Posted inMutual Fund

Hey! If you’re trying to shortlist the top 5 best multi cap mutual funds in 2025, let’s do this the smart way—like two friends grabbing chai and comparing notes. I’ll…

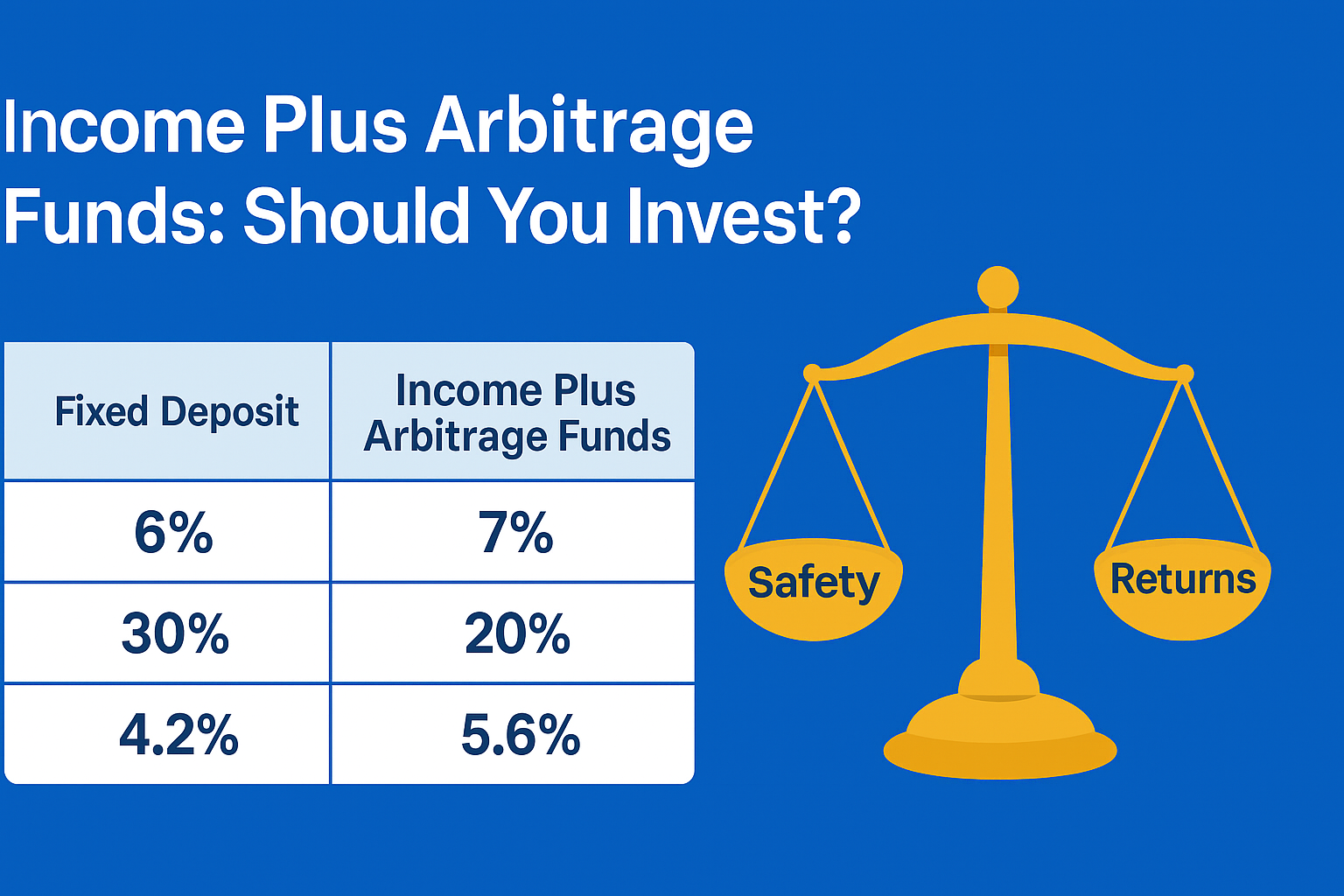

Posted inFinancial Literacy Mutual Fund

Understanding Income Plus Arbitrage Funds Have you ever wondered how to earn more than a fixed deposit but with less risk than equities? That’s where Income Plus Arbitrage Funds come…

Posted inMutual Fund Financial Literacy

Introduction John Abraham Mutual Funds Financial Journey When you think of John Abraham, the first image that comes to mind is a Bollywood star known for his sculpted physique, discipline,…

Posted inMutual Fund

Introduction Every investor, at some point, faces a dilemma: Should I invest in equities for high growth or in debt for stability? While equities can deliver impressive returns in the…

Posted inMutual Fund Indian Index Funds

Introduction: Why Everyone is Talking About Jio BlackRock Mutual Funds in 2025 The Indian mutual fund industry is witnessing a once-in-a-decade disruption. In 2025, Jio BlackRock Mutual Fund entered the…

Posted inNews Financial Literacy Mutual Fund

As a UPI specialist, I’m excited to unveil how UPI usage in shopping category data is transforming everyday spending—especially in the grocery segment—and creating remarkable avenues for savvy users to…

Posted inMutual Fund Fixed Income Mutual Fund

Introduction When it comes to building a well-diversified investment portfolio, every investor faces the same dilemma: how to balance growth with stability. Equity markets offer the potential for wealth creation…

Posted inCredit Cards Mutual Fund

Best Reward Points Credit Card – The Smartest Way to Build Wealth with Cashback and Mutual Fund SIP Introduction When we think about the best reward points credit card, most…

Posted inMutual Fund Mutual Fund SIP Rules

Buy on Deep Strategy: A Secret Weapon for Middle-Class Investors Have you ever felt frustrated watching the stock market fall, thinking your hard-earned money is vanishing?The truth is, smart investors…