Mutual Funds vs PMS:

When it comes to growing and managing your wealth, today’s investors have a range of options tailored to different financial goals, risk appetites, and levels of involvement. Among these, Mutual Funds and Portfolio Management Services (PMS) are two popular choices that cater to everyone, from beginners to seasoned investors. While both aim to create wealth through professionally managed investments, they differ significantly in structure, cost, customization, accessibility, and transparency. Understanding these differences is key to choosing the right tool that matches your investment objectives, time horizon, and risk tolerance.

What is Mutual Fund Investment?

Mutual Funds are pools of money collected from numerous investors and managed by Asset Management Companies (AMCs). These pooled funds are invested across a diverse range of securities — including equities, debts, and money-market instruments — depending on the fund’s objective. Investors can choose schemes based on their financial goals and risk profile, such as equity, debt, or hybrid funds, and make investments starting as low as ₹500. They can also choose to invest in mutual funds through regular Systematic Investment Plans (SIPs) or one-time lump-sum investments.

Mutual funds offer investors an affordable and transparent way to grow their money, as all decisions are taken by experienced fund managers who aim to optimize returns while mitigating risks.

What are Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) offer a highly customized investment service where a dedicated portfolio manager is assigned to manage investments for high-net-worth individuals (HNIs). PMS portfolios are tailored according to the investor’s financial goals, risk appetite, and preferences.

Unlike mutual funds, PMS can include direct investments into equities, bonds, mutual fund units, derivatives, and other assets. Investors also receive personalized advice and ongoing updates, ensuring their portfolio is actively managed for optimal returns. However, this service requires a significant capital commitment — with a typical minimum investment of ₹50 lakh — making it suitable for affluent investors looking for personalized wealth management.

Benefits of PMS and Mutual Funds

Benefits of PMS

- Personalized attention with a dedicated portfolio manager.

- Custom portfolios tailored to your financial goals.

- Greater transparency & control over investments.

- Potential for higher returns, accompanied by higher risk.

Benefits of Mutual Funds

- Diversified exposure across asset classes at an affordable cost.

- Easily accessible with a very low entry threshold (as low as ₹500).

- Professionally managed with transparent disclosures and periodic reports.

- Liquidity and flexibility — easy to buy, sell, and switch schemes.

Differences Between Mutual Funds and PMS

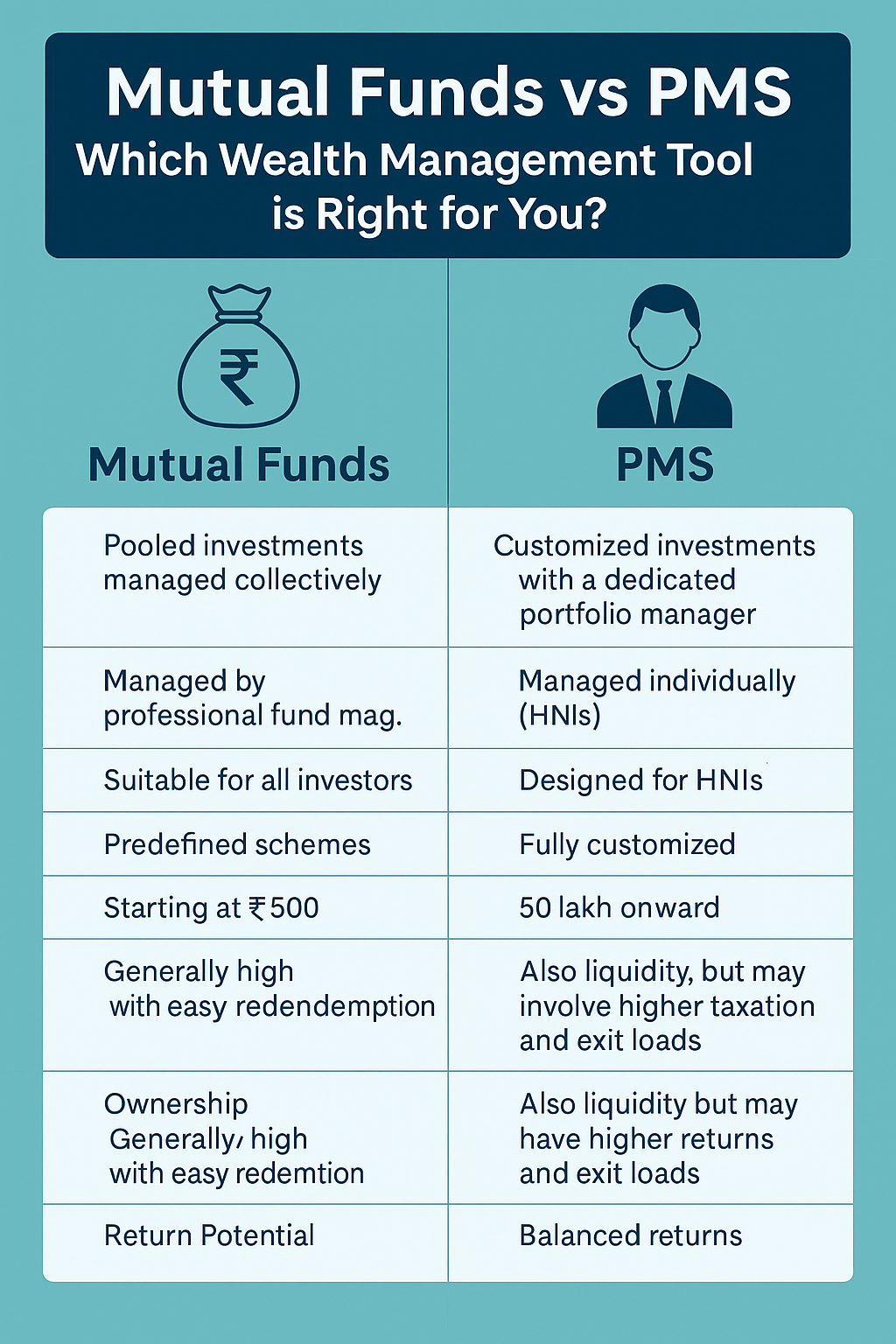

| Feature | Mutual Funds | PMS |

|---|---|---|

| Definition | Pooled investments in a diversified portfolio managed collectively. | Customized investments for wealthy clients with a dedicated portfolio manager. |

| Management | Managed by professional fund managers collectively for all investors. | Managed individually as per client’s specific goals and risk profile. |

| Investor Profile | Suitable for all types of investors. | Designed for HNIs who can meet the high minimum investment. |

| Customization | Predefined schemes with minimal flexibility. | Fully customized as per investor preferences. |

| Minimum Investment | ₹500 onward. | ₹50 lakh onward. |

| Ownership | Own mutual fund units, not the underlying securities. | Own the underlying securities directly. |

| Liquidity | Generally high, with easy redemption. | Also liquid but may have higher taxation and exit loads. |

| Transparency | Periodical reports with limited control. | Detailed reports and full control over holdings. |

| Return Potential | Balanced returns across all investors. | Potential for higher returns (also higher risk). |

Which Investment is Right for You?

Your choice between PMS and mutual funds will ultimately depend on your capital, risk tolerance, time horizon, and personal preferences.

Consider the following:

- Investment Amount: PMS requires a significant corpus; mutual funds can begin with just ₹500.

- Risk Appetite: PMS suits aggressive investors looking for high potential returns. Mutual funds suit those looking for balanced growth.

- Time Horizon: Both PMS and mutual funds can help you grow wealth long-term, but mutual funds offer greater flexibility and liquidity for shorter horizons.

- Customization: PMS is tailored to your specific goals; mutual funds follow a one-size-fits-all structure.

Conclusion

Both Mutual Funds and PMS are valuable tools for wealth creation — the right one for you depends on your financial profile and personal preferences.

If you want low-cost, diversified, professionally managed investments with minimal effort, then mutual funds are a great choice. On the other hand, if you have significant capital and want a customized, hands-on investment strategy with direct control and personal attention, PMS can be the perfect fit.

In short, choose mutual funds if you value accessibility, liquidity, and simplicity. Choose PMS if you want tailor-made wealth management with active portfolio oversight and higher return potential, and are ready to make a larger commitment to grow your wealth.

No matter which you choose, starting your investing journey and staying invested for the long term is the most important part of reaching your financial goals.

![]()