Posted inInvestment & Savings Mutual Fund

Investing in Mutual Funds in India Investing in mutual funds has become an integral part of the modern Indian investor’s journey toward financial independence. The ability to diversify across sectors…

Posted inIndian Index Funds

🐦 “The Tale of the Penny‑Pinching Parrot and the Ten Index‑Eggs” Once upon a brokerage account, there lived a parrot named Percy Penny‑Pincher. Percy was famously “stinzy”: he’d pinch every…

Posted inFinancial Literacy Mutual Fund

XIRR SIP Return Calculation: A Comprehensive Guide Investors in Systematic Investment Plans (SIPs) often wonder how much they really earn, especially when investments are made irregularly. This is where XIRR…

Posted inInvestment & Savings Mutual Fund

Introduction: Dividend vs Growth Mutual Funds In the ever-evolving landscape of personal finance, mutual funds have become a cornerstone investment vehicle for millions of Indians. Their ability to offer professional…

Posted inInvestment & Savings Mutual Fund

Mutual Fund Investment Story: Ananya's Journey Meet Ananya, a 30-year-old school teacher from Bengaluru. Like many of us, she believed that saving money in a bank account was enough to…

Posted inMutual Fund

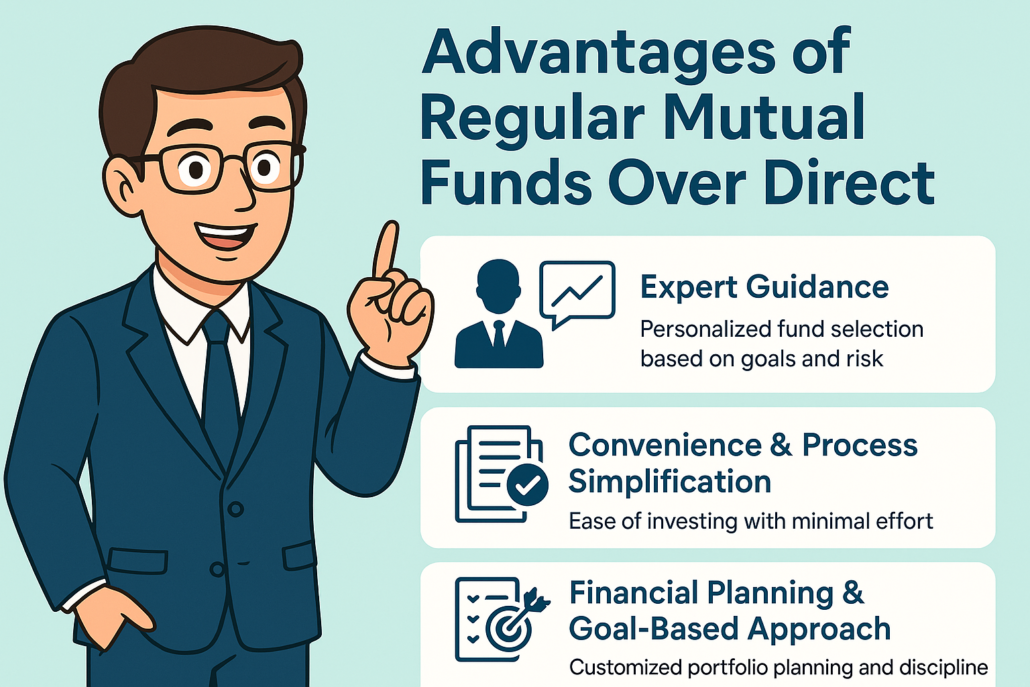

Introduction to Advantages of Regular Mutual Funds Over Direct Many investors are drawn to direct mutual funds for their lower expense ratios and potentially higher returns. However, the advantages of…

Posted inInvestment & Savings Mutual Fund

Why Women in India Should Start Investing in Mutual Funds? 1. A Diversified Investment Mutual funds pool money into diverse assets like equities, bonds, bullion, and other instruments across multiple…

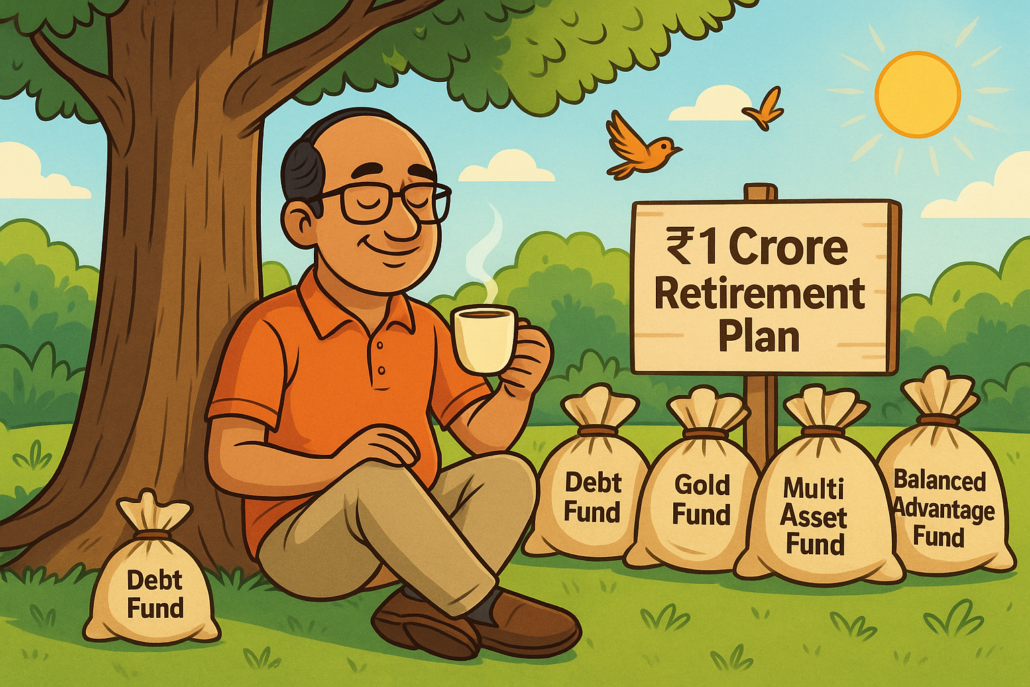

₹1 Crore Retirement Plan: A Strategic Investment Guide for a Peaceful Retirement Introduction: Why You Need a ₹1 Crore Retirement Plan Retirement should be a phase of comfort, not compromise.…

Posted inMutual Fund

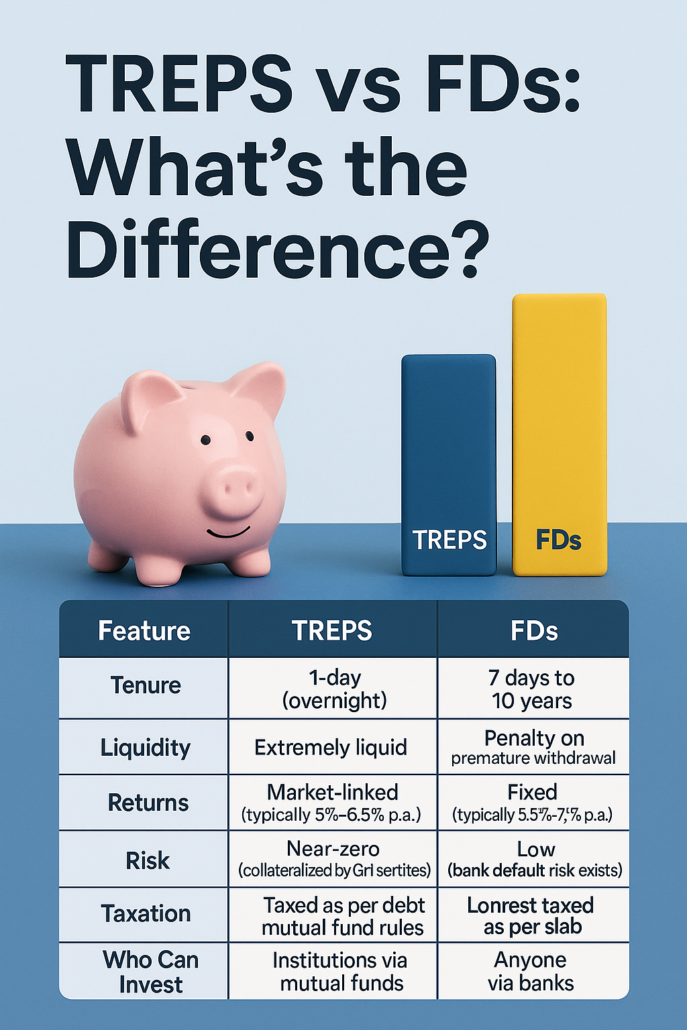

Introduction: Why This Comparison Matters Mutual fund managers, face countless questions related to TREPS in Mutual fund and TREPS vs FDs like, “Should I just park my idle funds in…