

| Flexible STP | Amount transferred is based on market conditions or your custom strategy. |

Each type serves different needs depending on how active or conservative the investor is.

🧠 Pro Tip:

“STP works best when used as a tool for risk management, not just returns. It’s a strategic way to balance liquidity, returns, and volatility.

5. Direct Plans vs. Regular Plans

All mutual funds are available in two formats: Direct Plans and Regular Plans.

✅ Direct Plan:

- Invest directly with the AMC (e.g., via their website).

- Lower expense ratio since there’s no commission to intermediaries.

- Suitable for investors comfortable making their own fund choices.

✅ Regular Plan:

- Invest via advisors, banks, or distributors.

- Includes a distribution fee, resulting in slightly lower returns.

- Offers professional guidance, useful for non-savvy investors.

❗ Comparison Table:

| Feature | Direct Plan | Regular Plan |

|---|---|---|

| Expense Ratio | Lower | Higher |

| Returns | Higher (over time) | Lower |

| Guidance | Self-managed | Advisor-supported |

| Best For | Informed investors | New or passive investors |

6. Investing via Online Platforms

Online platforms have revolutionized mutual fund investing in India, making it accessible, transparent, and efficient.

🔹 Popular Platforms:

- Apps: Groww, Zerodha Coin, Paytm Money, Kuvera

- Bank-Based Platforms: ICICI Direct, HDFC Securities, SBI Smart

✅ Advantages:

- Paperless Onboarding & KYC

- Easy comparison tools for fund selection

- Instant transactions with real-time status

- Low or zero commission (especially for Direct Plans)

- Portfolio Tracking: Automated reports and insights

❗ Risks & Limitations:

- Platform reliability: Downtime or technical errors can delay orders.

- Hidden charges: Some platforms charge convenience fees or annual maintenance.

7. Investing Through Banks & Financial Advisors

While digital platforms are rapidly growing, traditional investment channels—such as banks, relationship managers, and independent financial advisors (IFAs)—continue to hold a strong presence in India’s mutual fund landscape. For many investors, especially those less comfortable with digital tools or who value personalized guidance, these routes offer a sense of trust and human connection.

✅ Benefits of Investing Through Banks & Advisors

- Human Expertise & Guidance:

Financial advisors help tailor mutual fund recommendations based on your financial goals, investment horizon, and risk appetite. Their expertise can be valuable for first-time or conservative investors who prefer face-to-face discussions. - Assistance with Documentation:

These channels often assist with KYC, application forms, and transaction processing, making them ideal for individuals who are not digitally inclined or who prefer a paper-based process. - Trust & Comfort:

Many investors, especially older individuals, find comfort in transacting through trusted banks or long-standing advisors with whom they share a relationship. It adds a layer of perceived security and familiarity to the investment process. - Ongoing Portfolio Monitoring:

Good advisors often track your investments and alert you about rebalancing needs, market opportunities, or underperforming funds—something digital apps may not proactively offer unless configured.

❗ Limitations to Consider

- Higher Costs Due to Commissions:

Advisors and banks typically operate under the Regular Plan model, which includes distributor commissions or trail fees. Over time, these charges can eat into your returns when compared to Direct Plans. - Fund Bias & Conflict of Interest:

Since advisors earn commissions from AMCs (Asset Management Companies), they might recommend funds that pay higher commissions rather than those that are best suited for your goals. - Limited Fund Access:

Some banks and advisors may offer a limited selection of AMCs, reducing your exposure to the full spectrum of available mutual fund schemes.

📌 Best For:

- Traditional investors who prefer human interaction over app-based investing.

- Non-tech-savvy individuals who require assistance with paperwork and account setup.

- Busy professionals who want an advisor to manage and monitor their portfolios proactively.

- Senior citizens who may find digital interfaces complex.

🧠 Pro Tip:

Always ask your advisor about the commission structure and explore whether a Direct Plan with a fee-only financial planner might work better for your long-term wealth creation. Transparency builds trust.

8. Investing Through RTAs (CAMS & KFintech)

Registrar and Transfer Agents (RTAs) like CAMS (Computer Age Management Services) and KFintech (formerly Karvy Fintech) play a critical behind-the-scenes role in India’s mutual fund ecosystem. These organizations act as central recordkeepers for mutual fund transactions and maintain investor records on behalf of multiple Asset Management Companies (AMCs).

What makes RTAs particularly useful for investors is their ability to aggregate holdings across various AMCs into a single, unified view, offering convenience, transparency, and direct access to services—without going through third-party distributors or platforms.

✅ Benefits of Investing Through RTAs

- Unified Investment Dashboard:

RTAs consolidate your mutual fund holdings across multiple fund houses. Through platforms like myCAMS or KFinTrack, you can view and manage your entire portfolio in one place—even if you’ve invested in different mutual funds through different methods. - Direct Plan Access:

By investing directly through RTA platforms, you can opt for Direct Plans, which exclude distributor commissions and typically offer higher long-term returns compared to Regular Plans. - Convenient Service Requests:

RTAs allow you to perform a wide range of services such as:- Changing nominee details

- Updating contact/address/KYC info

- Switching between schemes

- Redeeming or investing in new schemes

- Downloading account statements

- Tracking NAVs and performance

All from a single login, saving both time and effort.

- Reliable Customer Support:

Both CAMS and KFintech offer responsive helplines, email support, and even walk-in service centers in major cities.

❗ How to Start Using RTAs

Getting started with RTAs is simple and user-friendly:

- Visit the official portals:

- Register using PAN + email/mobile:

Your investments will automatically be mapped using your PAN and registered email or mobile number. - Access Portfolio & Transact:

Once logged in, you can:- Invest in new schemes

- Set up SIPs

- Redeem or switch funds

- Generate consolidated account statements (CAS)

- Use Mobile Apps:

Both RTAs also offer Android and iOS apps with full functionality, giving you on-the-go portfolio access.

📌 Who Should Consider RTAs?

- Investors who have mutual fund investments across multiple AMCs.

- Those seeking a commission-free, Direct Plan investment route.

- Individuals who prefer centralized and streamlined tracking of their portfolio.

- DIY investors who want independent access without intermediaries.

🧠 Pro Tip:

Combine RTA dashboards with tools like MF Central or Consolidated Account Statements (CAS) to track, analyze, and manage your mutual fund portfolio like a pro—without paying advisory fees.

9. Dividend (IDCW) vs. Growth Options in Mutual Funds

When investing in a mutual fund scheme, investors must choose between two options for how their earnings are treated: Growth or Dividend (now termed IDCW – Income Distribution cum Capital Withdrawal). This decision significantly impacts how your money grows over time and how it is taxed.

Understanding the distinction between these options helps you align your investment with your financial goals, cash flow needs, and tax strategy.

✅ Growth Option: Let Your Money Compound

Under the Growth option, all profits made by the mutual fund are reinvested back into the scheme, rather than being distributed to the investor. Over time, this leads to compounding returns, making it ideal for long-term wealth creation.

🌱 Key Benefits:

- Higher Growth Potential: Reinvesting gains means your capital grows faster over time.

- Tax-Efficient: You only pay capital gains tax when you redeem your units, which can be strategically timed.

- Ideal for Wealth Accumulation: Perfect for goals like retirement, children’s education, or building a corpus.

👤 Suitable For:

- Long-term investors

- Those who don’t need periodic income

- Individuals in higher tax brackets seeking tax efficiency

✅ Dividend/IDCW Option: Get Periodic Income

In the Dividend (IDCW) option, profits are distributed to investors at regular intervals (monthly, quarterly, or annually). While this provides cash flow, it also reduces the NAV (Net Asset Value) of your mutual fund units after each payout.

💸 Key Benefits:

- Regular Payouts: Offers a steady income stream—especially useful for retirees or those needing periodic cash.

- Psychological Comfort: Many investors find reassurance in receiving income, even if it’s variable.

❗ Considerations:

- Dividends Are Taxable: As per the current tax regime, dividends are added to your total income and taxed as per your income slab.

- NAV Adjustment: After every dividend payout, your fund’s NAV reduces accordingly, which can affect capital appreciation.

👤 Suitable For:

- Retirees or pensioners needing regular income

- Conservative investors seeking partial withdrawals

- Those in lower tax brackets who are less impacted by dividend taxation

📊 Quick Comparison:

| Feature | Growth Option | Dividend/IDCW Option |

|---|---|---|

| Reinvestment | Profits reinvested | Profits distributed |

| NAV Impact | Grows steadily | Drops post-dividend |

| Taxation | Only on capital gains when sold | Taxable as income |

| Ideal For | Wealth accumulation | Regular income needs |

| Return Visibility | Seen via NAV appreciation | Seen via payouts |

🧠 Pro Tip:

If you don’t need regular payouts and want to minimize tax outgo, Growth is usually the better long-term choice. IDCW may look attractive, but payouts are not guaranteed and can disrupt compounding.

10. Other Specialized Routes for Mutual Fund Investing

Beyond the common approaches like SIPs, lump sum, ELSS, and STPs, the mutual fund landscape in India also offers specialized routes tailored for specific investment styles, goals, or preferences. These alternatives cater to investors seeking passive strategies, sectoral opportunities, or goal-based planning.

Let’s explore some of these specialized mutual fund investment options:

📌 Smart Beta & Index Funds: Low-Cost, Passive Investing

Index funds and smart beta funds aim to replicate market indices like the Nifty 50, Sensex, or thematic indices (e.g., Nifty Next 50, Nifty Bank). They do not rely on active fund managers but follow a rules-based or market-cap-based strategy.

✅ Key Benefits:

- Lower Expense Ratios: Because they are passively managed, they have lower costs compared to actively managed funds.

- Market-Mirroring Returns: These funds aim to replicate the performance of a specific index, offering predictability and transparency.

- No Fund Manager Bias: Removes human error or poor decision-making.

👤 Suitable For:

- Passive investors

- Cost-conscious investors

- Beginners looking for market exposure with minimal complexity

🔍 Smart Beta funds are a variant of index funds that tweak the index methodology by focusing on factors like value, momentum, or low volatility—ideal for semi-experienced investors looking for a data-driven edge.

📌 Thematic & Sectoral Funds: Targeted Investment Opportunities

These mutual funds invest in specific sectors (like IT, pharma, banking, infrastructure) or themes (like ESG, digital India, consumption, etc.).

✅ Key Benefits:

- High Growth Potential: Sectors on the rise can deliver outsized returns during economic booms or technological shifts.

- Focused Exposure: Allows investors to take tactical bets on areas they believe will outperform.

❗ Considerations:

- Higher Risk: Narrow focus leads to lower diversification, increasing volatility.

- Cyclicality: Sector funds can underperform for extended periods if the sector is out of favor.

👤 Suitable For:

- Experienced investors

- Those with strong convictions or market insights on specific sectors

- Investors with a short-to-medium-term tactical strategy

⚠️ Use them as a satellite component in your portfolio, not the core.

📌 Children’s & Retirement Funds: Goal-Based Planning with a Glide Path

These funds are designed with specific life goals in mind and often come with lock-in periods or restricted withdrawals to encourage long-term commitment.

🎯 Common Features:

- Children’s Funds: Focus on long-term capital appreciation for goals like education or marriage. Often come with equity-heavy allocations.

- Retirement Funds: Designed for wealth accumulation with a glide path—automatically shifting from equity to debt as retirement approaches.

✅ Key Benefits:

- Goal-Oriented: Aligns with long-term planning and behavioral finance.

- Disciplined Investing: Lock-in discourages premature withdrawals.

- Tax Advantages: Some retirement funds also offer Section 80C benefits.

👤 Suitable For:

- Parents planning future expenses

- Individuals planning for retirement

- Long-term investors with specific financial milestones

🧠 Final Tip:

Specialized mutual funds can add diversity and purpose to your investment portfolio. Use them strategically, ensure they align with your risk profile, and avoid overexposure to any single theme or sector.

Final Thoughts: Which Route is Right for You?

The best method to invest in mutual funds depends on your:

| Factor | Consideration |

|---|---|

| Investment Horizon | Long-term (SIP/Growth), Short-term (Liquid/Hybrid) |

| Risk Appetite | High (Equity, ELSS), Low (Debt, STP) |

| Income Needs | Dividend/IDCW options, hybrid funds |

| Tax Planning | ELSS funds |

| Investment Knowledge | Self-directed (Direct/Online), Guided (Regular/Advisors) |

Conclusion: Build Your Strategy, Stay Committed

Mutual fund investing in India is no longer a one-size-fits-all endeavor. Whether you’re a disciplined monthly investor using SIPs, someone with a lump sum ready to deploy, a tax-saver eyeing ELSS, or a strategist leveraging STPs for better market timing — there’s a route tailored for your financial journey.

Thanks to digital platforms, user-friendly tools, and expert advisory services, mutual funds have become more accessible, transparent, and customizable than ever before. But amidst all this variety, success ultimately hinges on your strategy and commitment.

✨ Key Takeaways for Smart Mutual Fund Investing:

-

Start Early: Time is your greatest ally — the earlier you begin, the more compounding works in your favor.

-

Stay Consistent: Regular contributions build discipline and smoothen market volatility over time.

-

Review Periodically: Markets and goals are constantly changing. Annual reviews help you stay on track.

-

Align Investments with Goals: Choose the method — SIP, lump sum, ELSS, STP — that matches your timeline, risk appetite, and purpose.

🎯 Final Thought:

In investing, there’s rarely a universal “best” method. The right approach aligns with your goals, risk tolerance, and stick with it. Because when you stay committed, your investments do the hard work of building wealth.

![]()