Is ₹1 Crore Really Enough Anymore for Smart Retirement Planning?

You might think ₹1 crore is a big amount. But is it enough to retire comfortably?

Let’s be honest—10 years ago, ₹100 could fill a shopping bag. Today? It barely gets you essentials. That’s inflation silently stealing your future.

So let me ask you:

Have you planned your retirement keeping inflation in mind?

If not, you’re not alone—but you’re also not safe. Let me guide you with 30 years of financial wisdom.

How 5% Inflation Erodes the Value of ₹1 Crore Over Time

Let’s break this down with hard numbers so you really feel the impact.

| Years | Value of ₹1 Crore at 5% Inflation | Real Value in Today’s Money |

|---|---|---|

| 10 | ₹61.39 Lakhs | ₹61.39 Lakhs |

| 20 | ₹37.69 Lakhs | ₹37.69 Lakhs |

| 30 | ₹23.14 Lakhs | ₹23.14 Lakhs |

Yes, your ₹1 crore will feel like just ₹23 lakhs in 30 years.

Still think it’s enough?

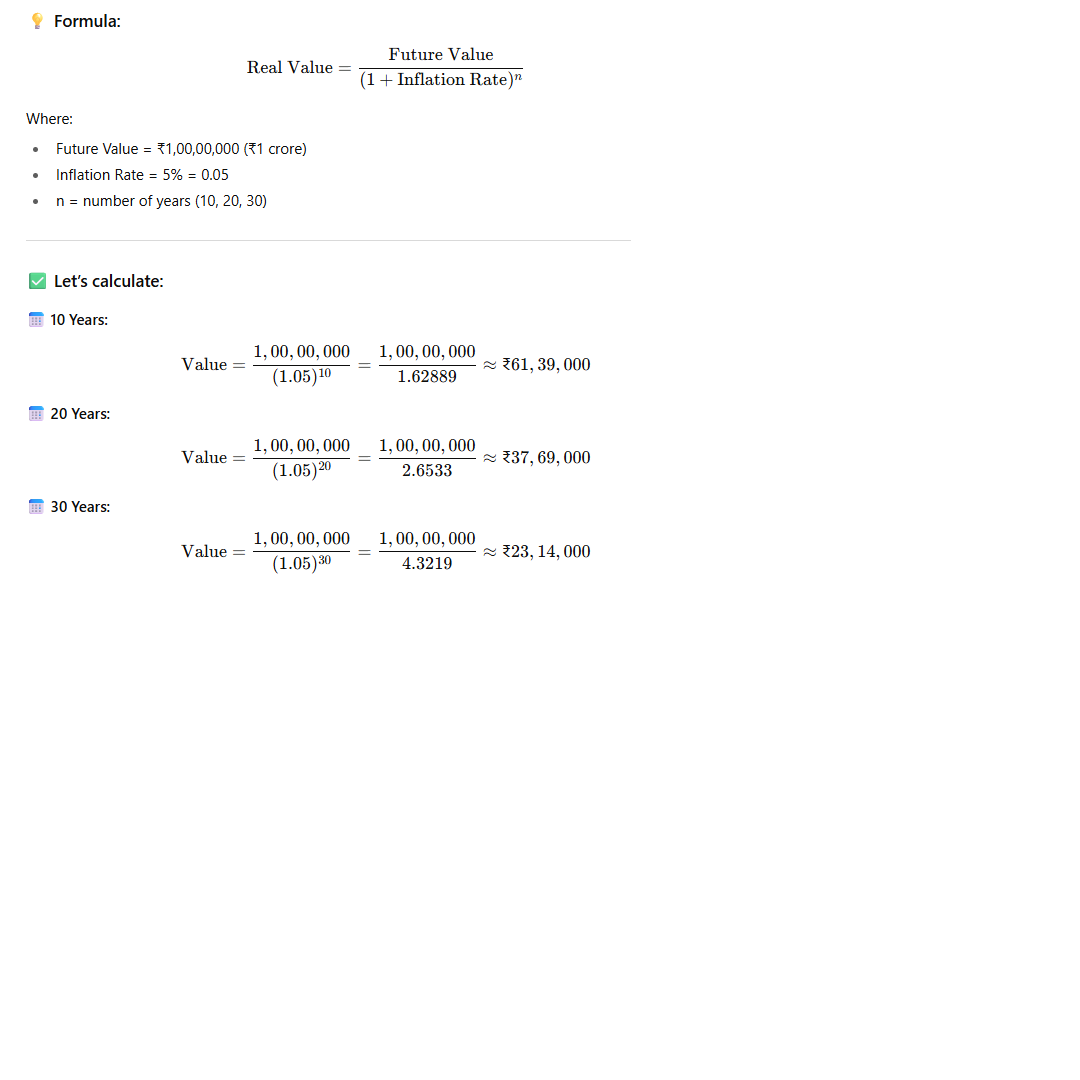

💡 Formula:

Real Value=Future Value(1+Inflation Rate)n\text{Real Value} = \frac{\text{Future Value}}{(1 + \text{Inflation Rate})^{n}}

Where:

-

Future Value = ₹1,00,00,000 (₹1 crore)

-

Inflation Rate = 5% = 0.05

-

n = number of years (10, 20, 30)

✅ Let’s calculate:

✅ Conclusion:

Yes, the values in your table are accurate for 5% annual inflation:

| Years | Value of ₹1 Crore in Today’s Money |

|---|---|

| 10 | ₹61.39 Lakhs |

| 20 | ₹37.69 Lakhs |

| 30 | ₹23.14 Lakhs |

How ₹1 Crore Shrinks Over Time – Thanks to 5% Inflation

You might feel secure today thinking, “I’ll be fine if I save up ₹1 crore for the future.” But have you considered the silent killer—inflation? Let’s break this down with cold, hard numbers to truly understand the damage. At an average annual inflation rate of just 5%, the value of money slowly melts away like ice under the sun. In 10 years, that ₹1 crore will feel like only ₹61.39 lakhs in today’s terms. Stretch it to 20 years, and you’re left with the spending power of just ₹37.69 lakhs. Go 30 years ahead? Brace yourself—your ₹1 crore will feel like a mere ₹23.14 lakhs. Yes, that’s the harsh reality.

So if you’re planning for retirement, your child’s future, or financial freedom, just “saving” isn’t enough. Your money must grow faster than inflation, or it will silently betray you over time. Let this be your wake-up call—start investing smartly today. Because ₹1 crore isn’t what it used to be, and tomorrow, it’ll be even less.

Why Smart Retirement Planning is No Longer Optional

You work hard for decades. Shouldn’t your retirement work hard for you?

Smart retirement planning means preparing not just for your needs, but for future inflation, health costs, and emergencies. You must plan beyond ₹1 crore, or you’ll struggle in your golden years.

What Happens If You Don’t Plan Beyond ₹1 Crore?

Ask yourself:

Can you survive 20 years of retirement with what feels like ₹37 lakhs?

Healthcare costs, home repairs, basic living—all become heavier as you age.

Without smart planning, your retirement could turn into a nightmare.

How to Calculate Your Ideal Retirement Corpus

Here’s a thumb rule:

Estimate your monthly expense today and project it forward at 5% inflation.

For example:

If you need ₹40,000/month today, in:

-

10 years: You’ll need ₹65,000/month

-

20 years: ₹1.05 lakh/month

-

30 years: ₹1.70 lakh/month

Now multiply by the number of years you expect to live post-retirement.

It’s not scary—it’s just math. And I’m here to guide you.

Can SIPs Help You Build Beyond ₹1 Crore?

Absolutely.

Let me show you how you can fight inflation smartly using Systematic Investment Plans (SIPs).

| Monthly SIP | 12% Return | 30 Years Corpus |

|---|---|---|

| ₹5,000 | ₹1.75 Cr | Beats ₹1 Cr easily |

| ₹10,000 | ₹3.5 Cr | Far ahead of inflation |

| ₹15,000 | ₹5.26 Cr | Peaceful retirement |

Isn’t that comforting?

Now the question is—when will you start?

What Investment Options Should You Trust?

Here’s your basic mix for smart retirement planning:

-

Equity Mutual Funds (For growth)

-

PPF/NPS (For safety & tax benefit)

-

SIPs in Balanced Funds (For consistent returns)

-

Health Insurance (For protection)

Don’t put all eggs in one basket. You’re not gambling—you’re planning your future.

How Often Should You Review Your Plan?

Answer: At least once a year.

Life changes. Income changes. Markets change.

If you’re not updating your plan, you’re falling behind.

Are You Factoring in Medical Inflation?

Normal inflation is 5%.

Medical inflation is 10%+ per year.

That’s a future health crisis waiting to happen.

So get covered. A good health plan is a retirement plan in disguise.

Is ₹1 Crore a Good Start? Yes. Is It the End Goal? No.

You should feel proud if you’re aiming for ₹1 crore.

But remember—that’s the new ₹25 lakhs in retirement terms.

So keep aiming higher. I’m not here to scare you—I’m here to show you the real path.

Want a Simple Rule? Use the 30x Rule

Here’s my favorite rule:

Multiply your annual expense by 30.

If you spend ₹6 lakhs/year today, plan for ₹1.8 crores minimum for retirement.

That way, even inflation won’t bother you.

Do You Need a Financial Mentor?

You can DIY your investments, but retirement isn’t trial and error.

A single mistake can cost you your peace of mind.

Get guidance from someone experienced. If not me, then find a planner you trust.

Cashbabu Gyan on Smart Retirement Planning

Retirement is not an age. It’s a financial condition.

Don’t just dream about peaceful evenings and vacations.

Plan for them.

And always, always remember—₹1 crore is a milestone, not the destination.

FAQs

Q1: Is ₹1 crore enough to retire in India?

Not anymore. With 5% inflation, its real value reduces drastically over 30 years.

Q2: How much should I invest monthly to beat inflation?

Start with at least ₹10,000 in SIPs and increase it yearly.

Q3: Can I retire early with smart planning?

Yes, early retirement is possible if you start young and invest aggressively.

Q4: Which is better—PPF or mutual funds?

Both serve different goals. Combine safety of PPF with growth of mutual funds.

Q5: How do I adjust my retirement plan over time?

Review annually and adjust SIPs, insurance, and corpus goals based on life events.

Q6: Is inflation the biggest threat to retirement?

Yes, especially medical inflation which can cripple your savings if not planned.

Q7: What should be my corpus for ₹50,000 monthly retirement income?

With 5% withdrawal rate, target ₹1.2 crore today—adjust upward for future inflation.

![]()

Pingback: Don’t Forget Inflation: The Silent Wealth Killer in Retirement Planning - Cash Babu