Unlocking Value: Why the HSBC Visa Cashback (Live+) Card Still Shines in 2025

If you’re someone who loves dining out, ordering food delivery, or stocking up on groceries — and you want to earn while spending — the HSBC Visa Cashback (Live+) credit card can be a smart addition to your wallet. Here’s everything you need to know: its unique features, the costs, and how to make the most of its cashback benefits.

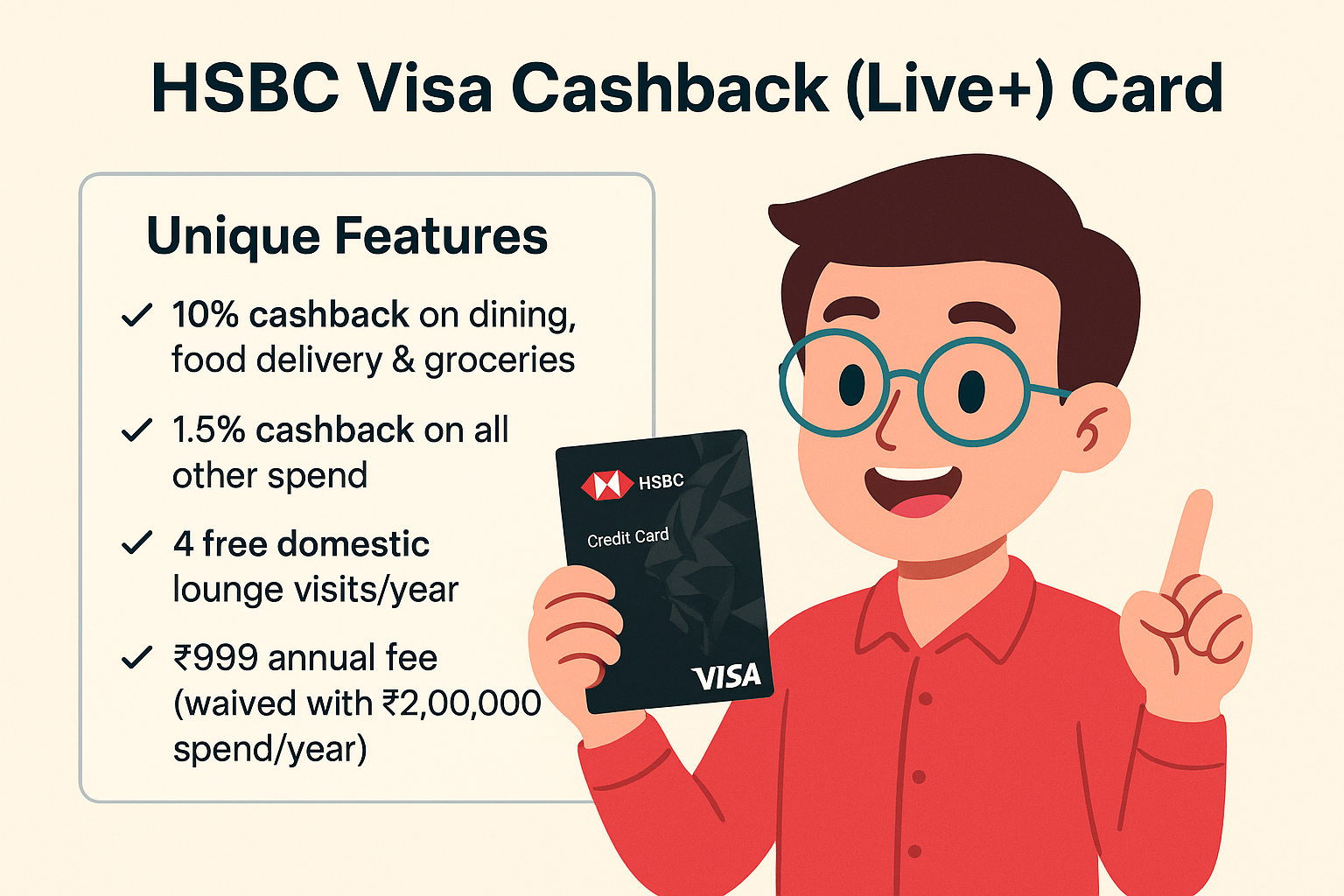

Unique Features of the HSBC Visa Cashback / Live+ Card

-

Aggressive Cashback on Key Categories

-

Earn 10% accelerated cashback on all dining, food delivery, and grocery spends, capped at ₹1,000 per billing cycle.

-

For all other eligible spends, you get 1.5% unlimited cashback.

-

Cashback is also available via Instant EMI on selected merchants, letting you earn while converting transactions into EMI.

-

-

Domestic Airport Lounge Access

-

4 complimentary domestic lounge visits per year — one per quarter.

-

This is quite valuable for frequent flyers or those who like to relax pre-flight.

-

-

Zero Liability for Lost Card

-

Insurance protection up to ₹3,00,000 for misuse from 24 hours before you report a lost card.

-

This gives you peace of mind in case of fraud or theft.

-

-

Flexible Repayment Options

-

You can convert your credit card dues to EMIs: Balance Transfer EMI, Cash-on-EMI, or Loan-on-Phone.

-

Also supports Google Pay for quick and secure payments.

-

Emergency card replacement is available anywhere in the world.

-

-

Renamed & Rebranded

-

The HSBC Cashback Credit Card has been rebranded as the HSBC Live+ Credit Card, aligning it with a more lifestyle-centric identity.

-

This rebranding also came with refreshed rewards and a lifestyle proposition.

-

Charges and Fees (As of November 2025)

Here’s a breakdown of the costs associated with the card:

| Charge Type | Amount / Rate |

|---|---|

| Joining / Annual Fee | ₹ 999 |

| Annual Fee Waiver | Waived if you spend ₹2,00,000 or more per year. |

| Interest on Outstanding Balance | 3.49% per month (on credit card balance) |

| Cash Withdrawal Fee | 2.5% of the amount, minimum ₹ 500 |

| Late Payment Charge | 100% of the minimum amount due, between ₹250 – ₹1,200 depending on the bill. |

| Other Fees | Dishonoured SI / NACH / cheque bounce: ₹500. |

Key Benefits and Strategic Uses

-

Maximizing Cashback

-

Focus your spending in dining, food delivery, and grocery categories to hit the ₹1,000 monthly cap for 10% cashback.

-

For other regular spends (shopping, entertainment, etc.), the 1.5% rate ensures you keep earning.

-

Use Instant EMI on large payments to continue earning cashback even when paying in installments.

-

-

Lounge Access for Free

-

Use the 4 domestic lounge visits strategically — for business or leisure travel — to extract value from this perk.

-

-

Safety Net

-

Thanks to zero-liability coverage, you’re protected if your card is lost or misused, but make sure to report loss immediately.

-

-

Cash Flow Management

-

Convert big spends or outstanding dues into EMIs, making repayment easier and more predictable.

-

Google Pay integration ensures that small everyday transactions are seamless and benefit from the card.

-

Things to Be Careful About

-

Cap on 10% Cashback: The ₹1,000 monthly cap means you can’t endlessly benefit from higher cashback in the accelerated categories.

-

Exclusions Apply: Not all MCCs (merchant category codes) might qualify for cashback, so check the detailed service guide. Information are collected from official website of HSBC India.

-

Annual Fee if Spend Is Low: If you’re not likely to spend ₹2,00,000 in a year, you’ll end up paying the ₹999 fee.

-

Cash Advance Cost: With the 2.5% withdrawal fee + interest on cash advances, using the card for cash withdrawal isn’t very economical.

-

Statement to Cashback Timing: Cashback is credited within 45 days from your statement date.

Final Verdict for CashBabu Readers

For savvy spenders who prioritize food, grocery, and dining, the HSBC Visa Cashback (Live+) card offers one of the most attractive cashback rates in its category. The 10% acceleration, combined with 1.5% on everything else, means you get consistent value across your spending. Throw in 4 lounge visits and zero liability, and you’ve got a well-rounded card — provided you can hit the ₹2 lakh annual spend to waive the fee, or you’re comfortable paying it in exchange for meaningful cashback.

![]()