💡 Key Takeaway

Inflation is the silent killer of your retirement dreams. That’s why you should calculate your retirement corpus wisely.

If you only plan based on today’s expenses, you’ll severely underestimate how much you’ll actually need.Even a 1% rise in inflation can increase your required retirement corpus by several lakhs or even crores.

That’s why you must:

✅ Adjust your future expenses for inflation before calculating your corpus.

✅ Invest in instruments (like equity mutual funds) that offer returns higher than inflation.

✅ Revisit your corpus plan every few years to stay aligned with changing inflation and lifestyle needs.In short:

Don’t just save for retirement — plan to outpace inflation.

Because the goal isn’t just to retire… it’s to retire without compromise. 💰🔥

Introduction

Everyone dreams of a comfortable and worry-free retirement. But how much money do you really need? The answer lies in how well you calculate your retirement corpus, especially by factoring in inflation. In this blog, I’ll walk you through each step: years till retirement, inflation adjustments, estimating lifestyle costs, choosing investments, and finally arriving at the corpus you need. Use this as a blueprint to build your own figures and stay ahead of rising costs.

What Is “Retirement Corpus” and Why Does Inflation Matter?

-

Retirement corpus is the lump sum you need by the time you retire so that it supports your post-retirement expenses without you running out of money.

-

Inflation erodes purchasing power: what costs ₹1 lakh today may cost ₹2+ lakhs in 20 years. Thus, any corpus calculated without inflation is misleading.

-

In India, financial planners often assume inflation in the 6%–8% range when projecting long-term growth.

Hence, to beat inflation, your corpus calculation must adjust future expenses upward and assume real returns (returns minus inflation) rather than nominal returns.

Step-by-Step: How to Calculate Your Retirement Corpus

Here is a systematic five-step method (mirroring the ET article) you can follow to calculate your retirement corpus.

Step 1: Determine Years Left Until Retirement & Years After Retirement

-

Decide your current age (A) and planned retirement age (B).

-

The number of years you have till retirement = C = B – A.

-

Choose a probable life expectancy or planning horizon (say age DD).

-

Years of retirement = E = D – B.

For example, if you are 40 now, plan to retire at 60, and expect to live till 90, then:

-

Years till retirement = 20

-

Years after retirement = 30

Step 2: Account for Inflation & Real Return

You need two key rates:

-

Expected average return during accumulation phase (F) — how much your investments will earn before retirement (nominal).

-

Expected return after retirement (G) — what your corpus will yield while you withdraw from it (nominal).

-

Expected inflation rate (H) over the full period (common assumption: 6% in India).

From these, compute the inflation-adjusted (real) return:

Real Return=1+Nominal Return1+Inflation−1\text{Real Return} = \frac{1 + \text{Nominal Return}}{1 + \text{Inflation}} – 1

In the ET example, they assume:

-

F = 12%

-

G = 8%

-

H = 6%

The inflation-adjusted return during accumulation becomes:

1.121.06−1≈1.89% per year\frac{1.12}{1.06} – 1 \approx 1.89\% \text{ per year}

Step 3: Estimate Post-Retirement Expenses (Inflation-Adjusted)

-

Start with your current monthly expense (e) — your everyday expenses you want to maintain in retirement.

-

Convert it into current annual expense = e × 12.

-

To project this into the retirement day, inflate it over E years:

Expense at retirement=e×(1+H)E\text{Expense at retirement} = e \times (1 + H)^E

-

Then annual post-retirement expense = above × 12.

In the ET example:

-

Current monthly = ₹50,000 → annual = ₹6,00,000

-

E = 30 years, H = 6%

-

Future monthly expense at retirement ≈ ₹2,87,175

-

That leads to annual expense ≈ ₹34,46,095

Step 4: Select Investment Strategy / Instruments

Your risk tolerance and time horizon influence which asset classes you invest in:

-

In accumulation phase (20+ years to go), equity or aggressive mutual funds may be appropriate for higher growth.

-

As you approach retirement, shift allocation toward safer assets (debt, fixed income) to protect capital.

-

Post retirement, ensure part of your corpus continues to generate returns (e.g. through annuities, bond investments) so that your withdrawals do not erode the principal too quickly.

The ET article emphasizes that your asset mix should evolve with age and risk capacity.

Step 5: Compute the Required Retirement Corpus

Now, you combine the inflation-adjusted expense and real return to find the lump sum required such that your corpus sustains you for E years.

A simplified formula (present value of a perpetuity or annuity) is:

Corpus=Annual Post-Retirement ExpenseReal Return\text{Corpus} = \frac{\text{Annual Post-Retirement Expense}}{\text{Real Return}}

However, a more accurate formula accounts for withdrawal over finite years (E). You may use:

Corpus=Annual Expense at retirement×[1−(1+r)−Er]\text{Corpus} = \text{Annual Expense at retirement} \times \left[ \frac{1 – (1 + r)^{-E}}{r} \right]

where rr = real return (adjusted for inflation).

Using the ET example’s numbers:

-

Annual expense at retirement = ₹34,46,095

-

r = 1.89%

-

E = 30 years

That gives you a corpus figure (this example in the article yields the required number).

Once you have this target corpus, you can also back-calculate how much to invest monthly (via SIPs or other instruments) to reach it, factoring compounding.

Example Walk-Through

Let’s recapitulate with the example:

-

Current age = 40

-

Retirement age = 60 → 20 years of accumulation

-

Life expectancy = 90 → 30 years post-retirement

-

Expected nominal return during accumulation = 12%

-

Expected nominal return post-retirement = 8%

-

Inflation assumption = 6%

-

Present monthly expense = ₹50,000

Using inflation adjustment, the monthly expense at retirement = ₹2,87,175 (approx)

Annual requirement ≈ ₹34,46,095

Assuming real return ~1.89%, the required corpus to sustain 30 years of withdrawals would be around:

Corpus=₹34,46,0950.0189≈₹18.24 crore (approx)\text{Corpus} = \frac{₹34,46,095}{0.0189} \approx ₹18.24\,crore \; (\text{approx})

(This is illustrative; you should compute using precise formula or spreadsheet.)

Then, given your current savings and how many years you have, you can derive the monthly investment needed (SIP) to attain that corpus.

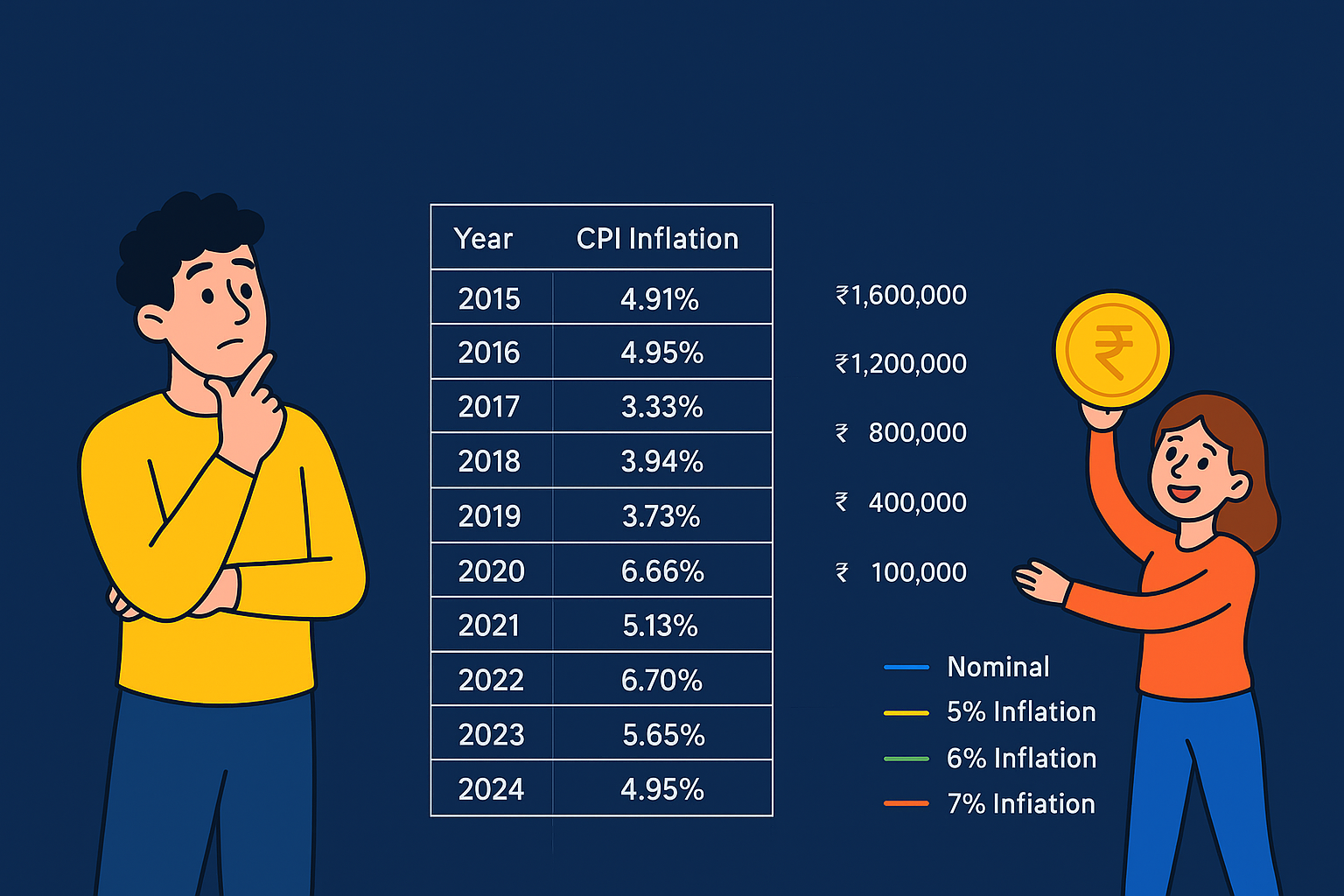

🧮 Table: How Inflation Changes Your Required Retirement Corpus

| Parameter | Inflation 5% | Inflation 6% | Inflation 7% |

|---|---|---|---|

| Current Monthly Expense (₹) | 50,000 | 50,000 | 50,000 |

| Years till Retirement | 20 | 20 | 20 |

| Monthly Expense at Retirement (₹) | 1,32,665 | 1,60,357 | 1,94,786 |

| Annual Expense at Retirement (₹) | 15,91,980 | 19,24,284 | 23,37,432 |

| Expected Real Return After Inflation | 2.67% | 1.89% | 1.12% |

| Years in Retirement | 30 | 30 | 30 |

| Required Retirement Corpus (₹ Crore) | 9.84 | 12.32 | 16.12 |

(Assumptions: Current Age = 40, Retirement Age = 60, Life Expectancy = 90, Nominal Return Before Retirement = 12%, After Retirement = 8%)

💡 What This Table Tells You

👉 The higher the inflation, the larger your retirement corpus must be — even if your lifestyle and investment habits remain the same.

-

At 5% inflation, your ₹50,000 monthly lifestyle becomes ₹1.3 lakh in 20 years.

-

At 6% inflation, it rises to ₹1.6 lakh.

-

But at 7% inflation, it explodes to nearly ₹1.95 lakh!

That difference of just 2% inflation means you’ll need over ₹6 crore more to survive 30 retirement years comfortably.

You will love to read also: At 65: Broke, Still Working, Well-to-Do or Wealthy? How a Retirement Plan SIP Decides Your Category

Understanding the 4 per cent rule: How much you can safely withdraw from your retirement corpus

💭 Why This Matters for the Middle Class

Think about it —

you’re not just saving for retirement years, you’re saving for the future cost of your current lifestyle.

Your morning tea, your medical bills, your grocery cart, even your daughter’s wedding — all will silently become 2–3x costlier over time.

That’s why it’s not enough to “just save” — you must invest smartly to beat inflation, not merely chase nominal returns.

🔑 Takeaway

💬 Inflation is the invisible thief of retirement.

If you plan your corpus with 6% inflation and reality turns out to be 7%, you might run out of money five years earlier than expected.

So, always calculate your retirement corpus under different inflation assumptions — just like this table — to create a buffer and retire truly stress-free.

![]()

Pingback: Beating Inflation India: How a 15% CAGR Small-Cap Mutual Fund Can Help - Cash Babu

Pingback: Are You Truly Retirement Ready? Discover the “350x Rule” for a Secure Future - Cash Babu