Posted inCredit Cards

In today’s world, credit is more than just a convenience—it’s a financial lifeline. From getting a loan for your dream home to applying for a car loan, education loan, or…

Posted inCredit Cards Mutual Fund

Best Reward Points Credit Card – The Smartest Way to Build Wealth with Cashback and Mutual Fund SIP Introduction When we think about the best reward points credit card, most…

Posted inCredit Cards Mutual Fund

Why You Need the Best Reward Points Credit Card My friend, every time you swipe your card for groceries, fuel, school fees, or electricity bills, you are leaving free money…

Top 5 Best Credit Cards in India 2025: Introduction In today’s fast-paced financial landscape, credit cards are no longer just tools of convenience—they are gateways to rewards, travel privileges, lifestyle…

Posted inCredit Cards Loan

Understanding the Credit Card Loan: A Comprehensive Introduction In today’s fast-paced and digitally driven financial landscape, credit cards have evolved far beyond their original purpose as tools for cashless transactions.…

Posted inCredit Cards

Introduction: The Financial Power of Credit Card In today’s fast-paced financial world, Credit Card have become integral to our daily lives. Whether it’s purchasing the latest gadget online, booking a…

Posted inShopping Credit Cards

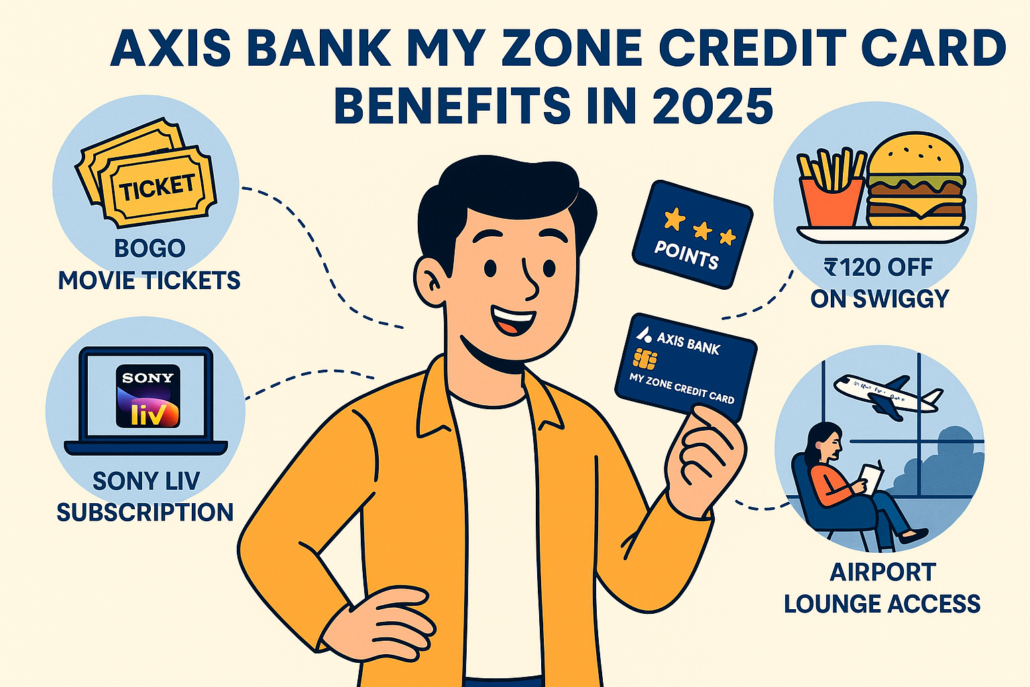

Axis Bank My Zone Credit Card Benefits in 2025: A Smart Lifestyle Choice The Axis Bank My Zone Credit Card benefits in 2025 are perfectly tailored for those who want…

Posted inCredit Cards Fuel Credit Cards

Introducing the Indian Oil Axis Bank Credit Card, an unparalleled financial companion that transcends mere transactions to offer a realm of exclusive benefits and substantial savings. This credit card isn't…

Posted inShopping Credit Cards Credit Cards

Why Middle-Class Families Should Choose the Right Credit Card Middle-class families often walk a tightrope between dreams and monthly expenses.A well-chosen credit card can be more than plastic—it’s a silent…