Posted inMutual Fund

Key Takeaways: Flexicap mutual funds offer flexibility to invest across large, mid, and small caps. Rolling returns show consistent performance over time, not just one-time spikes. Top performers like HDFC,…

Posted inMutual Fund

Understanding Jio BlackRock: The New Investment Venture in India In recent months, Jio BlackRock has emerged as one of the most talked-about names in India’s financial world. But what exactly…

Posted inMutual Fund

Multi Asset Allocation Fund vs FlexiCap Fund: Which is Better in the Long Run? When it comes to choosing mutual funds, most investors get confused between multi asset allocation fund…

Posted inMutual Fund Financial Literacy

Introduction to Jio FlexiCap Fund Review If you are searching for the next big opportunity in mutual funds, this Jio FlexiCap Fund Review will help you. Jio Financial Services and…

Posted inFinancial Literacy Mutual Fund

Why Flexicap Funds Matter in 2025 Markets are never steady. Some months feel like a festival; others feel like a roller coaster ride. But smart investors don’t panic — they…

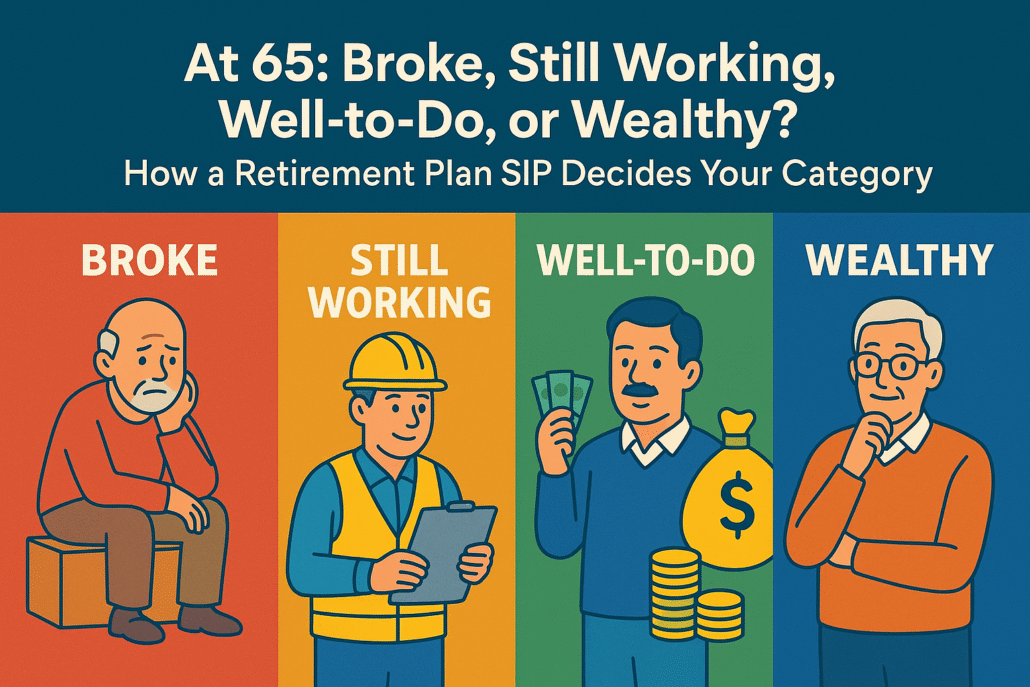

Why do most people panic at 65? We dream of freedom at 65—yet bills, medicines, and family commitments don’t retire.Without a plan, “later” becomes “too late.” A retirement plan SIP…

Posted inFinancial Literacy Mutual Fund

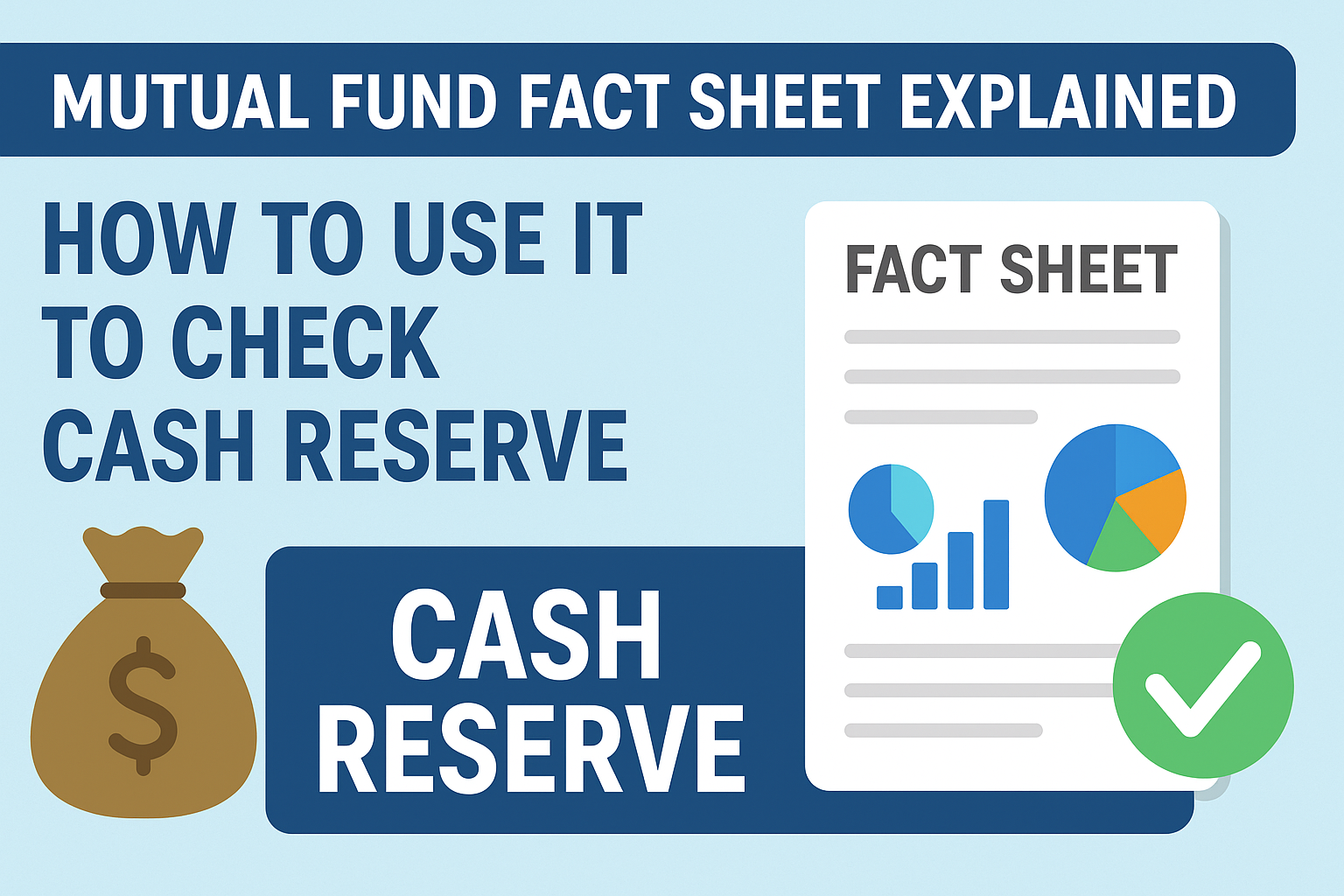

What is a Fact Sheet and How to Use it for Understanding Cash Reserve in Mutual Funds? Introduction: Why Mutual Fund Fact Sheet Matters When you invest in mutual funds,…

Posted inMutual Fund Mutual Fund SIP Rules

💸 8 Wealth-Creation Habits That Changed My Life Forever Introduction: Wealth Is a Habit, Not a Coincidence We often look at wealthy people and assume they got lucky. Maybe they…

Posted inMutual Fund

Why Concentration Matters in Mutual Fund SIP Investing Investing in a Mutual Fund SIP may sound automatic and hands-off, but your mental discipline and concentration are what decide whether it’s…